Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part IVA Sensitivity Analysis Use this information to answer questions 26-30. BearKat Enterprises wants you to do a sensitivity analysis where you increase the mask

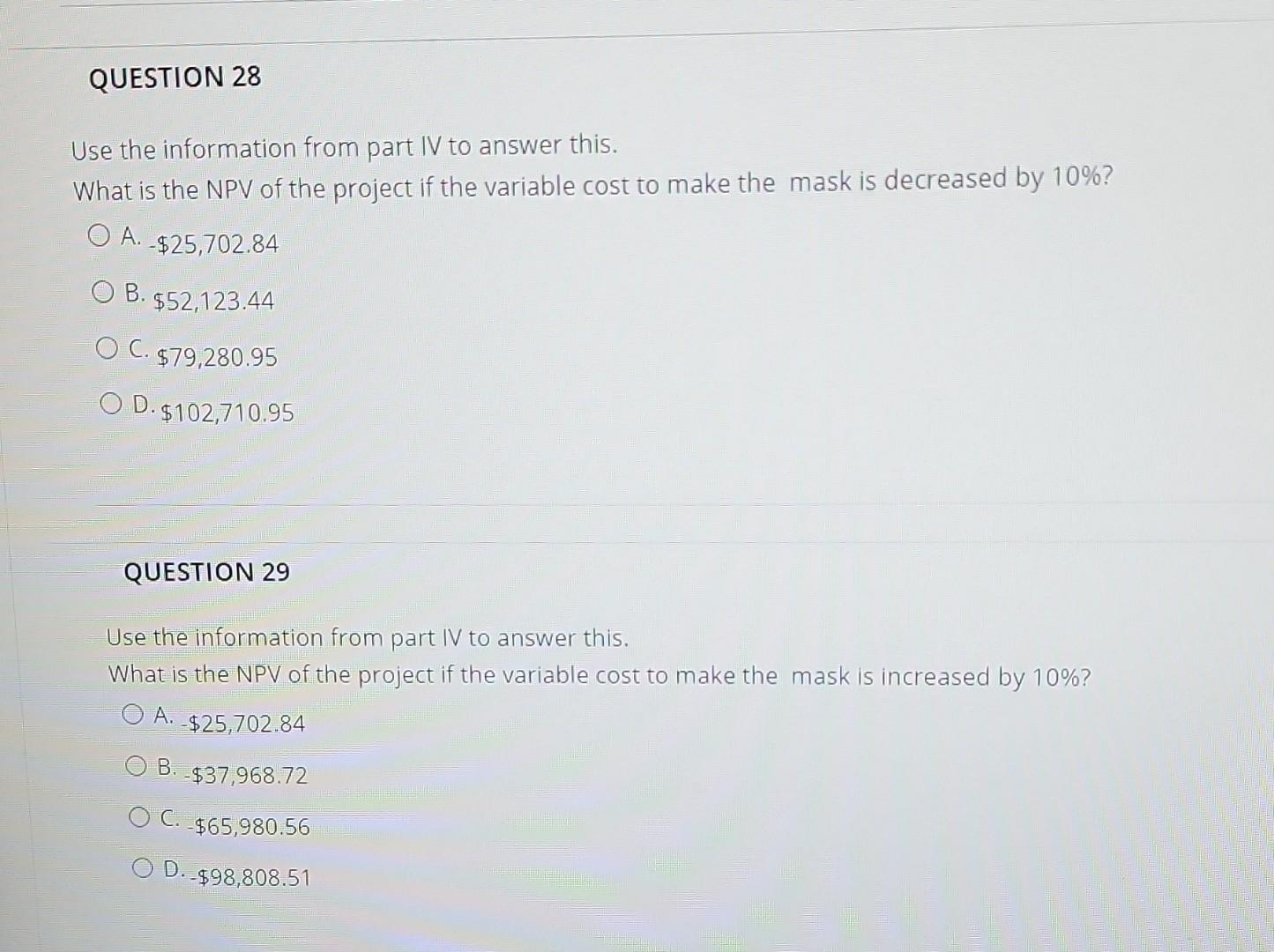

Part IVA Sensitivity Analysis Use this information to answer questions 26-30. BearKat Enterprises wants you to do a sensitivity analysis where you increase the mask price by 10% and decrease it by 10%. Also see what happens when you increase the variable costs by 10% and decrease them by 10%. QUESTION 28 Use the information from part IV to answer this. What is the NPV of the project if the variable cost to make the mask is decreased by 10%? OA. -$25,702.84 OB.$52,123.44 O C. $79,280.95 O D.$102,710.95 QUESTION 29 Use the information from part IV to answer this. What is the NPV of the project if the variable cost to make the mask is increased by 10%? A. -$25,702.84 B. -$37,968.72 O C. -$65,980.56 OD. -$98,808.51 Part IVA Sensitivity Analysis Use this information to answer questions 26-30. BearKat Enterprises wants you to do a sensitivity analysis where you increase the mask price by 10% and decrease it by 10%. Also see what happens when you increase the variable costs by 10% and decrease them by 10%. QUESTION 28 Use the information from part IV to answer this. What is the NPV of the project if the variable cost to make the mask is decreased by 10%? OA. -$25,702.84 OB.$52,123.44 O C. $79,280.95 O D.$102,710.95 QUESTION 29 Use the information from part IV to answer this. What is the NPV of the project if the variable cost to make the mask is increased by 10%? A. -$25,702.84 B. -$37,968.72 O C. -$65,980.56 OD. -$98,808.51

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started