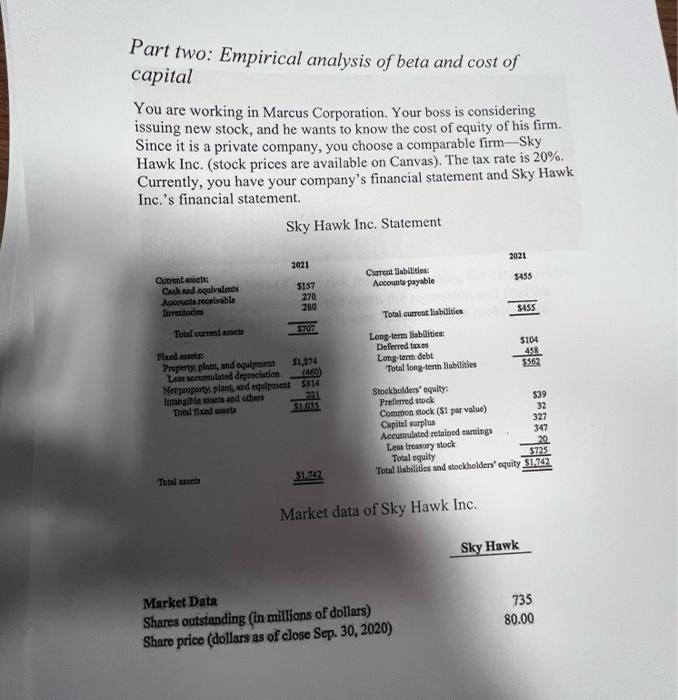

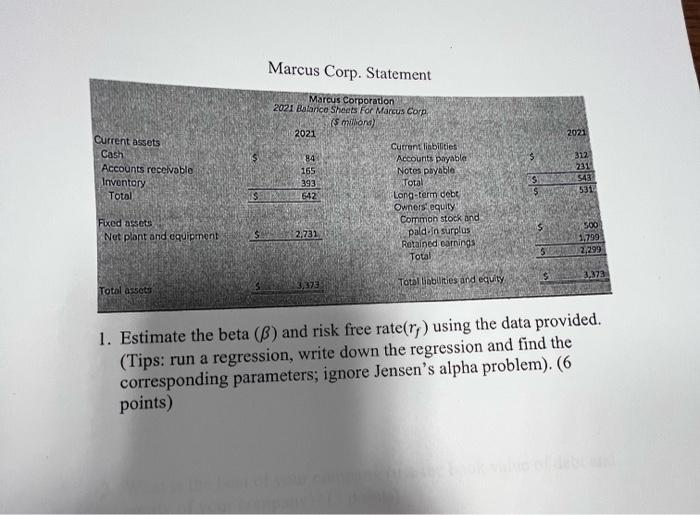

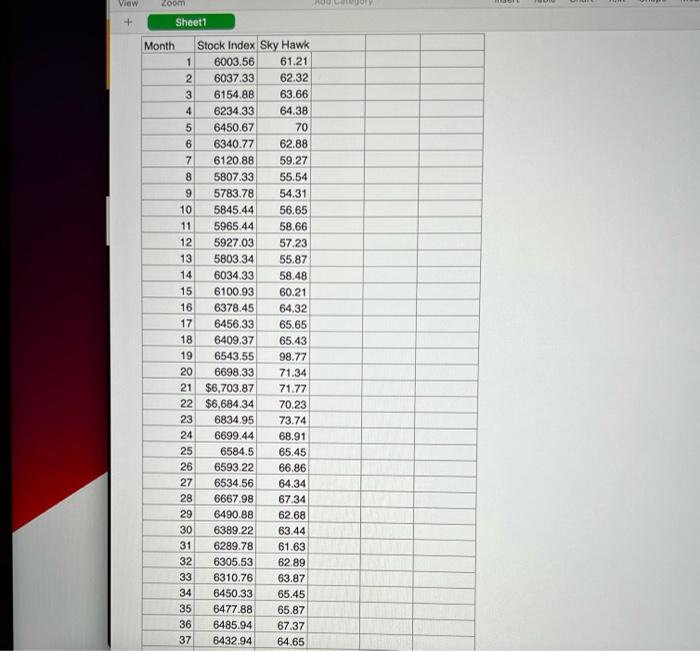

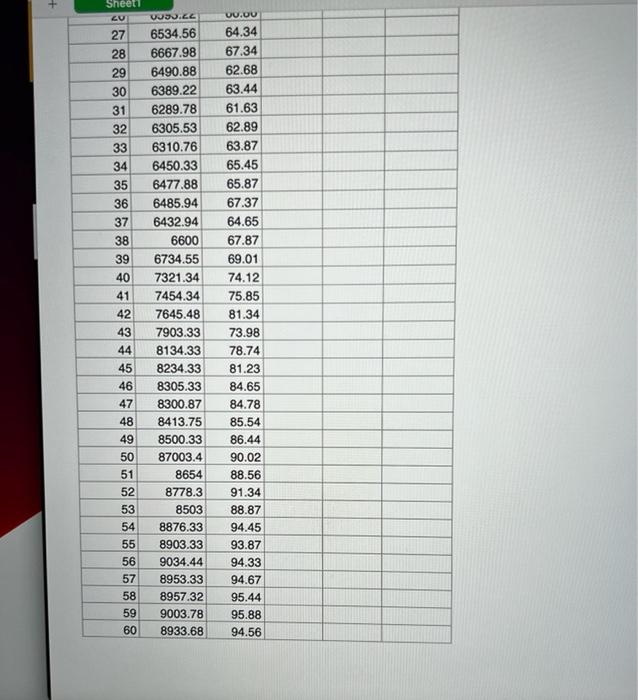

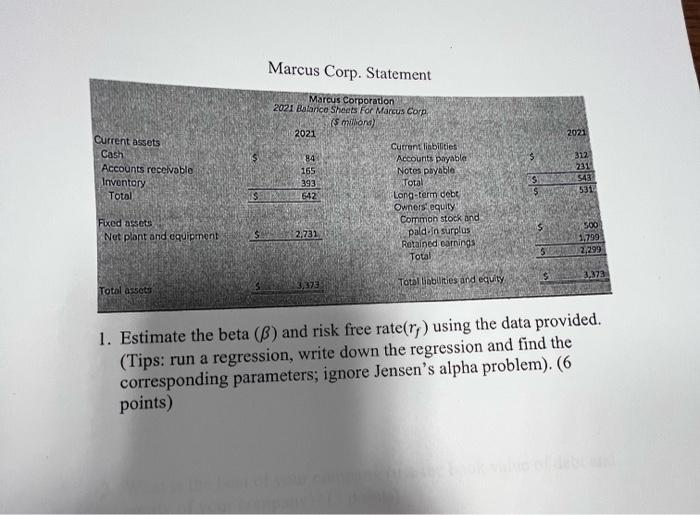

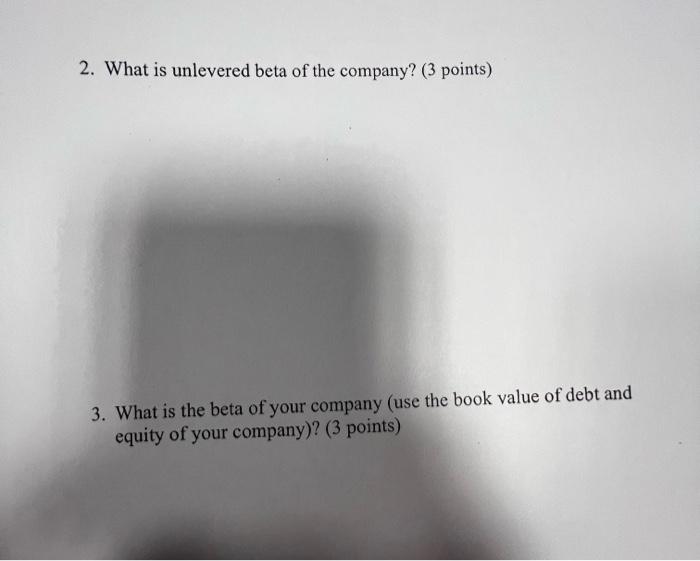

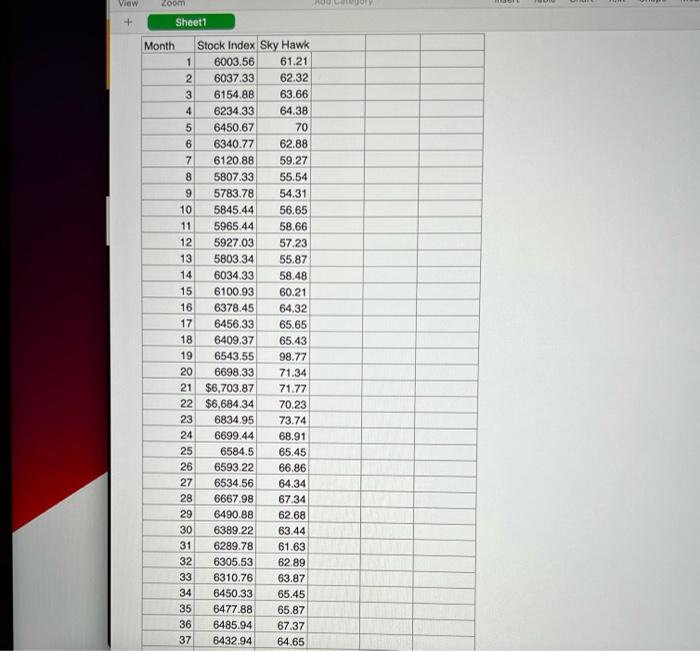

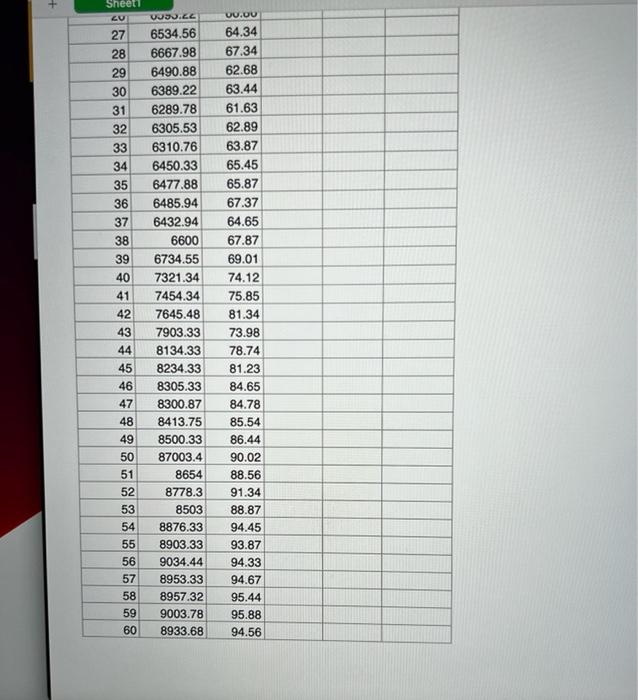

Part two: Empirical analysis of beta and cost of capital You are working in Marcus Corporation. Your boss is considering issuing new stock, and he wants to know the cost of equity of his firm. Since it is a private company, you choose a comparable firm-Sky Hawk Inc. (stock prices are available on Canvas). The tax rate is 20%. Currently, you have your company's financial statement and Sky Hawk Inc.'s financial statement Sky Hawk Inc. Statement 2021 2021 Current abilities: Accounts payable 3455 Quente: Cash and galvalents Apcounts receivable Tuvemonto 3157 270 280 $455 Total current liabilities $707 Total corrent et Long-term liabilities Deferred taxes Long-term debt Total long-term liabilities $104 453 3562 Predmet Property plans, and equipment $1,274 Le secumulatod depreciation (460) Ne property, plant, and equipment $814 Intangible that and others 221 Total fled asta 1.00 Stockholders' equity: Preferred stock $39 Common stock (51 par value) Capital garplus 327 Accumulated retained earnings Less treasury stock 202 Total equity $725 Total abilities and stockholders' equity $1742 51.742 