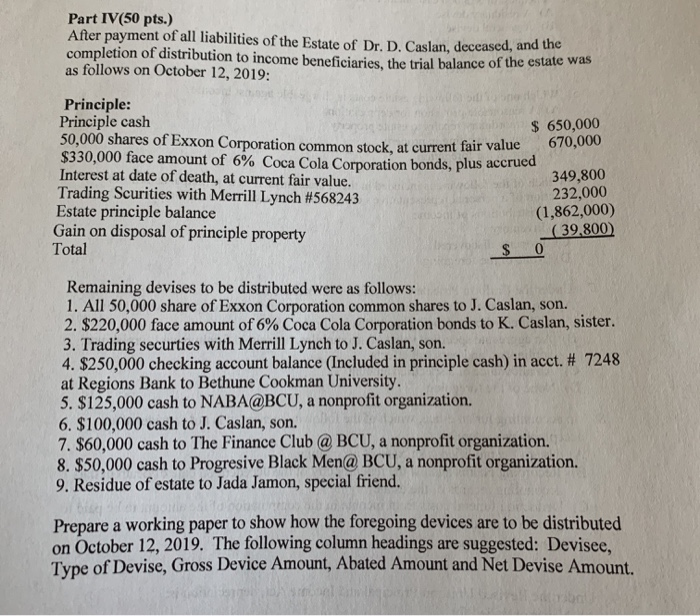

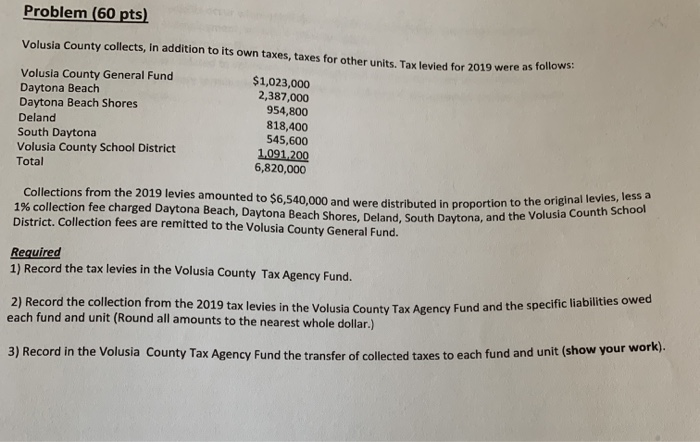

Part IV(50 pts.) After payment of all liabilities of the Estate of Dr. D. Caslan, deceased, and the completion of distribution to income beneficiaries, the trial balance of the estate as follows on October 12, 2019: Principle: Principle cash $ 650,000 01 Exxon Corporation common stock, at current fair value 670,000 $330,000 face amount of 6% Coca Cola Corporation bonds, plus accrued Interest at date of death, at current fair value. 349,800 Trading Scurities with Merrill Lynch #568243 232,000 Estate principle balance (1,862,000) Gain on disposal of principle property (39.800) Total SO Remaining devises to be distributed were as follows: 1. All 50,000 share of Exxon Corporation common shares to J. Caslan, son. 2. $220,000 face amount of 6% Coca Cola Corporation bonds to K. Caslan, sister. 3. Trading securties with Merrill Lynch to J. Caslan, son. 4. $250,000 checking account balance (Included in principle cash) in acct. # 7248 at Regions Bank to Bethune Cookman University. 5. $125,000 cash to NABA@BCU, a nonprofit organization. 6. $100,000 cash to J. Caslan, son. 7. $60,000 cash to The Finance Club @ BCU, a nonprofit organization. 8. $50,000 cash to Progresive Black Men@ BCU, a nonprofit organization. 9. Residue of estate to Jada Jamon, special friend. Prepare a working paper to show how the foregoing devices are to be distributed on October 12, 2019. The following column headings are suggested: Devisee, Type of Devise, Gross Device Amount, Abated Amount and Net Devise Amount. Problem (60 pts) Volusia County collects, in addition to its own taxes, taxes for other units. Tax levied for 2019 were as follow Volusia County General Fund Daytona Beach Daytona Beach Shores Deland South Daytona Volusia County School District Total $1,023,000 2,387,000 954,800 818,400 545,600 1.091.200 6,820,000 Collections from the 2019 Tevies amounted to $6,540.000 and were distributed in proportion to 1% collection fee charged Daytona Beach, Daytona Beach Shores. Deland, South Daytona, and the District Collection fees are remitted to the Volusia County General Fund. buted in proportion to the original levies, less a and, South Daytona, and the Volusia Counth School Required 1) Record the tax levies in the Volusia County Tax Agency Fund. 2) Record the collection from the 2019 tax levies in the Volusia County Tax Agency Fund and the speci the specific liabilities owed each fund and unit (Round all amounts to the nearest whole dollar.) 3) Record in the Volusia County Tax Agency Fund the transfer of collected taxes to each fund and units er of collected taxes to each fund and unit (show your work)