Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PART IV-COMPLETE THE FOLLOWING PROBLEM SET OUT IN FIVE PARTS, NUMBERED 16-20. Show all of your work to receive full and/or partial credit. Lenny and

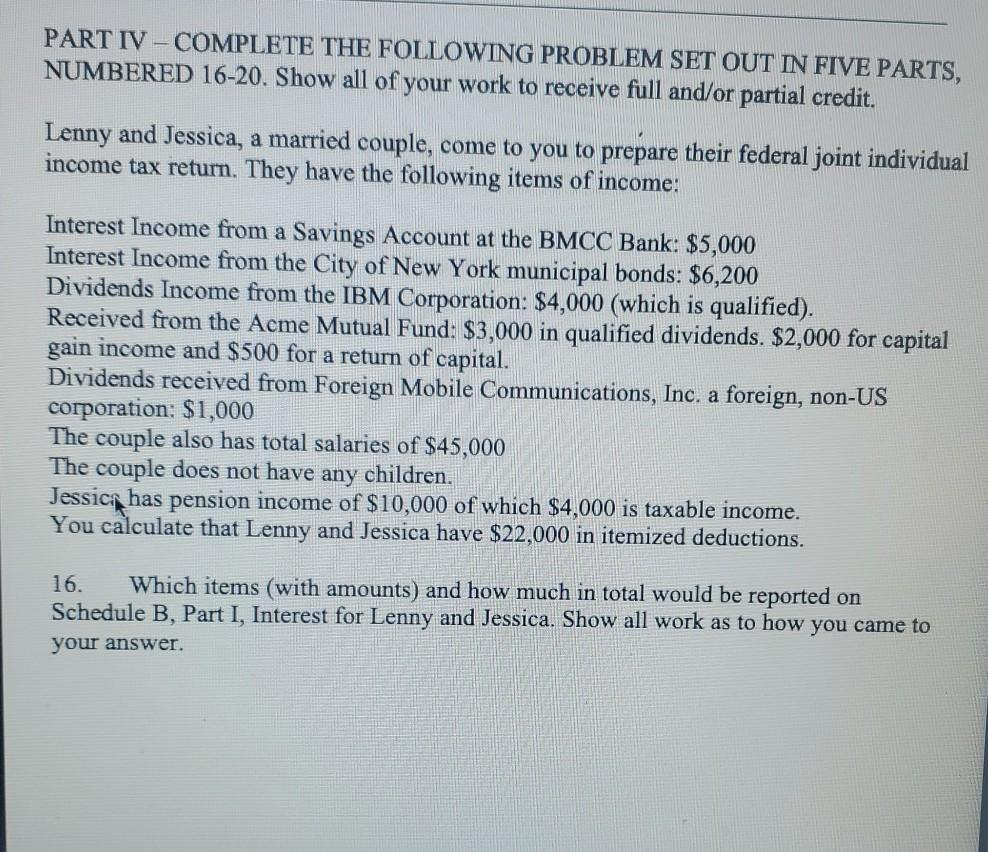

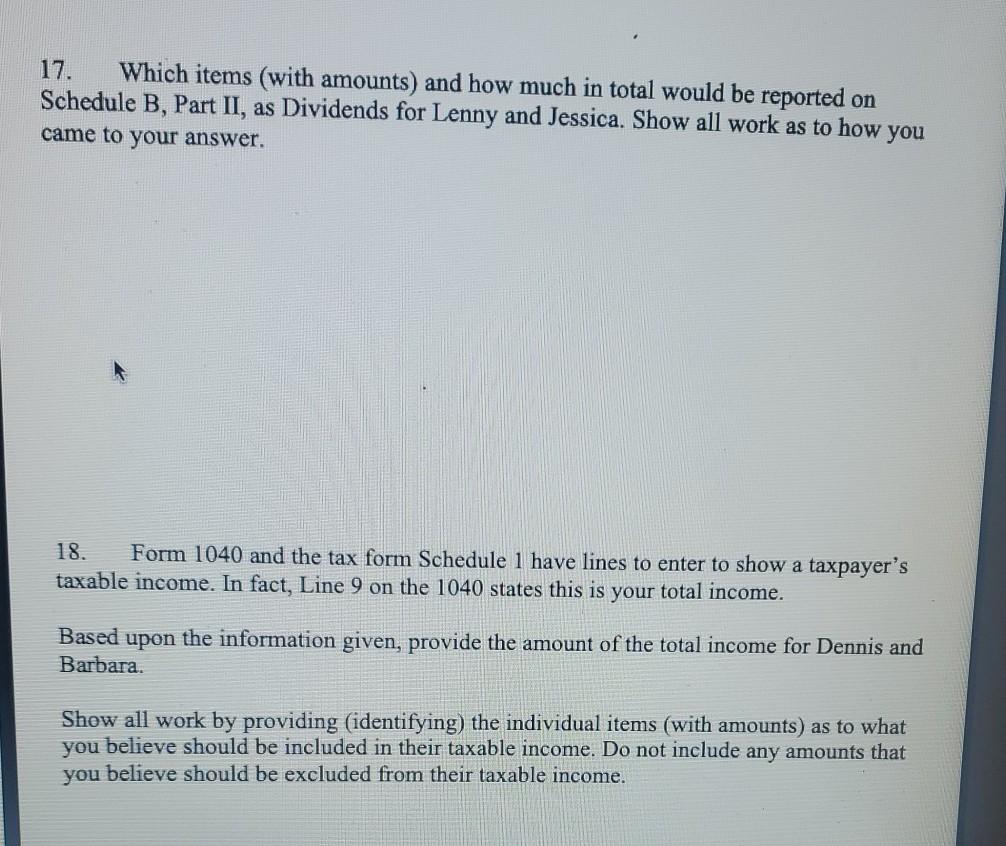

PART IV-COMPLETE THE FOLLOWING PROBLEM SET OUT IN FIVE PARTS, NUMBERED 16-20. Show all of your work to receive full and/or partial credit. Lenny and Jessica, a married couple, come to you to prepare their federal joint individual income tax return. They have the following items of income: Interest Income from a Savings Account at the BMCC Bank: $5,000 Interest Income from the City of New York municipal bonds: $6,200 Dividends Income from the IBM Corporation: $4,000 (which is qualified). Received from the Acme Mutual Fund: $3,000 in qualified dividends. $2,000 for capital gain income and $500 for a return of capital. Dividends received from Foreign Mobile Communications, Inc. a foreign, non-US corporation: $1,000 The couple also has total salaries of $45,000 The couple does not have any children. Jessic, has pension income of $10,000 of which $4,000 is taxable income. You calculate that Lenny and Jessica have $22,000 in itemized deductions. 16. Which items (with amounts) and how much in total would be reported on Schedule B, Part I, Interest for Lenny and Jessica. Show all work as to how you came to your answer. 17. Which items (with amounts) and how much in total would be reported on Schedule B, Part II, as Dividends for Lenny and Jessica. Show all work as to how you came to your answer. 18. Form 1040 and the tax form Schedule 1 have lines to enter to show a taxpayer's taxable income. In fact, Line 9 on the 1040 states this is your total income. Based upon the information given, provide the amount of the total income for Dennis and Barbara. Show all work by providing (identifying) the individual items (with amounts) as to what you believe should be included