Answered step by step

Verified Expert Solution

Question

1 Approved Answer

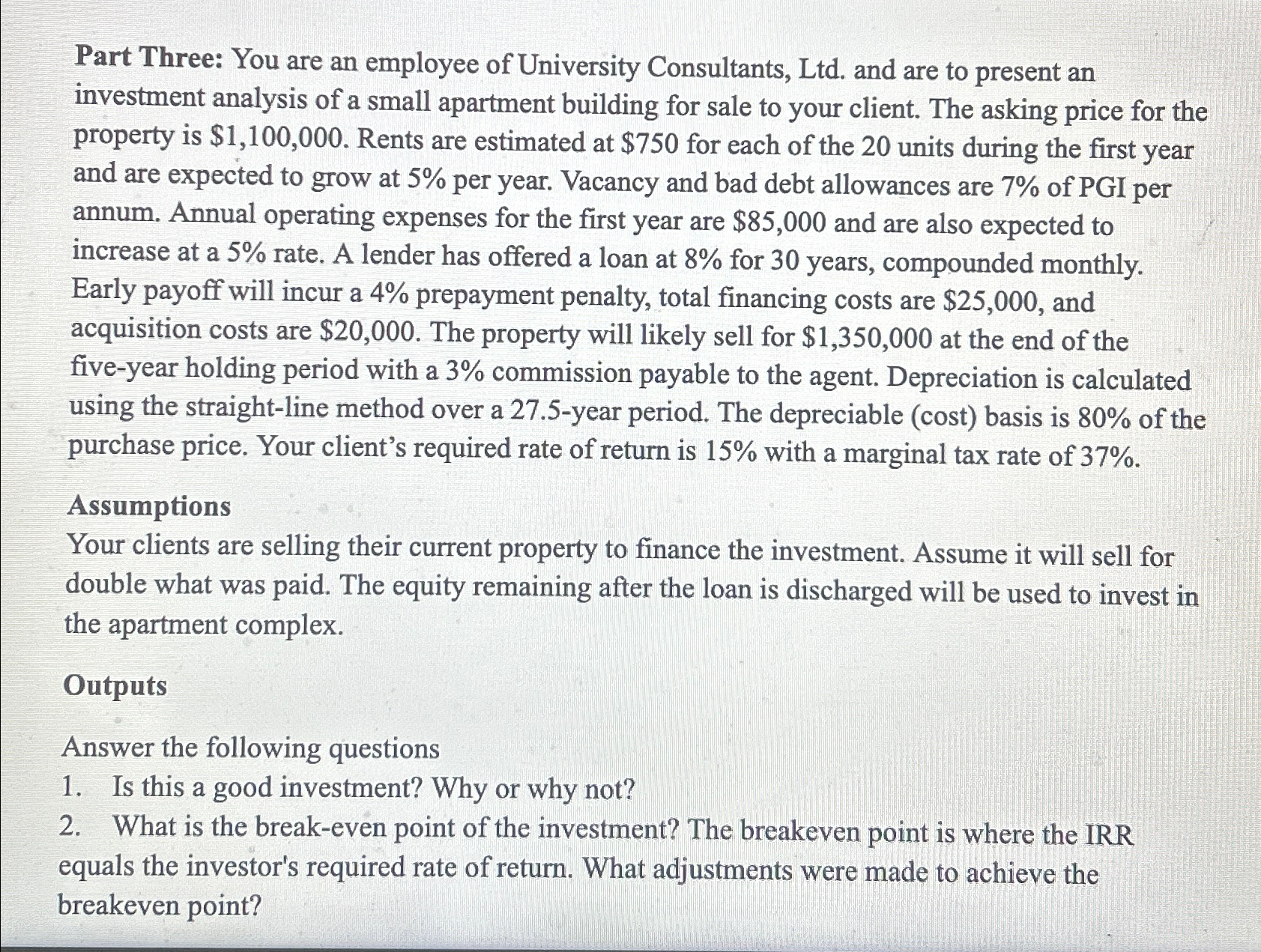

Part Three: You are an employee of University Consultants, Ltd . and are to present an investment analysis of a small apartment building for sale

Part Three: You are an employee of University Consultants, Ltd and are to present an investment analysis of a small apartment building for sale to your client. The asking price for the property is $ Rents are estimated at $ for each of the units during the first year and are expected to grow at per year. Vacancy and bad debt allowances are of PGI per annum. Annual operating expenses for the first year are $ and are also expected to increase at a rate. A lender has offered a loan at for years, compounded monthly. Early payoff will incur a prepayment penalty, total financing costs are $ and acquisition costs are $ The property will likely sell for $ at the end of the fiveyear holding period with a commission payable to the agent. Depreciation is calculated using the straightline method over a year period. The depreciable cost basis is of the purchase price. Your client's required rate of return is with a marginal tax rate of

Assumptions:

Your clients are selling their current property to finance the investment. Assume it will sell for double what was paid. The equity remaining after the loan is discharged will be used to invest in the apartment complex.

Outputs:

Answer the following questions

Is this a good investment? Why or why not?

What is the breakeven point of the investment? The breakeven point is where the IRR equals the investor's required rate of return. What adjustments were made to achieve the breakeven point?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started