Total Market data of Sky Hawk Inc. Sky Hawk Market Data Shares outstanding (in millions of dollars) Share price (dollars as of close Sep. 30, 2020) 735 80.00 Marcus Corp. Statement 2021 Current assets Gash Accounts receivable Inventory Total Marcus Corporation 2021 Balance Sheets For Marcus Corp (s millon) 2021 Current liabilities 84 Accounts payable 165 Notes payable 293 Total 642 Long-term debt Owners equity Common stock and 2,731 paldin surplus Rotained carnings Total 312 231 543 531 SI Fixed assets Net plant and equipment 500 3.799 12.299 5 3,373 3,373 Totol assets Total Goblities and equity 1. Estimate the beta (B) and risk free rate(ro) using the data provided. (Tips: run a regression, write down the regression and find the corresponding parameters; ignore Jensen's alpha problem). (6 points) 2. What is unlevered beta of the company? (3 points) 3. What is the beta of your company (use the book value of debt and equity of your company)? (3 points) 4. What is the cost of equity of your company (Last year's market return is 8%)? (3 points) View Zoom + Sheet1 13 Month Stock Index Sky Hawk 1 6003.56 61.21 2 6037.33 62.32 3 6154.88 63.66 4 6234.33 64.38 5 6450.67 70 6 6340.77 62.88 7 6120.88 59.27 8 5807.33 55.54 9 5783.78 54.31 10 5845.44 56.65 11 5965.44 58.66 12 5927.03 57.23 5803.34 55.87 14 6034.33 58.48 15 6100.93 60.21 16 6378.45 64.32 17 6456.33 65.65 18 6409.37 65.43 19 6543.55 98.77 20 6698.33 71.34 21 $6,703.87 71.77 22 $6,684.34 70.23 23 6834.95 73.74 24 6699.44 68.91 25 6584.5 65.45 26 6593.22 66.86 27 6534.56 64.34 28 6667.98 67.34 29 6490.88 62.68 30 6389.22 63.44 31 6289.78 61.63 32 6305.53 62.89 33 6310.76 63.87 34 6450.33 65.45 35 6477.88 65.87 36 6485.94 67.37 37 6432.94 64.65 + Sheet 20 UU.00 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 Dedu.t 6534.56 6667.98 6490.88 6389.22 6289.78 6305.53 6310.76 6450.33 6477.88 6485.94 6432.94 6600 6734.55 7321.34 7454.34 7645.48 7903.33 8134.33 8234.33 8305.33 8300.87 8413.75 8500.33 87003.4 8654 8778.3 8503 8876.33 8903.33 9034.44 8953.33 8957.32 9003.78 8933.68 64.34 67.34 62.68 63.44 61.63 62.89 63.87 65.45 65.87 67.37 64.65 67.87 69.01 74.12 75.85 81.34 73.98 78.74 81.23 84.65 84.78 85.54 86.44 90.02 88.56 91.34 88.87 94.45 93.87 94.33 94.67 95.44 95.88 94.56 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 Part two: Empirical analysis of beta and cost of capital You are working in Marcus Corporation. Your boss is considering issuing new stock, and he wants to know the cost of equity of his firm. Since it is a private company, you choose a comparable firm-Sky Hawk Inc. (stock prices are available on Canvas). The tax rate is 20%. Currently, you have your company's financial statement and Sky Hawk Inc.'s financial statement Sky Hawk Inc. Statement 2021 2021 Current abilities: Accounts payable 3455 Quente: Cash and galvalents Apcounts receivable