Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part VI. Budgeted Balance Sheet (15 Points) Cainas Cookies has applied for a loan with Bank of America. The bank has requested a budgeted balance

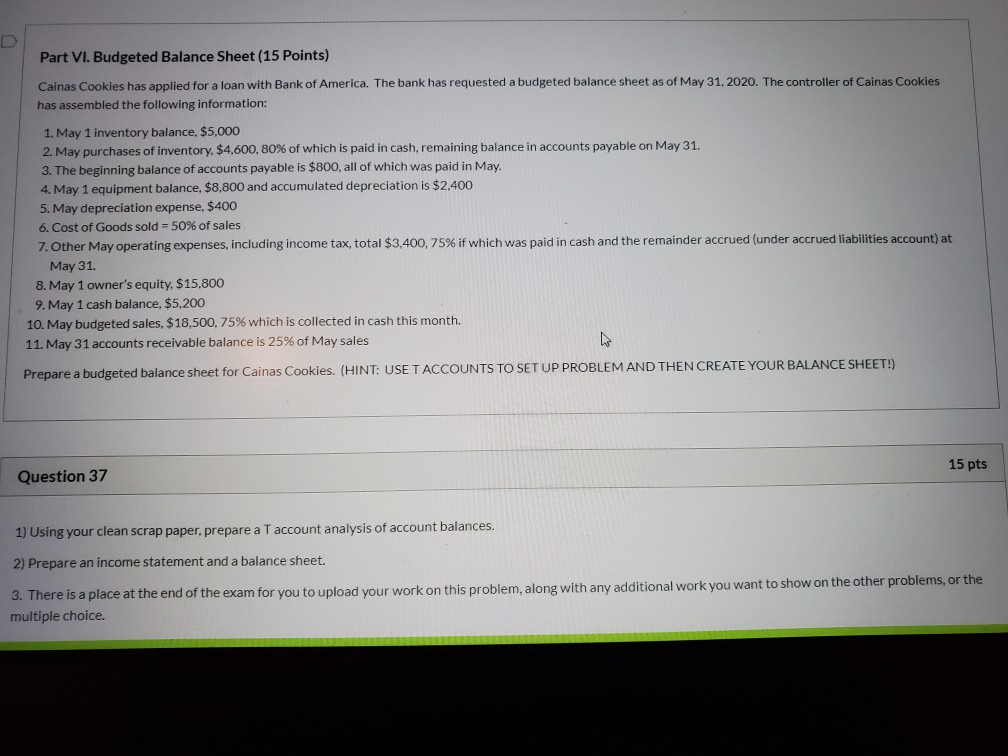

Part VI. Budgeted Balance Sheet (15 Points) Cainas Cookies has applied for a loan with Bank of America. The bank has requested a budgeted balance sheet as of May 31, 2020. The controller of Cainas Cookies has assembled the following information: 1. May 1 inventory balance, $5,000 2. May purchases of inventory. $4,600, 80% of which is paid in cash, remaining balance in accounts payable on May 31. 3. The beginning balance of accounts payable is $800, all of which was paid in May. 4. May 1 equipment balance, $8,800 and accumulated depreciation is $2.400 5. May depreciation expense, $400 6. Cost of Goods sold = 50% of sales 7. Other May operating expenses, including income tax, total $3,400,75% if which was paid in cash and the remainder accrued (under accrued liabilities account) at May 31. 8. May 1 owner's equity, $15.800 9. May 1 cash balance. $5.200 10. May budgeted sales, $18,500, 75% which is collected in cash this month. 11. May 31 accounts receivable balance is 25% of May sales Prepare a budgeted balance sheet for Cainas Cookies. (HINT: USE TACCOUNTS TO SET UP PROBLEM AND THEN CREATE YOUR BALANCE SHEET!) Question 37 15 pts 1) Using your clean scrap paper, prepare a T account analysis of account balances. 2) Prepare an income statement and a balance sheet. 3. There is a place at the end of the exam for you to upload your work on this problem, along with any additional work you want to show on the other problems, or the multiple choice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started