Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part Two: The Accrual Method The accrual method only applies to the income statement. Under the accrual method, there will be some transactions where revenue

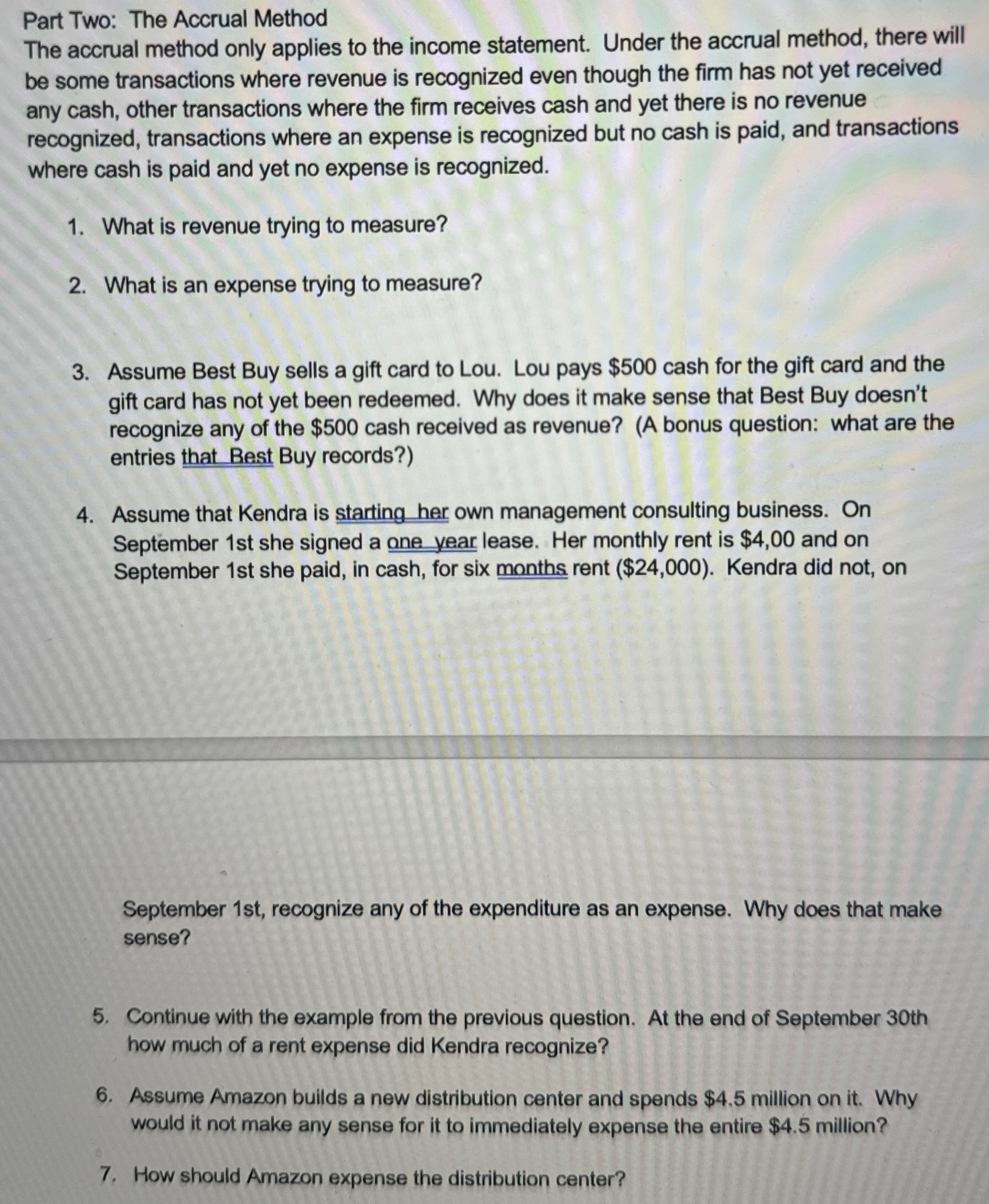

Part Two: The Accrual Method

The accrual method only applies to the income statement. Under the accrual method, there will be some transactions where revenue is recognized even though the firm has not yet received any cash, other transactions where the firm receives cash and yet there is no revenue recognized, transactions where an expense is recognized but no cash is paid, and transactions where cash is paid and yet no expense is recognized.

What is revenue trying to measure?

What is an expense trying to measure?

Assume Best Buy sells a gift card to Lou. Lou pays $ cash for the gift card and the gift card has not yet been redeemed. Why does it make sense that Best Buy doesn't recognize any of the $ cash received as revenue? A bonus question: what are the entries that Best Buy records?

Assume that Kendra is starting her own management consulting business. On September st she signed a one year lease. Her monthly rent is $ and on September st she paid, in cash, for six months rent $ Kendra did not, on

September st recognize any of the expenditure as an expense. Why does that make sense?

Continue with the example from the previous question. At the end of September th how much of a rent expense did Kendra recognize?

Assume Amazon builds a new distribution center and spends $ million on it Why would it not make any sense for it to immediately expense the entire $ million?

How should Amazon expense the distribution center?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started