in their taxable income. Do not include any amounts that you believe should be excluded from their taxable income. PART IV-COMPLETE THE FOLLOWING PROBLEM SET OUT IN FIVE PARTS, NUMBERED 16-20. Show all of your work to receive full and/or partial credit. Lenny and Jessica, a married couple, come to you to prepare their federal joint individual income tax return. They have the following items of income: Interest Income from a Savings Account at the BMCC Bank: $5,000 Interest Income from the City of New York municipal bonds: $6,200 Dividends Income from the IBM Corporation: $4,000 (which is qualified). Received from the Acme Mutual Fund: $3,000 in qualified dividends. $2,000 for capital gain income and $500 for a return of capital. Dividends received from Foreign Mobile Communications, Inc. a foreign, non-US corporation: $1,000 The couple also has total salaries of $45,000 The couple does not have any children. Jessic, has pension income of $10,000 of which $4,000 is taxable income. You calculate that Lenny and Jessica have $22,000 in itemized deductions. 16. Which items (with amounts) and how much in total would be reported on Schedule B, Part I, Interest for Lenny and Jessica. Show all work as to how you came to your answer. 17. Which items (with amounts) and how much in total would be reported on Schedule B, Part II, as Dividends for Lenny and Jessica. Show all work as to how you came to your answer. 18. Form 1040 and the tax form Schedule 1 have lines to enter to show a taxpayer's taxable income. In fact, Line 9 on the 1040 states this is your total income. Based upon the information given, provide the amount of the total income for Dennis and Barbara. Show all work by providing (identifying) the individual items (with amounts) as to what you believe should be included in their taxable income. Do not include any amounts that you believe should be excluded from their taxable income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started