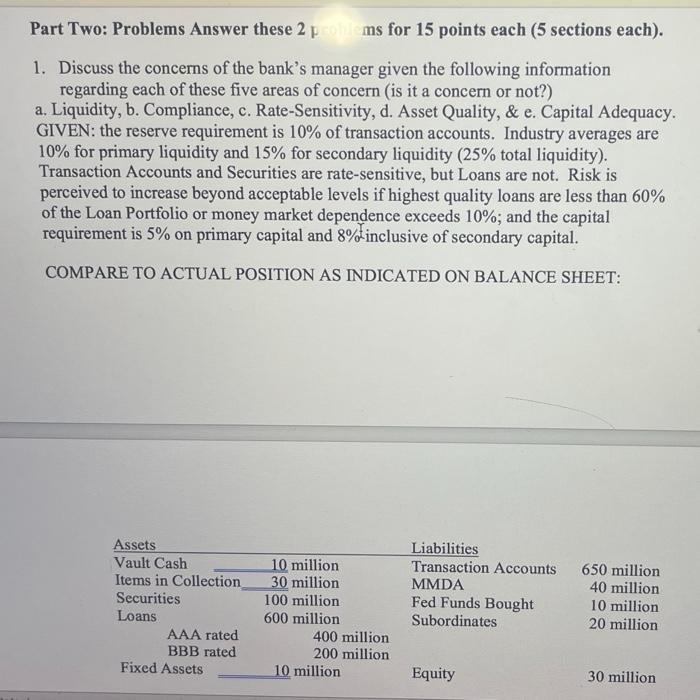

Part Two: Problems Answer these 2 pms for 15 points each (5 sections each). 1. Discuss the concerns of the bank's manager given the following information regarding each of these five areas of concern (is it a concern or not?) a. Liquidity, b. Compliance, c. Rate-Sensitivity, d. Asset Quality, & e. Capital Adequacy. GIVEN: the reserve requirement is 10% of transaction accounts. Industry averages are 10% for primary liquidity and 15% for secondary liquidity (25% total liquidity). Transaction Accounts and Securities are rate-sensitive, but Loans are not. Risk is perceived to increase beyond acceptable levels if highest quality loans are less than 60% of the Loan Portfolio or money market dependence exceeds 10%; and the capital requirement is 5% on primary capital and 8%-inclusive of secondary capital. COMPARE TO ACTUAL POSITION AS INDICATED ON BALANCE SHEET: Assets Vault Cash Items in Collection Securities Loans AAA rated BBB rated Fixed Assets 10 million 30 million 100 million 600 million 400 million 200 million 10 million Liabilities Transaction Accounts MMDA Fed Funds Bought Subordinates 650 million 40 million 10 million 20 million Equity 30 million Part Two: Problems Answer these 2 pms for 15 points each (5 sections each). 1. Discuss the concerns of the bank's manager given the following information regarding each of these five areas of concern (is it a concern or not?) a. Liquidity, b. Compliance, c. Rate-Sensitivity, d. Asset Quality, & e. Capital Adequacy. GIVEN: the reserve requirement is 10% of transaction accounts. Industry averages are 10% for primary liquidity and 15% for secondary liquidity (25% total liquidity). Transaction Accounts and Securities are rate-sensitive, but Loans are not. Risk is perceived to increase beyond acceptable levels if highest quality loans are less than 60% of the Loan Portfolio or money market dependence exceeds 10%; and the capital requirement is 5% on primary capital and 8%-inclusive of secondary capital. COMPARE TO ACTUAL POSITION AS INDICATED ON BALANCE SHEET: Assets Vault Cash Items in Collection Securities Loans AAA rated BBB rated Fixed Assets 10 million 30 million 100 million 600 million 400 million 200 million 10 million Liabilities Transaction Accounts MMDA Fed Funds Bought Subordinates 650 million 40 million 10 million 20 million Equity 30 million