PART TWO ONLY:

Before leaving, Joyce advised Royce that there is a need for better forecasting regarding the companys cash inflows and outflows. After a series of questions, you determined that (1) the company had not prepared a cash budget for several quarters and (2) is not up to date on its payables and receivables. You are going to prepare a forecasted income statement and a forecasted cash budget for the fourth quarter. Pertinent information needed has been collected and is outlined below. Pertinent Information:

The business manager/accountant and Royce provided projections pertaining to the 2nd quarter (April through June2020) and other information outlined below:

1. Total sales 2nd quarter: 2,500 3-piece set; Sales price is $900/3-piece set

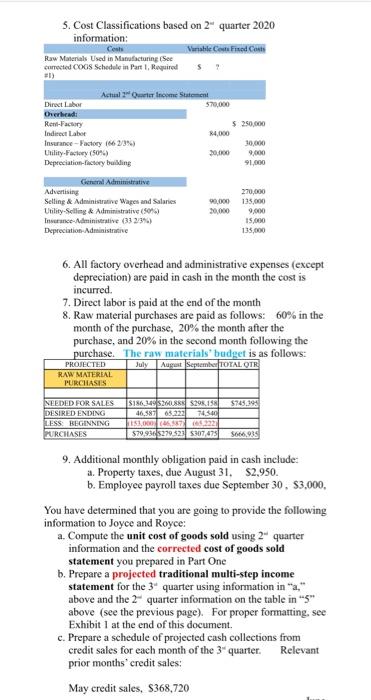

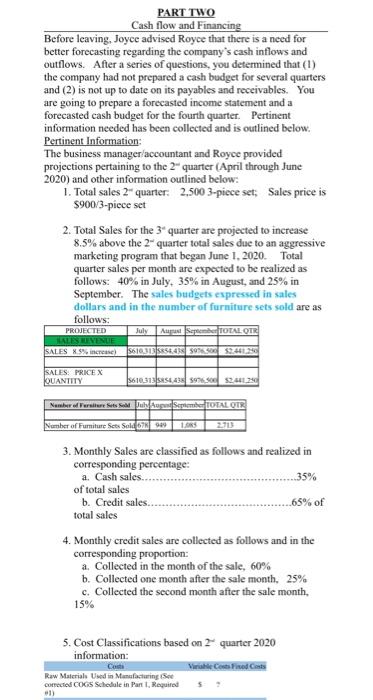

2. Total Sales for the 3rd quarter are projected to increase 8.5% above the 2nd quarter total sales due to an aggressive marketing program that began June 1, 2020. Total quarter sales per month are expected to be realized as follows: 40% in July, 35% in August, and 25% in September. The sales budgets expressed in sales dollars and in the number of furniture sets sold are as follows:

