PART TWO https://www.chegg.com/homework-help/questions-and-answers/part-one-q82609735

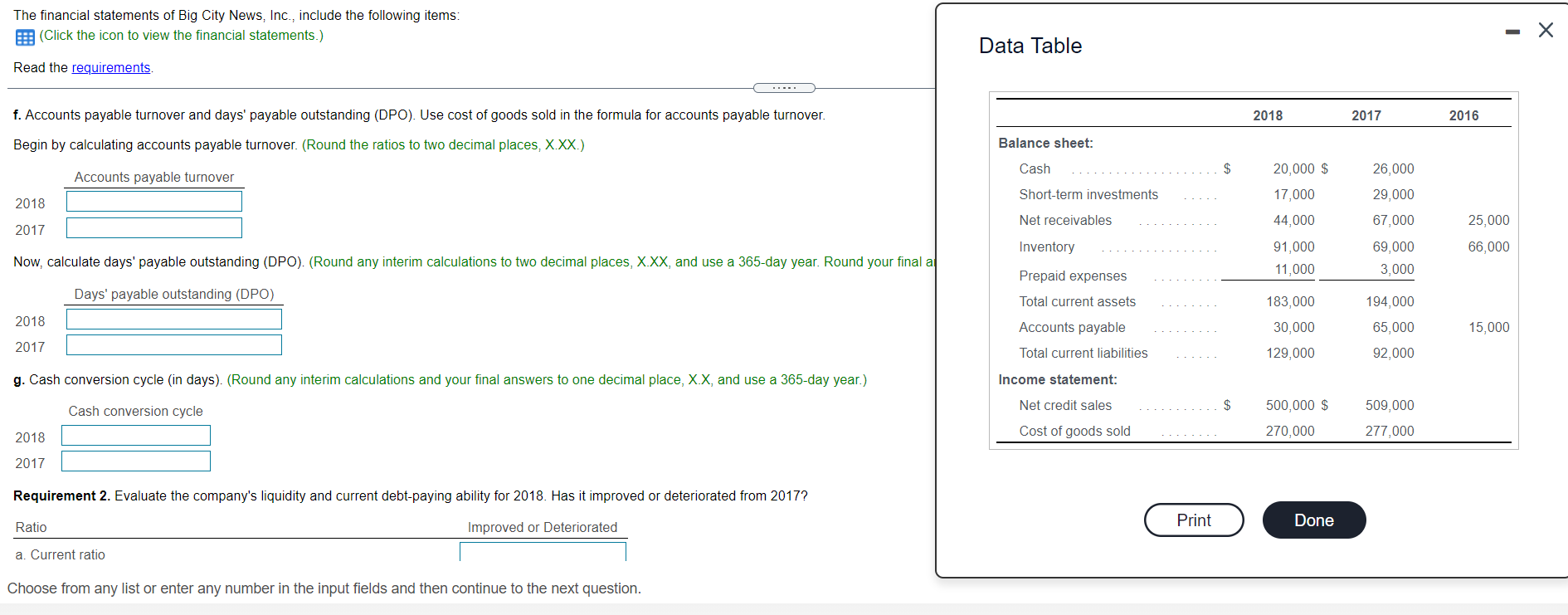

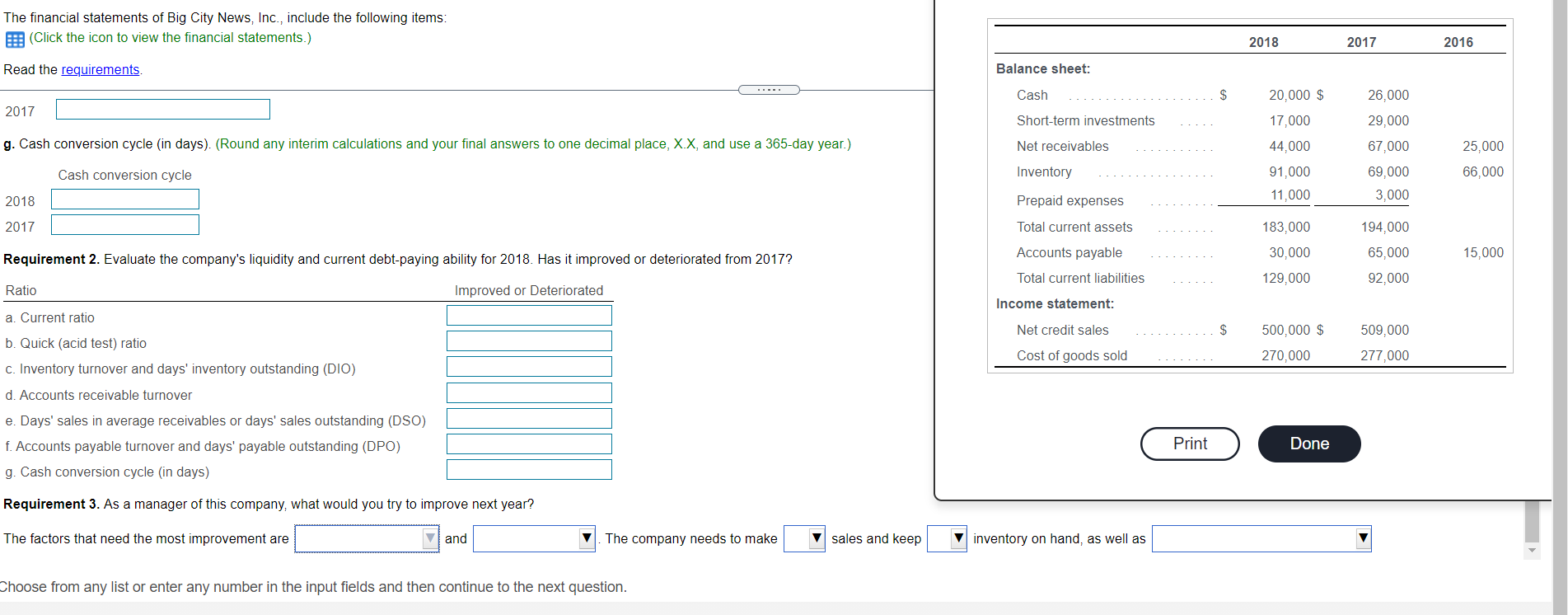

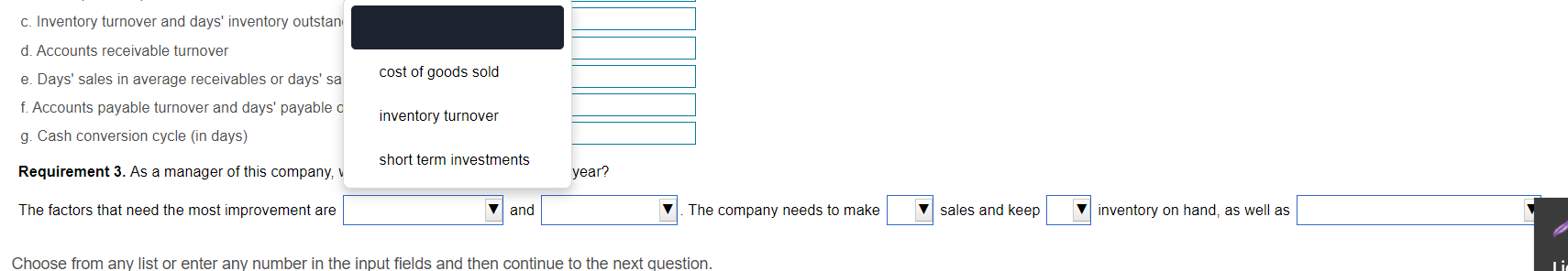

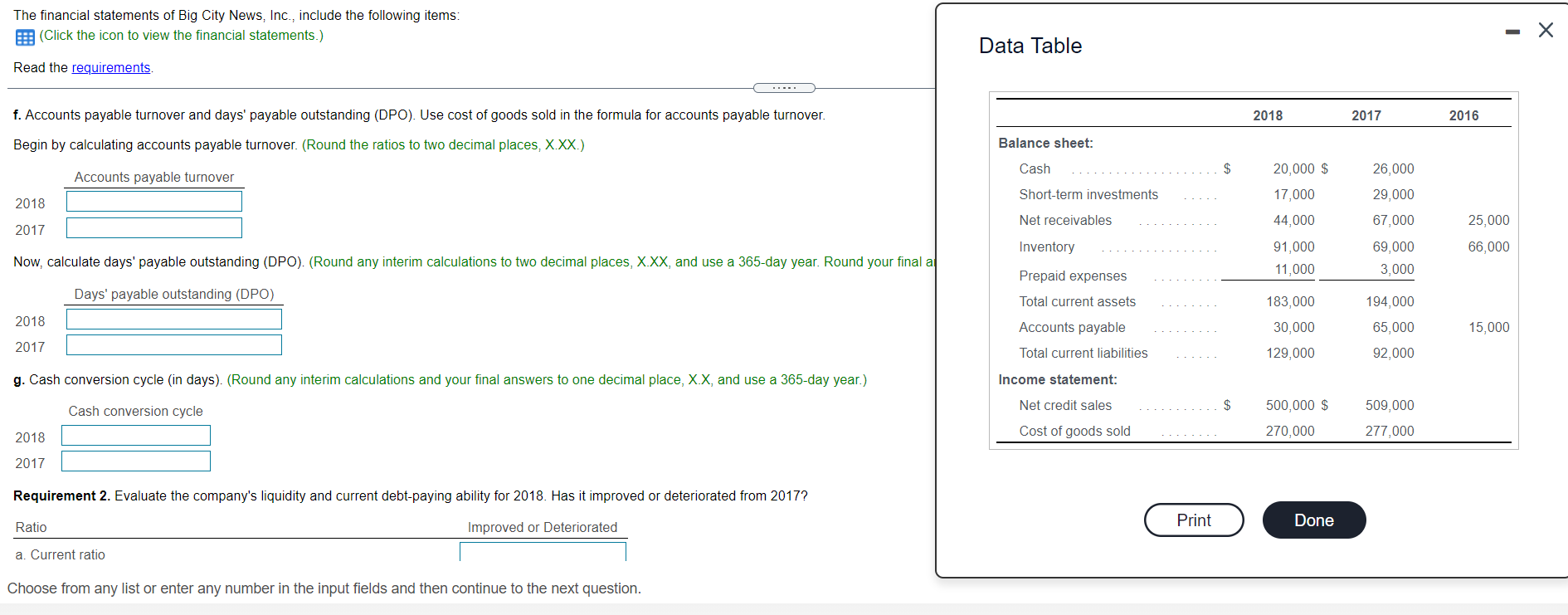

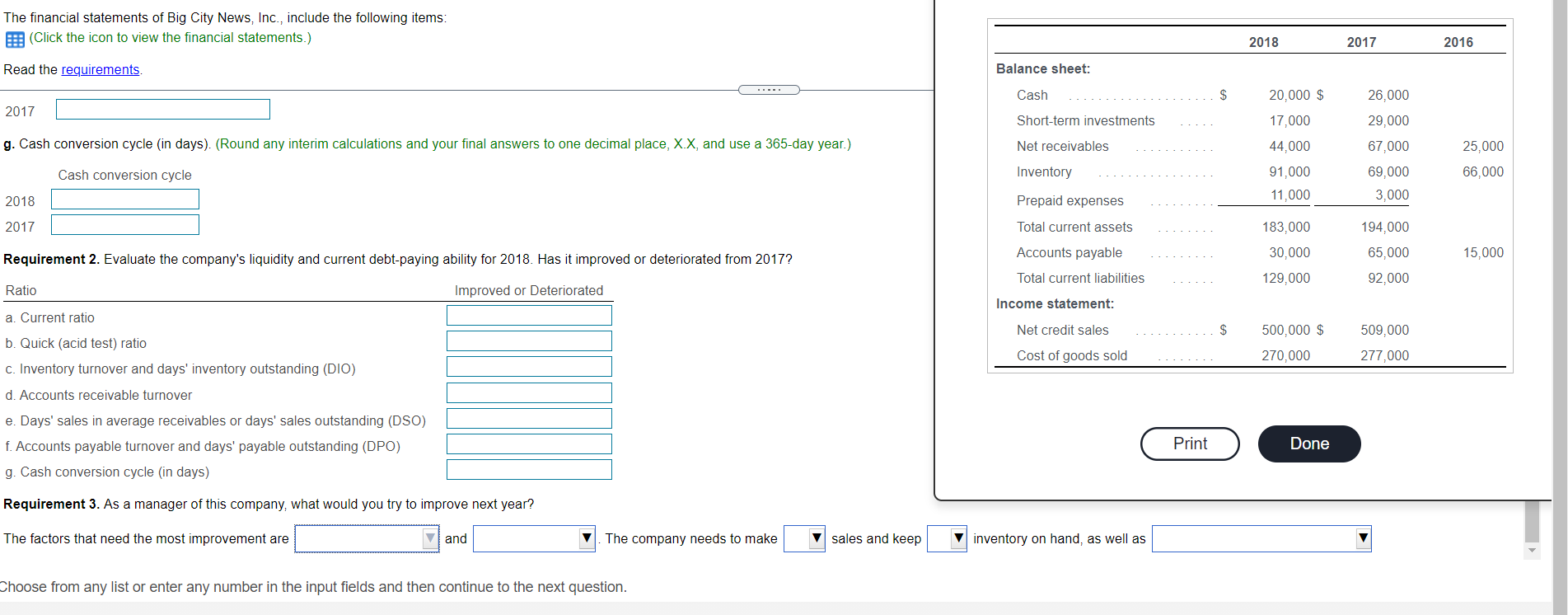

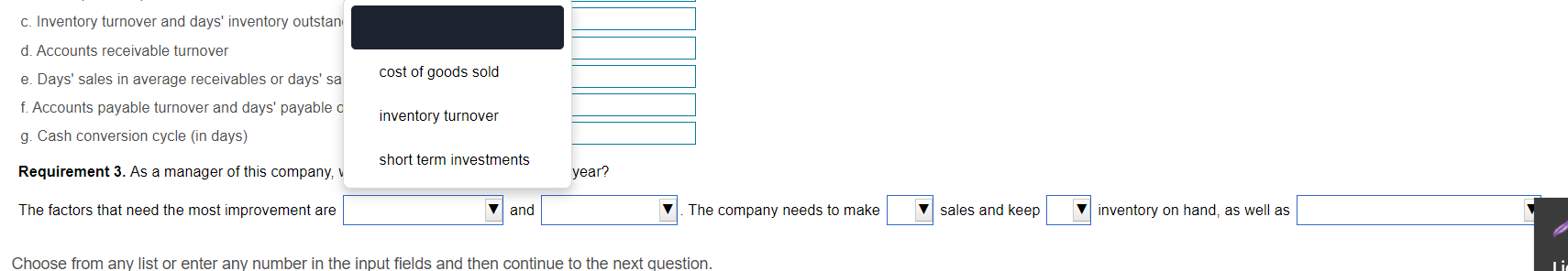

The financial statements of Big City News, Inc., include the following items: (Click the icon to view the financial statements.) Data Table Read the requirements f. Accounts payable turnover and days' payable outstanding (DPO). Use cost of goods sold in the formula for accounts payable turnover. 2018 2017 2016 Begin by calculating accounts payable turnover. (Round the ratios to two decimal places, X.XX.) Balance sheet: Cash $ 20,000 $ 26,000 Accounts payable turnover Short-term investments 2018 17,000 44,000 Net receivables 2017 29,000 67,000 69,000 3,000 25,000 66,000 Inventory Now, calculate days' payable outstanding (DPO). (Round any interim calculations to two decimal places, X.XX, and use a 365-day year. Round your finala 91,000 11,000 Prepaid expenses Days' payable outstanding (DPO) Total current assets 183,000 194,000 2018 30,000 65,000 15,000 Accounts payable Total current liabilities 2017 129,000 92,000 g. Cash conversion cycle (in days). (Round any interim calculations and your final answers to one decimal place, X.X, and use a 365-day year.) Income statement: Cash conversion cycle Net credit sales $ 500,000 $ 509,000 2018 Cost of goods sold 270,000 277,000 2017 Requirement 2. Evaluate the company's liquidity and current debt-paying ability for 2018. Has it improved or deteriorated from 2017? Ratio Print Improved or Deteriorated Done a. Current ratio Choose from any list or enter any number in the input fields and then continue to the next question. The financial statements of Big City News, Inc., include the following items: (Click the icon to view the financial statements.) 2018 2017 2016 Read the requirements Balance sheet: Cash 20,000 $ 26,000 2017 Short-term investments 17,000 29,000 g. Cash conversion cycle (in days). (Round any interim calculations and your final answers to one decimal place, X.X, and use a 365-day year.) Net receivables 25,000 44,000 91,000 Cash conversion cycle Inventory 67,000 69,000 3,000 66,000 2018 11,000 Prepaid expenses 2017 Total current assets 194,000 183,000 30,000 65,000 Requirement 2. Evaluate the company's liquidity and current debt-paying ability for 2018. Has it improved or deteriorated from 2017? 15,000 Accounts payable Total current liabilities 129,000 92,000 Ratio Improved or Deteriorated Income statement: a. Current ratio Net credit sales 500,000 $ 509,000 Cost of goods sold 270,000 277,000 b. Quick (acid test) ratio c. Inventory turnover and days' inventory outstanding (DIO) d. Accounts receivable turnover e. Days' sales in average receivables or days' sales outstanding (DSO) f. Accounts payable turnover and days' payable outstanding (DPO) g. Cash conversion cycle (in days) Print Done Requirement 3. As a manager of this company, what would you try to improve next year? The factors that need the most improvement are vand The company needs to make sales and keep inventory on hand, as well as Choose from any list or enter any number in the input fields and then continue to the next question. c. Inventory turnover and days' inventory outstan d. Accounts receivable turnover cost of goods sold e. Days' sales in average receivables or days' sa f. Accounts payable turnover and days' payable o g. Cash conversion cycle (in days) inventory turnover short term investments Requirement 3. As a manager of this company, year? The factors that need the most improvement are V and The company needs to make sales and keep inventory on hand, as well as Choose from any list or enter any number in the input fields and then continue to the next question. li