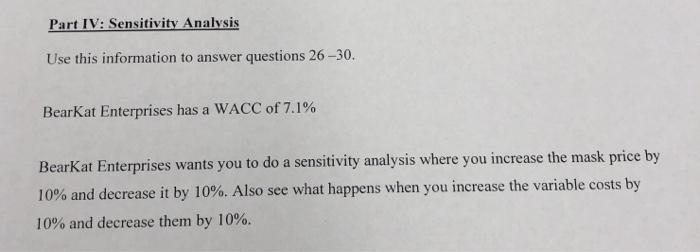

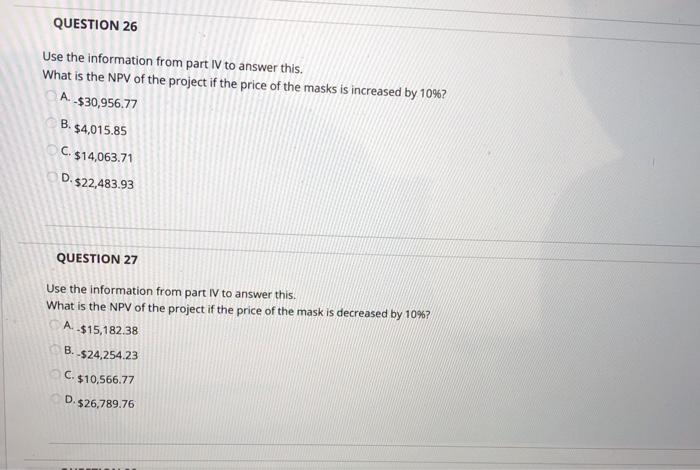

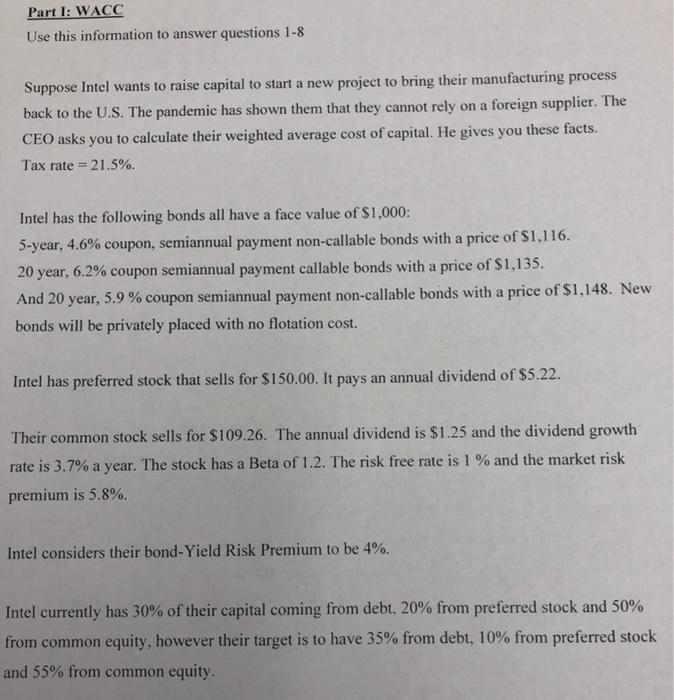

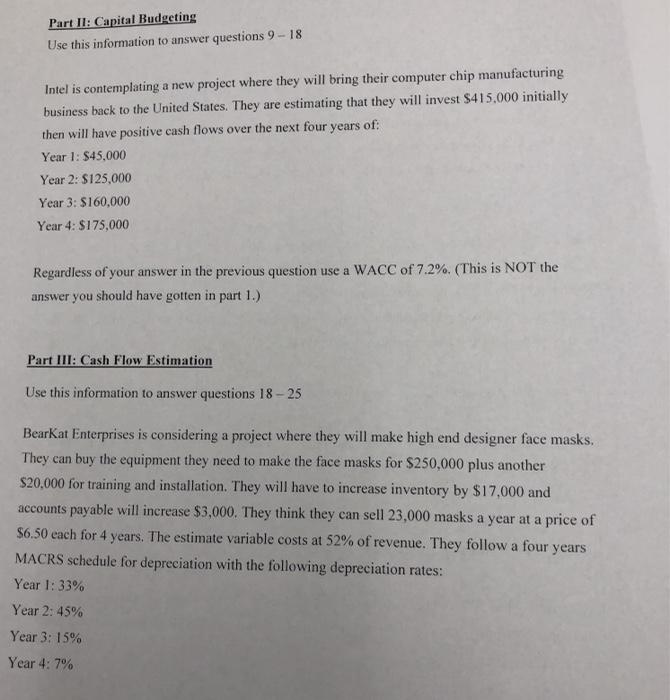

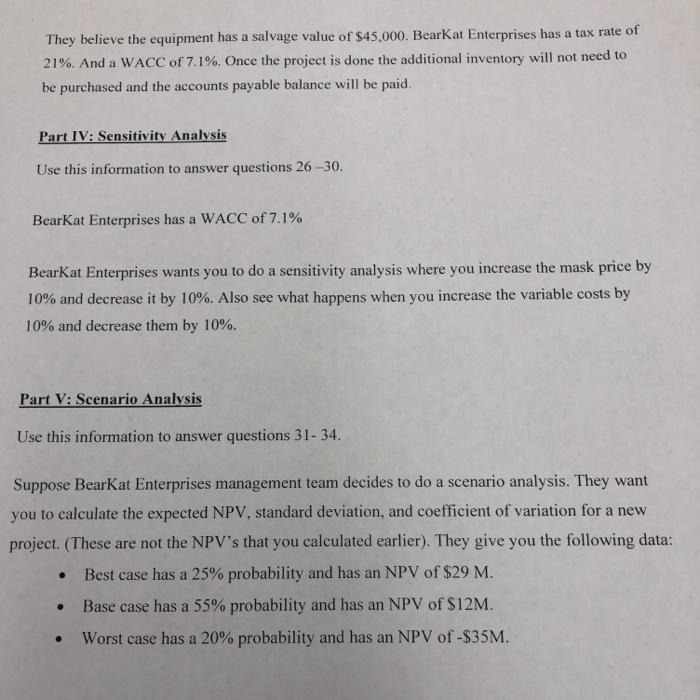

Part IV: Sensitivity Analysis Use this information to answer questions 26-30. BearKat Enterprises has a WACC of 7.1% BearKat Enterprises wants you to do a sensitivity analysis where you increase the mask price by 10% and decrease it by 10%. Also see what happens when you increase the variable costs by 10% and decrease them by 10%. QUESTION 26 Use the information from part IV to answer this. What is the NPV of the project if the price of the masks is increased by 10%? A. $30,956.77 B. $4,015.85 C. $14,063.71 D. $22,483.93 QUESTION 27 Use the information from part IV to answer this. What is the NPV of the project if the price of the mask is decreased by 10%? A. $15,182.38 B. $24,254.23 C. $10,566.77 D. $26,789.76 Part I: WACC Use this information to answer questions 1-8 Suppose Intel wants to raise capital to start a new project to bring their manufacturing process back to the U.S. The pandemic has shown them that they cannot rely on a foreign supplier. The CEO asks you to calculate their weighted average cost of capital. He gives you these facts. Tax rate = 21.5%. Intel has the following bonds all have a face value of $1,000: 5-year, 4.6% coupon, semiannual payment non-callable bonds with a price of $1,116. 20 year, 6.2% coupon semiannual payment callable bonds with a price of $1,135. And 20 year, 5.9% coupon semiannual payment non-callable bonds with a price of $1,148. New bonds will be privately placed with no flotation cost. Intel has preferred stock that sells for $150.00. It pays an annual dividend of $5.22. Their common stock sells for $109.26. The annual dividend is $1.25 and the dividend growth rate is 3.7% a year. The stock has a Beta of 1.2. The risk free rate is 1 % and the market risk premium is 5.8% Intel considers their bond-Yield Risk Premium to be 4%. Intel currently has 30% of their capital coming from debt, 20% from preferred stock and 50% from common equity, however their target is to have 35% from debt, 10% from preferred stock and 55% from common equity. Part II: Capital Budgeting Use this