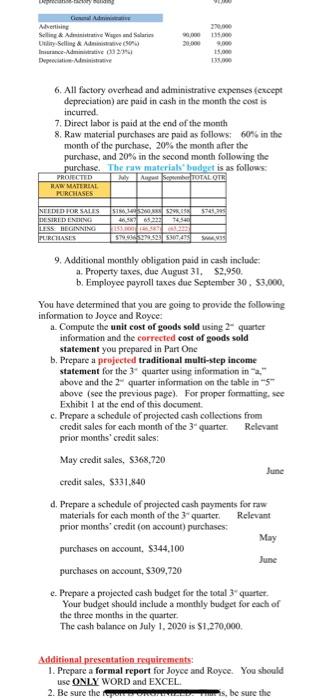

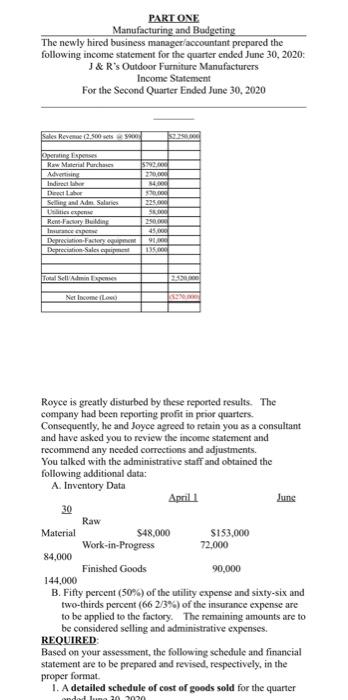

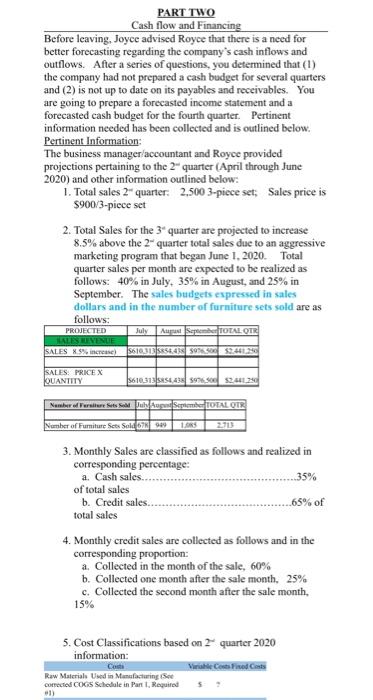

PART TWO Cash flow and Financing Before leaving, Joyce advised Royce that there is a need for better forecasting regarding the company's cash inflows and outflows. After a series of questions, you determined that (1) the company had not prepared a cash budget for several quarters and (2) is not up to date on its payables and receivables. You are going to prepare a forecasted income statement and a forecasted cash budget for the fourth quarter. Pertinent information needed has been collected and is outlined below. Pertinent Information: The business manager accountant and Royce provided projections pertaining to the 2" quarter (April through June 2020) and other information outlined below: 1. Total sales 2" quarter. 2.500 3-piece set: Sales price is $900/3-piece set 2. Total Sales for the 3 quarter are projected to increase 8.5% above the 2- quarter total sales due to an aggressive marketing program that began June 1, 2020. Total quarter sales per month are expected to be realized as follows: 40% in July 35% in August, and 25% in September. The sales budgets expressed in sales dollars and in the number of furniture sets sold are as follows: PROJECTED July August Sepet TOTAL OTR TALES VENUE SALES XS increase) SSIIS SEASON 5224435 SALES PRICE X QUANTITY 5610313 SSE4359700 2012 Nandre ersture Sith Agad Septembe-TOTAL OTR Number of Furniture Sets Sald 678909 3. Monthly Sales are classified as follows and realized in corresponding percentage: a. Cash sales. 35% of total sales b. Credit sales.. 65% of total sales 4. Monthly credit sales are collected as follows and in the corresponding proportion: a. Collected in the month of the sale, 60% b. Collected one month after the sale month, 25% c. Collected the second month after the sale month, 15% 5. Cost Classifications based on 2 quarter 2020 information: Vile Costs Fixed Costs Raw Materials used in Manufacturing See corrected COGS Schedule in Pan Required 5. Cost Classifications based on 24 quarter 2020 information: Com ble Comised.Com Raw Materials used in Manufacturing See corected COGS Schedule in Part 1, Required #1) Actul Orte income Sustent Direct Labor 570,000 Cherhead Ren-Factory $ 250,000 Indirect Labor R4,000 Insurance - Factory (46 2/3%) 30,000 Utility Factory (50%) 20.000 9,000 Depreciation-actory building 91,000 General Administrative Advertising Selling & Administratie Wages and Salaries Utility-Selling & Administrative (50%) Invence-Administrative (33 2.3%) Depreciation Administratie 270,000 135,000 90.000 20,000 19.000 135,000 6. All factory overhead and administrative expenses (except depreciation) are paid in cash in the month the cost is incurred 7. Direct labor is paid at the end of the month 8. Raw material purchases are paid as follows: 60% in the month of the purchase, 20% the month after the purchase, and 20% in the second month following the purchase. The raw materials' budget is as follows: July August Septembad TOTAL OTR RAW MATERIAL PROJECTED PURCHASIS $745 194 NEEDED FOR SALES DESIRED ENDING LESS BEGINNING ZURCHASES 8186_1495285295.15 46,581 63.322 745 11,000 (457622 $79.93652793285307,475 $666.935 9. Additional monthly obligation paid in cash include: a. Property taxes, due August 31. $2.950. b. Employee payroll taxes due September 30, $3,000, You have determined that you are going to provide the following information to Joyce and Royce: a. Compute the unit cost of goods sold using 2 quarter information and the corrected cost of goods sold statement you prepared in Part One b. Prepare a projected traditional multi-step income statement for the 3 quarter using information in a." above and the 2 quarter information on the table in "5" above (see the previous page). For proper formatting, see Exhibit 1 at the end of this document. c. Prepare a schedule of projected cash collections from credit sales for each month of the 3* quarter. Relevant prior months' credit sales: May credit sales, S368,720 GA Avertising Selling & Administrative Wagen und Solaris Selling & Admin Inice Amie 232 3000 135.000 30.000 6. All factory overhead and administrative expenses (except depreciation) are paid in cash in the month the cost is incurred. 