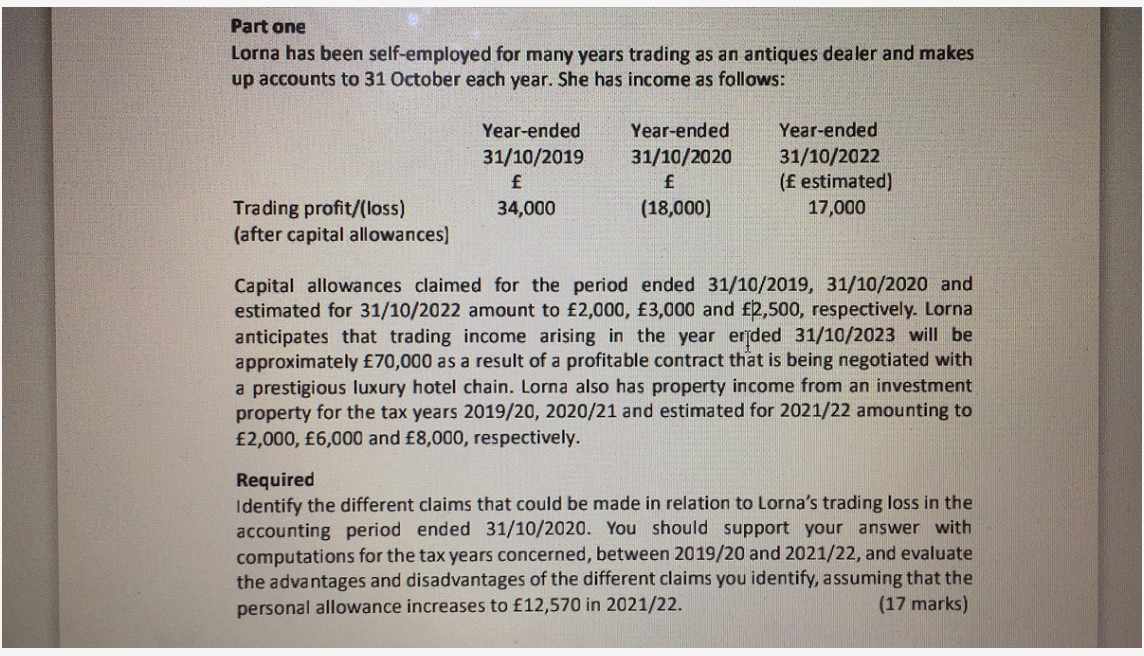

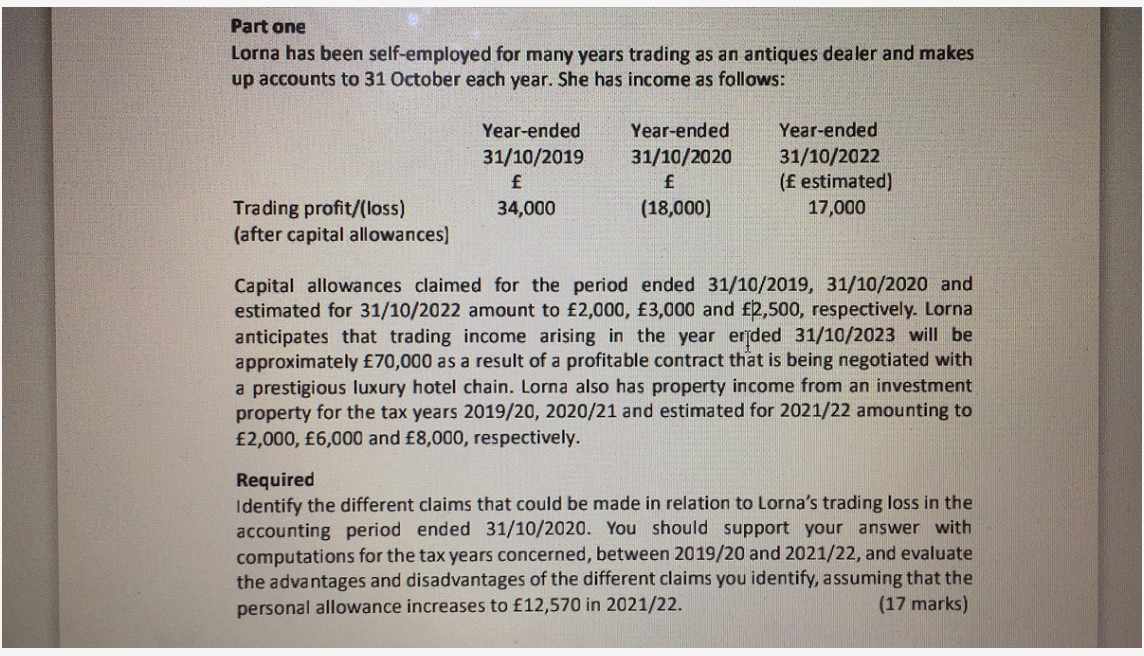

Part one Lorna has been self-employed for many years trading as an antiques dealer and makes up accounts to 31 October each year. She has income as follows: Year-ended 31/10/2019 f 34,000 Year-ended 31/10/2020 f (18,000) Year-ended 31/10/2022 ( estimated) 17,000 Trading profit/(loss) (after capital allowances) Capital allowances claimed for the period ended 31/10/2019, 31/10/2020 and estimated for 31/10/2022 amount to 2,000, 3,000 and 2,500, respectively. Lorna anticipates that trading income arising in the year erded 31/10/2023 will be approximately 70,000 as a result of a profitable contract that is being negotiated with a prestigious luxury hotel chain. Lorna also has property income from an investment property for the tax years 2019/20, 2020/21 and estimated for 2021/22 amounting to 2,000, 6,000 and 8,000, respectively. Required Identify the different claims that could be made in relation to Lorna's trading loss in the accounting period ended 31/10/2020. You should support your answer with computations for the tax years concerned, between 2019/20 and 2021/22, and evaluate the advantages and disadvantages of the different claims you identify, assuming that the personal allowance increases to 12,570 in 2021/22. (17 marks) Part one Lorna has been self-employed for many years trading as an antiques dealer and makes up accounts to 31 October each year. She has income as follows: Year-ended 31/10/2019 f 34,000 Year-ended 31/10/2020 f (18,000) Year-ended 31/10/2022 ( estimated) 17,000 Trading profit/(loss) (after capital allowances) Capital allowances claimed for the period ended 31/10/2019, 31/10/2020 and estimated for 31/10/2022 amount to 2,000, 3,000 and 2,500, respectively. Lorna anticipates that trading income arising in the year erded 31/10/2023 will be approximately 70,000 as a result of a profitable contract that is being negotiated with a prestigious luxury hotel chain. Lorna also has property income from an investment property for the tax years 2019/20, 2020/21 and estimated for 2021/22 amounting to 2,000, 6,000 and 8,000, respectively. Required Identify the different claims that could be made in relation to Lorna's trading loss in the accounting period ended 31/10/2020. You should support your answer with computations for the tax years concerned, between 2019/20 and 2021/22, and evaluate the advantages and disadvantages of the different claims you identify, assuming that the personal allowance increases to 12,570 in 2021/22. (17 marks)