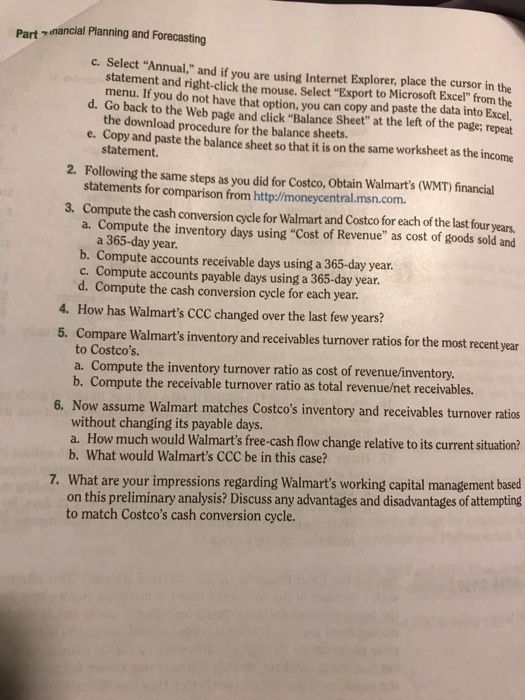

Part nancial Planning and Forecasting c. Select "Annual," and if you are using Internet Explorer, place the cursor in the statement and right-click the mouse. Select "Export to Microsoft Excel" from the menu. If you do not have that option, you can copy and paste the data into Excel. d. Go back to the Web page and click "Balance Sheet" at the left of the page; repeat the download procedure for the balance sheets. e. Copy and paste the balance sheet so that it is on the same worksheet as the income statement. 2. Following the same steps as you did for Costco, Obtain Walmart's (WMT) financial statements for comparison from http://moneycentral.msn.com. 3. Compute the cash conversion cycle for Walmart and Costco for each of the last four years a. Compute the inventory days using "Cost of Revenue' as cost of goods sold and a 365-day year. b. Compute accounts receivable days using a 365-day year. c. Compute accounts payable days using a 365-day year. d. Compute the cash conversion cycle for each year. 4. How has Walmart's ccC changed over the last few years? 5. Compare Walmart's inventory and receivables turnover ratios for the most recent year to Costco's. a. Compute the inventory turnover ratio as cost of revenue/inventory b. Compute the receivable turnover ratio as total revenueet receivables. 6. Now assume Walmart matches Costco's inventory and receivables turnover ratios without changing its payable days. a. How much would Walmart's free-cash flow change relative to its current situation? b. What would Walmart's CCC be in this case? What are your impressions regarding Walmart's working capital management based on this preliminary analysis? Discuss any advantages and disadvantages of attempting to match Costco's cash conversion cycle. 7. Part nancial Planning and Forecasting c. Select "Annual," and if you are using Internet Explorer, place the cursor in the statement and right-click the mouse. Select "Export to Microsoft Excel" from the menu. If you do not have that option, you can copy and paste the data into Excel. d. Go back to the Web page and click "Balance Sheet" at the left of the page; repeat the download procedure for the balance sheets. e. Copy and paste the balance sheet so that it is on the same worksheet as the income statement. 2. Following the same steps as you did for Costco, Obtain Walmart's (WMT) financial statements for comparison from http://moneycentral.msn.com. 3. Compute the cash conversion cycle for Walmart and Costco for each of the last four years a. Compute the inventory days using "Cost of Revenue' as cost of goods sold and a 365-day year. b. Compute accounts receivable days using a 365-day year. c. Compute accounts payable days using a 365-day year. d. Compute the cash conversion cycle for each year. 4. How has Walmart's ccC changed over the last few years? 5. Compare Walmart's inventory and receivables turnover ratios for the most recent year to Costco's. a. Compute the inventory turnover ratio as cost of revenue/inventory b. Compute the receivable turnover ratio as total revenueet receivables. 6. Now assume Walmart matches Costco's inventory and receivables turnover ratios without changing its payable days. a. How much would Walmart's free-cash flow change relative to its current situation? b. What would Walmart's CCC be in this case? What are your impressions regarding Walmart's working capital management based on this preliminary analysis? Discuss any advantages and disadvantages of attempting to match Costco's cash conversion cycle. 7