Answered step by step

Verified Expert Solution

Question

1 Approved Answer

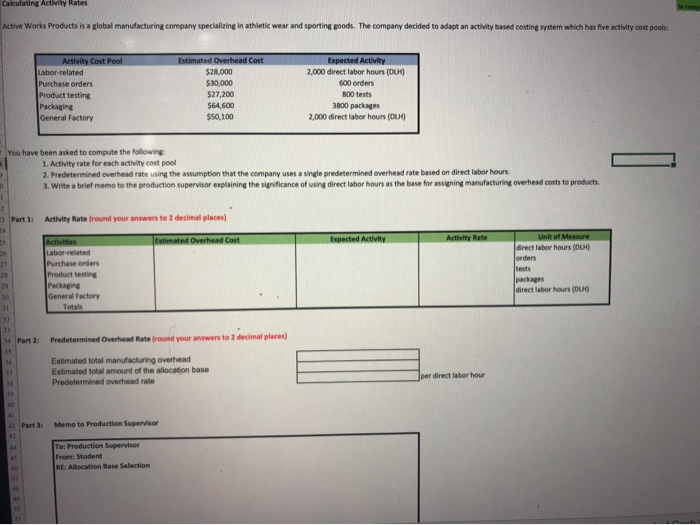

part-1, part 2, part-3 has to be filled as detailed possible. Active Works Products is a global manufacturing company specializing in thetic wear and sporting

part-1, part 2, part-3 has to be filled as detailed possible.

Active Works Products is a global manufacturing company specializing in thetic wear and sporting goods. The company decided to adapt an activity based costing system which has five activity cost pool Activity Cost Pool Labor related Purchase orders Product testing Packaging General Factory Estimated Overhead Cost $26.000 $30,000 $27,200 $64,600 $50,100 Expected Activity 2,000 direct labor hours (DLH) 500 orders 800 tests 3800 packages 2,000 direct labor hours (OH) You have been asked to compute the following 1. Activity rate for each activity cost pool 2. Predetermined overhead ratewing the sumption that the company s ingle predetermined overhead rate based on direct labor hours. 3. Write a brief meme to the production Supervisor explaining the significance of using direct labor hours as the base for assigning manufacturing overhead costs to products, Activity Rate round your answers to 2 decimal places) Estimated Overhead Cost pected Activity Activity Rate Unit of Mesure direct labor hours (OH) orders Activities Labor-related Purchase orders Product testing Packaging General Factory packages direct labor hours (DUH 14 Part 2 Predetermined Overhead Rate round your answers to decimal places Estimated total manufacturing overhead Estimated total amount of the allocation base Predetermined overhead role per direct labor hour Part: Memo to Production Supervisor To: Production Supervisor From Student RE: Allocation Base Selection Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started