7. Direct labor is paid at the end of the month 8. Raw material purchases are paid as follows: 60% in the month of the purchase, 20% the month after the purchase, and 20% in the second month following the purchase. The raw materials budext is as follows PROJECTED Maly ApaTOTAL OTR HAW MATERIAL PURCHASES 5721 NEED FOR SALES DESIRED INRNG LES REGINNING PERCHASES STAR 2005 14:54 251 59.322 523 5.475 9. Additional monthly obligation paid in cash include: a. Property taxes, due August 31, S2,950. b. Employee payroll taxes due September 30, $3.000, You have determined that you are going to provide the following information to Joyce and Royce! a. Compute the unit cost of goods sold using 2- quarter information and the corrected cost of goods sold statement you prepared in Part One b. Prepare a projected traditional multi-step income statement for the 3 quarter using information in above and the 2 quarter information on the table in above (see the previous page). For proper formatting, see Exhibit I at the end of this document c. Prepare a schedule of projected cash collections from credit sales for each month of the 3 quarter Relevant prior months' credit sales: May credit sales, S368,720 June credit sales, S331.840 d. Prepare a schedule of projected cash payments for raw materials for each month of the quarter. Relevant prior months' credit (on account) purchases May purchases on account, $344,100 June purchases on account, $309,720 c. Prepare a projected cash budget for the total 3* quartet Your budget should include a monthly budget for each of the three months in the quarter The cash balance on July 1, 2020 is $1.270,000 Additional presentation requirements: 1. Prepare a formal report for Joyce and Royce. You should use ONLY WORD and EXCEL 2. Be sure the room Ps, be sure the PART ONE Manufacturing and Budgeting The newly hired business manager accountant prepared the following income statement for the quarter ended June 30, 2020: J&R's Outdoor Furniture Manufacturers Income Statement For the Second Quarter Ended June 30, 2020 Sales Reveme 2.500 sets 500 seruling Expenses Raw Material Parches SN 220,00 14. 320.00 Indt De Sing and Adm. Salarios Ustens RanFactory Building Impe Deprecate Depreciation Sales 45 135.00 Total Sell Admin 223 Netcome Royce is greatly disturbed by these reported results. The company had been reporting profit in prior quarters. Consequently, he and Joyce agreed to retain you as a consultant and have asked you to review the income statement and recommend any needed corrections and adjustments. You talked with the administrative staff and obtained the following additional data: A. Inventory Data Aprill Juns 30 Raw Material $48,000 S153,000 Work-in-Progress 72,000 84,000 Finished Goods 90,000 144,000 B. Fifty percent (50%) of the utility expense and sixty-six and two-thirds percent (662/3%) of the insurance expense are to be applied to the factory. The remaining amounts are to be considered selling and administrative expenses. REQUIRED Based on your assessment, the following schedule and financial statement are to be prepared and revised, respectively, in the proper format 1. A detailed schedule of cost of goods sold for the quarter ndod lung in 2010 PART TWO Cash flow and Financing Before leaving, Joyce advised Royce that there is a need for better forecasting regarding the company's cash inflows and outflows. After a series of questions, you determined that (1) the company had not prepared a cash budget for several quarters and (2) is not up to date on its payables and receivables. You are going to prepare a forecasted income statement and a forecasted cash budget for the fourth quarter. Pertinent information needed has been collected and is outlined below. Pertinent Information: The business manager accountant and Royce provided projections pertaining to the 2" quarter (April through June 2020) and other information outlined below: 1. Total sales 2" quarter. 