part of the same question

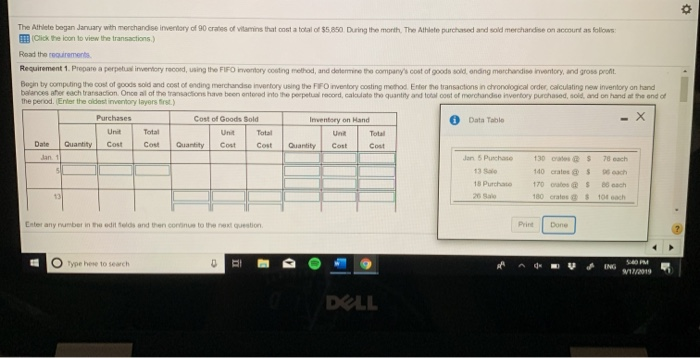

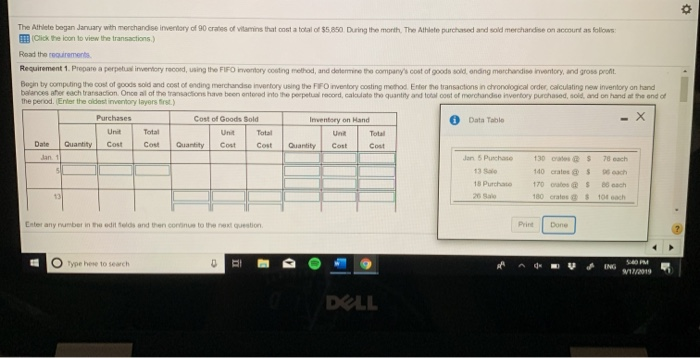

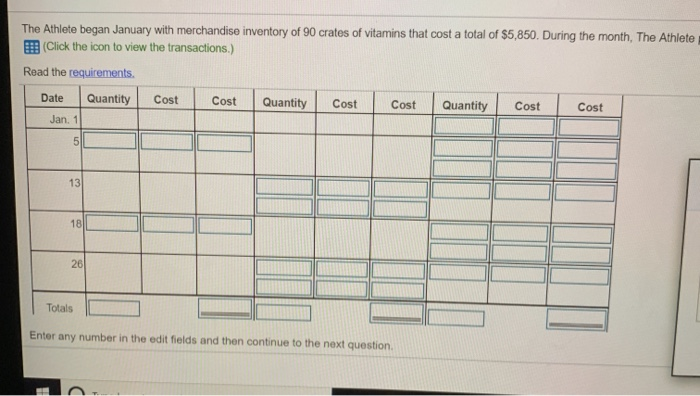

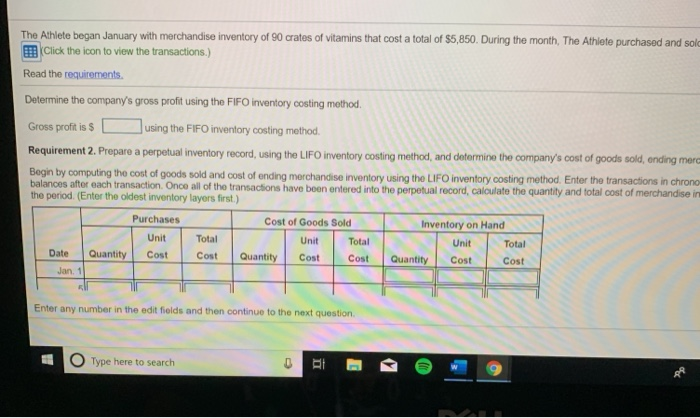

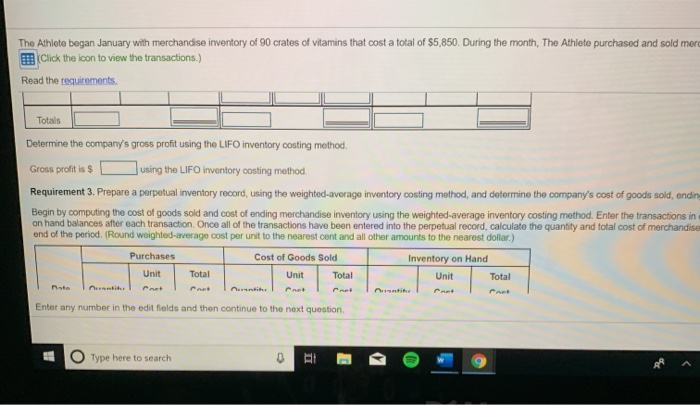

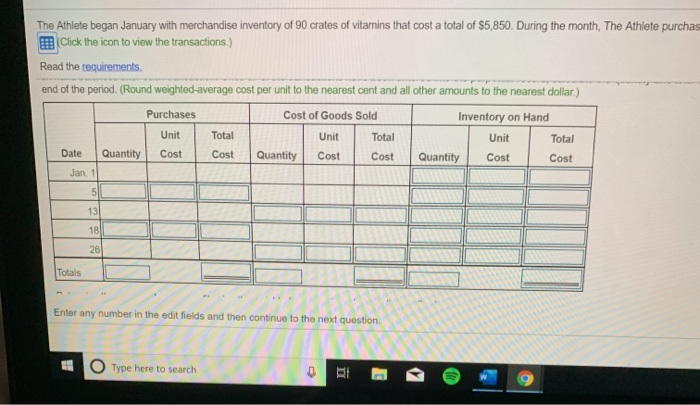

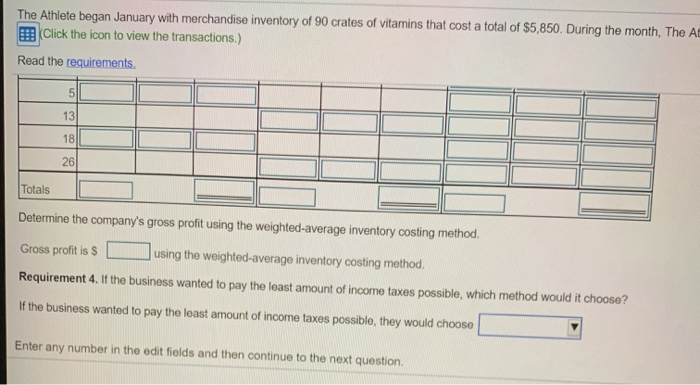

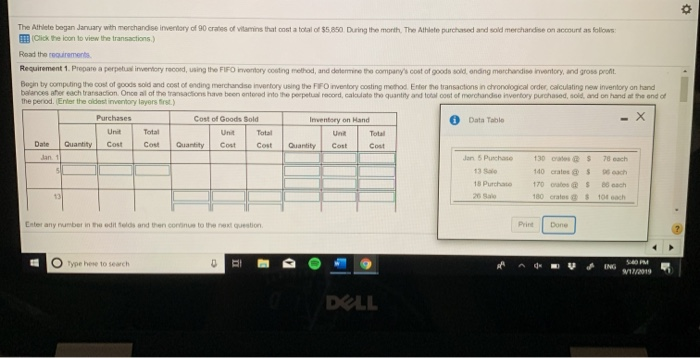

The Athlete began January with merchandise inventory of 90 crates of vitamins that cost a total of $5850 During the month The Athlete purchased and sold merchandise on account as follows: Click the icon to view the transactions) Read the requirements Requirement 1. Prepare a perpen tory record, using the FIFO inventory costing method, and determine the company's cost of goods soldanding merchandisinventory and gross pro Begin by computing the cost of goods sold and cost of ending merchandise for the FFO inventory coching method to the ansactions in chronological order i ng new t ory on hand balances her each r acion Onceal of the transactions have been tran e pre c ord, calitate and lot of merchandise inventory purchased and on and the one of the period. Enten tory layers Purchases Cost of Goods Sold Data Table Text Total Cost Unit C ost Total Cost Quantity Cost Quantity Jan 5 Purchase 130 140 crates 1700 O 70 each each each ch 18 Purchase o Ester any number in the editada and then continue to the next question Print Dono O Type here to search DOLL The Athlete began January with merchandise inventory of 90 crates of vitamins that cost a total of $5,850. During the month, The Athlete (Click the icon to view the transactions.) Read the requirements. Date Quantity Jan. 1 Cost Cost Quantity Cost Cost Quantity Cost Cost Totals Enter any number in the edit fields and then continue to the next question. The Athlete began January with merchandise inventory of 90 crates of vitamins that cost a total of $5,850. During the month, The Athlete purchased and soll Click the icon to view the transactions.) Read the requirements Determine the company's gross profit using the FIFO inventory costing method. Gross profit is using the FIFO inventory costing method. Requirement 2. Prepare a perpetual inventory record, using the LIFO inventory costing method, and determine the company's cost of goods sold, ending mere Begin by computing the cost of goods sold and cost of ending merchandise inventory using the LIFO inventory costing method. Enter the transactions in chrong balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise in the period. (Enter the oldest inventory layers first.) Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Quantity Cost Cost Quantity Cost Cost Quantity | Cost Cost Unit Total Date Jan. 1 Enter any number in the edit fields and then continue to the next question Type here to search The Athlete began January with merchandise inventory of 90 crates of vitamins that cost a total of $5,850. During the month, The Athlete purchased and sold men Click the icon to view the transactions.) Read the requirements Totals Determine the company's gross profit using the LIFO inventory costing method. Gross profit is using the LIFO inventory costing method. Requirement 3. Prepare a perpetual inventory record, using the weighted-average inventory costing method, and determine the company's cost of goods sold, ondin Begin by computing the cost of goods sold and cost of ending merchandise inventory using the weighted average inventory costing method. Enter the transactions in on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise end of the period. (Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar) Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Enter any number in the edit fields and then continue to the next question O Type here to search The Athlete began January with merchandise inventory of 90 crates of vitamins that cost a total of $5,850. During the month, The Athlete purchas Click the icon to view the transactions.) Read the requirements end of the period. (Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar) Purchases Unit Quantity Cost Total Cost Cost of Goods Sold Unit Total Quantity Cost Cost Inventory on Hand Unit Total Quantity Cost Cost Date Tatals Enter any number in the edit fields and then continue to the next questi O Type here to search RI The Athlete began January with merchandise inventory of 90 crates of vitamins that cost a total of $5,850. During the month, The Al Click the icon to view the transactions.) Read the requirements. 26 Totals Determine the company's gross profit using the weighted average inventory costing method. Gross profit is using the weighted-average inventory costing method. Requirement 4. If the business wanted to pay the least amount of income taxes possible, which method would it choose? If the business wanted to pay the least amount of income taxes possible, they would choose Enter any number in the edit fields and then continue to the next