Tuvemonto 3157 270 280 $455 Total current liabilities $707 Total corrent et Long-term liabilities Deferred taxes Long-term debt Total long-term liabilities $104 453 3562 Predmet Property plans, and equipment $1,274 Le secumulatod depreciation (460) Ne property, plant, and equipment $814 Intangible that and others 221 Total fled asta 1.00 Stockholders' equity: Preferred stock $39 Common stock (51 par value) Capital garplus 327 Accumulated retained earnings Less treasury stock 202 Total equity $725 Total abilities and stockholders' equity $1742 51.742 Total Market data of Sky Hawk Inc. Sky Hawk Market Data Shares outstanding (in millions of dollars) Share price (dollars as of close Sep. 30, 2020) 735 80.00 Marcus Corp. Statement 2021 Current assets Gash Accounts receivable Inventory Total Marcus Corporation 2021 Balance Sheets For Marcus Corp (s millon) 2021 Current liabilities 84 Accounts payable 165 Notes payable 293 Total 642 Long-term debt Owners equity Common stock and 2,731 paldin surplus Rotained carnings Total 312 231 543 531 SI Fixed assets Net plant and equipment 500 3.799 12.299 5 3,373 3,373 Totol assets Total Goblities and equity 1. Estimate the beta (B) and risk free rate(ro) using the data provided. (Tips: run a regression, write down the regression and find the corresponding parameters; ignore Jensen's alpha problem). (6 points) 2. What is unlevered beta of the company? (3 points) 3. What is the beta of