2.500 3-piece set: Sales price is $900/3-piece set 2. Total Sales for the 3 quarter are projected to increase 8.5% above the 2- quarter total sales due to an aggressive marketing program that began June 1, 2020. Total quarter sales per month are expected to be realized as follows: 40% in July 35% in August, and 25% in September. The sales budgets expressed in sales dollars and in the number of furniture sets sold are as follows: PROJECTED July August Sepet TOTAL OTR TALES VENUE SALES XS increase) SSIIS SEASON 5224435 SALES PRICE X QUANTITY 5610313 SSE4359700 2012 Nandre ersture Sith Agad Septembe-TOTAL OTR Number of Furniture Sets Sald 678909 3. Monthly Sales are classified as follows and realized in corresponding percentage: a. Cash sales. 35% of total sales b. Credit sales.. 65% of total sales 4. Monthly credit sales are collected as follows and in the corresponding proportion: a. Collected in the month of the sale, 60% b. Collected one month after the sale month, 25% c. Collected the second month after the sale month, 15% 5. Cost Classifications based on 2 quarter 2020 information: Vile Costs Fixed Costs Raw Materials used in Manufacturing See corrected COGS Schedule in Pan Required 5. Cost Classifications based on 24 quarter 2020 information: Com ble Comised.Com Raw Materials used in Manufacturing See corected COGS Schedule in Part 1, Required #1) Actul Orte income Sustent Direct Labor 570,000 Cherhead Ren-Factory $ 250,000 Indirect Labor R4,000 Insurance - Factory (46 2/3%) 30,000 Utility Factory (50%) 20.000 9,000 Depreciation-actory building 91,000 General Administrative Advertising Selling & Administratie Wages and Salaries Utility-Selling & Administrative (50%) Invence-Administrative (33 2.3%) Depreciation Administratie 270,000 135,000 90.000 20,000 19.000 135,000 6. All factory overhead and administrative expenses (except depreciation) are paid in cash in the month the cost is incurred 7. Direct labor is paid at the end of the month 8. Raw material purchases are paid as follows: 60% in the month of the purchase, 20% the month after the purchase, and 20% in the second month following the purchase. The raw materials' budget is as follows: July August Septembad TOTAL OTR RAW MATERIAL PROJECTED PURCHASIS $745 194 NEEDED FOR SALES DESIRED ENDING LESS BEGINNING ZURCHASES 8186_1495285295.15 46,581 63.322 745 11,000 (457622 $79.93652793285307,475 $666.935 9. Additional monthly obligation paid in cash include: a. Property taxes, due August 31. $2.950. b. Employee payroll taxes due September 30, $3,000, You have determined that you are going to provide the following information to Joyce and Royce: a. Compute the unit cost of goods sold using 2 quarter information and the corrected cost of goods sold statement you prepared in Part One b. Prepare a projected traditional multi-step income statement for the 3 quarter using information in a." above and the 2 quarter information on the table in "5" above (see the previous page). For proper formatting, see Exhibit 1 at the end of this document. c. Prepare a schedule of projected cash collections from credit sales for each month of the 3* quarter. Relevant prior months' credit sales: May credit sales, S368,720 GA Avertising Selling & Administrative Wagen und Solaris Selling & Admin Inice Amie 232 3000 135.000 30.000 6. All factory overhead and administrative expenses (except depreciation) are paid in cash in the month the cost is incurred. 