information to answer questions 9-18 Intel is contemplating a new project where they will bring their computer chip manufacturing business back to the United States. They are estimating that they will invest $415.000 initially then will have positive cash flows over the next four years of Year 1: $45,000 Year 2: $125,000 Year 3: $160,000 Year 4: $175,000 Regardless of your answer in the previous question use a WACC of 7.2%. (This is NOT the answer you should have gotten in part 1.) Part III: Cash Flow Estimation Use this information to answer questions 18 - 25 BearKat Enterprises is considering a project where they will make high end designer face masks. They can buy the equipment they need to make the face masks for $250,000 plus another $20,000 for training and installation. They will have to increase inventory by $17,000 and accounts payable will increase $3,000. They think they can sell 23,000 masks a year at a price of $6.50 each for 4 years. The estimate variable costs at 52% of revenue. They follow a four years MACRS schedule for depreciation with the following depreciation rates: Year 1: 33% Year 2: 45% Year 3: 15% Year 4: 7% They believe the equipment has a salvage value of $45,000. Bearkat Enterprises has a tax rate of 21%. And a WACC of 7.1%. Once the project is done the additional inventory will not need to be purchased and the accounts payable balance will be paid. Part IV: Sensitivity Analysis Use this information to answer questions 26-30, BearKat Enterprises has a WACC of 7.1% BearKat Enterprises wants you to do a sensitivity analysis where you increase the mask price by 10% and decrease it by 10%. Also see what happens when you increase the variable costs by 10% and decrease them by 10%. Part V: Scenario Analysis Use this information to swer questions 31- 34. Suppose BearKat Enterprises management team decides to do a scenario analysis. They want you to calculate the expected NPV. standard deviation, and coefficient of variation for a new project. (These are not the NPV's that you calculated earlier). They give you the following data: Best case has a 25% probability and has an NPV of $29 M. Base case has a 55% probability and has an NPV of $12M. Worst case has a 20% probability and has an NPV of -$35M