your company (use the book value of debt and equity of your company)? (3 points) 4. What is the cost of equity of your company (Last year's market return is 8%)? (3 points) View Zoom + Sheet1 13 Month Stock Index Sky Hawk 1 6003.56 61.21 2 6037.33 62.32 3 6154.88 63.66 4 6234.33 64.38 5 6450.67 70 6 6340.77 62.88 7 6120.88 59.27 8 5807.33 55.54 9 5783.78 54.31 10 5845.44 56.65 11 5965.44 58.66 12 5927.03 57.23 5803.34 55.87 14 6034.33 58.48 15 6100.93 60.21 16 6378.45 64.32 17 6456.33 65.65 18 6409.37 65.43 19 6543.55 98.77 20 6698.33 71.34 21 $6,703.87 71.77 22 $6,684.34 70.23 23 6834.95 73.74 24 6699.44 68.91 25 6584.5 65.45 26 6593.22 66.86 27 6534.56 64.34 28 6667.98 67.34 29 6490.88 62.68 30 6389.22 63.44 31 6289.78 61.63 32 6305.53 62.89 33 6310.76 63.87 34 6450.33 65.45 35 6477.88 65.87 36 6485.94 67.37 37 6432.94 64.65 + Sheet 20 UU.00 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 Dedu.t 6534.56 6667.98 6490.88 6389.22 6289.78 6305.53 6310.76 6450.33 6477.88 6485.94 6432.94 6600 6734.55 7321.34 7454.34 7645.48 7903.33 8134.33 8234.33 8305.33 8300.87 8413.75 8500.33 87003.4 8654 8778.3 8503 8876.33 8903.33 9034.44 8953.33 8957.32 9003.78 8933.68 64.34 67.34 62.68 63.44 61.63 62.89 63.87 65.45 65.87 67.37 64.65 67.87 69.01 74.12 75.85 81.34 73.98 78.74 81.23 84.65 84.78 85.54 86.44 90.02 88.56 91.34 88.87 94.45 93.87 94.33 94.67 95.44 95.88 94.56 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60