7. Direct labor is paid at the end of the month 8. Raw material purchases are paid as follows: 60% in the month of the purchase, 20% the month after the purchase, and 20% in the second month following the purchase. The raw materials budext is as follows PROJECTED Maly ApaTOTAL OTR HAW MATERIAL PURCHASES 5721 NEED FOR SALES DESIRED INRNG LES REGINNING PERCHASES STAR 2005 14:54 251 59.322 523 5.475 9. Additional monthly obligation paid in cash include: a. Property taxes, due August 31, S2,950. b. Employee payroll taxes due September 30, $3.000, You have determined that you are going to provide the following information to Joyce and Royce! a. Compute the unit cost of goods sold using 2- quarter information and the corrected cost of goods sold statement you prepared in Part One b. Prepare a projected traditional multi-step income statement for the 3 quarter using information in above and the 2 quarter information on the table in above (see the previous page). For proper formatting, see Exhibit I at the end of this document c. Prepare a schedule of projected cash collections from credit sales for each month of the 3 quarter Relevant prior months' credit sales: May credit sales, S368,720 June credit sales, S331.840 d. Prepare a schedule of projected cash payments for raw materials for each month of the quarter. Relevant prior months' credit (on account) purchases May purchases on account, $344,100 June purchases on account, $309,720 c. Prepare a projected cash budget for the total 3* quartet Your budget should include a monthly budget for each of the three months in the quarter The cash balance on July 1, 2020 is $1.270,000 Additional presentation requirements: 1. Prepare a formal report for Joyce and Royce. You should use ONLY WORD and EXCEL 2. Be sure the room Ps, be sure the PART ONE Manufacturing and Budgeting The newly hired business manager accountant prepared the following income statement for the quarter ended June 30, 2020: J&R's Outdoor Furniture Manufacturers Income Statement For the Second Quarter Ended June 30, 2020 Sales Reveme 2.500 sets 500 seruling Expenses Raw Material Parches SN 220,00 14. 320.00 Indt De Sing and Adm. Salarios Ustens RanFactory Building Impe Deprecate Depreciation Sales 45 135.00 Total Sell Admin 223 Netcome Royce is greatly disturbed by these reported results. The company had been reporting profit in prior quarters. Consequently, he and Joyce agreed to retain you as a consultant and have asked you to review the income statement and recommend any needed corrections and adjustments. You talked with the administrative staff and obtained the following additional data: A. Inventory Data Aprill Juns 30 Raw Material $48,000 S153,000 Work-in-Progress 72,000 84,000 Finished Goods 90,000 144,000 B. Fifty percent (50%) of the utility expense and sixty-six and two-thirds percent (662/3%) of the insurance expense are to be applied to the factory. The remaining amounts are to be considered selling and administrative expenses. REQUIRED Based on your assessment, the following schedule and financial statement are to be prepared and revised, respectively, in the proper format 1. A detailed schedule of cost of goods sold for the quarter ndod lung in 2010

PART TWO ONLY: Before leaving, Joyce advised Royce that there is a need for better forecasting regarding the companys cash inflows and outflows. After a series of questions, you determined that (1) the company had not prepared a cash budget for several quarters and (2) is not up to date on its payables and receivables. You are going to prepare a forecasted income statement and a forecasted cash budget for the fourth quarter. Pertinent information needed has been collected and is outlined below.

PART TWO ONLY: Before leaving, Joyce advised Royce that there is a need for better forecasting regarding the companys cash inflows and outflows. After a series of questions, you determined that (1) the company had not prepared a cash budget for several quarters and (2) is not up to date on its payables and receivables. You are going to prepare a forecasted income statement and a forecasted cash budget for the fourth quarter. Pertinent information needed has been collected and is outlined below.