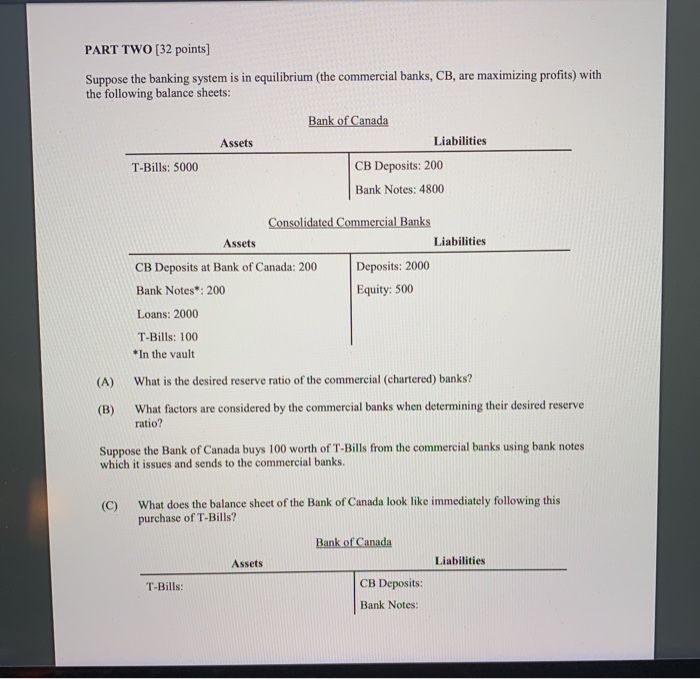

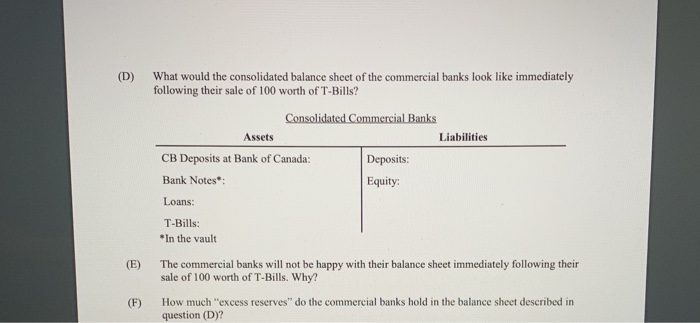

PART TWO (32 points) Suppose the banking system is in equilibrium (the commercial banks, CB, are maximizing profits) with the following balance sheets Bank of Canada Assets Liabilities T-Bills: 5000 CB Deposits: 200 Bank Notes: 4800 Assets Consolidated Commercial Banks Liabilities CB Deposits at Bank of Canada: 200 Deposits: 2000 Bank Notes*: 200 Equity: 500 Loans: 2000 T-Bills: 100 *In the vault (A) What is the desired reserve ratio of the commercial (chartered) banks? (B) What factors are considered by the commercial banks when determining their desired reserve ratio? Suppose the Bank of Canada buys 100 worth of T-Bills from the commercial banks using bank notes which it issues and sends to the commercial banks. (C) What does the balance sheet of the Bank of Canada look like immediately following this purchase of T-Bills? Bank of Canada Assets Liabilities T-Bills: CB Deposits: Bank Notes: (D) What would the consolidated balance sheet of the commercial banks look like immediately following their sale of 100 worth of T-Bills? Consolidated Commercial Banks Assets Liabilities CB Deposits at Bank of Canada: Deposits: Bank Notes: Equity: Loans: T-Bills: *In the vault (E) The commercial banks will not be happy with their balance sheet immediately following their sale of 100 worth of T-Bills. Why? (F) How much "excess reserves" do the commercial banks hold in the balance sheet described in question (D)? PART TWO (32 points) Suppose the banking system is in equilibrium (the commercial banks, CB, are maximizing profits) with the following balance sheets Bank of Canada Assets Liabilities T-Bills: 5000 CB Deposits: 200 Bank Notes: 4800 Assets Consolidated Commercial Banks Liabilities CB Deposits at Bank of Canada: 200 Deposits: 2000 Bank Notes*: 200 Equity: 500 Loans: 2000 T-Bills: 100 *In the vault (A) What is the desired reserve ratio of the commercial (chartered) banks? (B) What factors are considered by the commercial banks when determining their desired reserve ratio? Suppose the Bank of Canada buys 100 worth of T-Bills from the commercial banks using bank notes which it issues and sends to the commercial banks. (C) What does the balance sheet of the Bank of Canada look like immediately following this purchase of T-Bills? Bank of Canada Assets Liabilities T-Bills: CB Deposits: Bank Notes: (D) What would the consolidated balance sheet of the commercial banks look like immediately following their sale of 100 worth of T-Bills? Consolidated Commercial Banks Assets Liabilities CB Deposits at Bank of Canada: Deposits: Bank Notes: Equity: Loans: T-Bills: *In the vault (E) The commercial banks will not be happy with their balance sheet immediately following their sale of 100 worth of T-Bills. Why? (F) How much "excess reserves" do the commercial banks hold in the balance sheet described in question (D)