Answered step by step

Verified Expert Solution

Question

1 Approved Answer

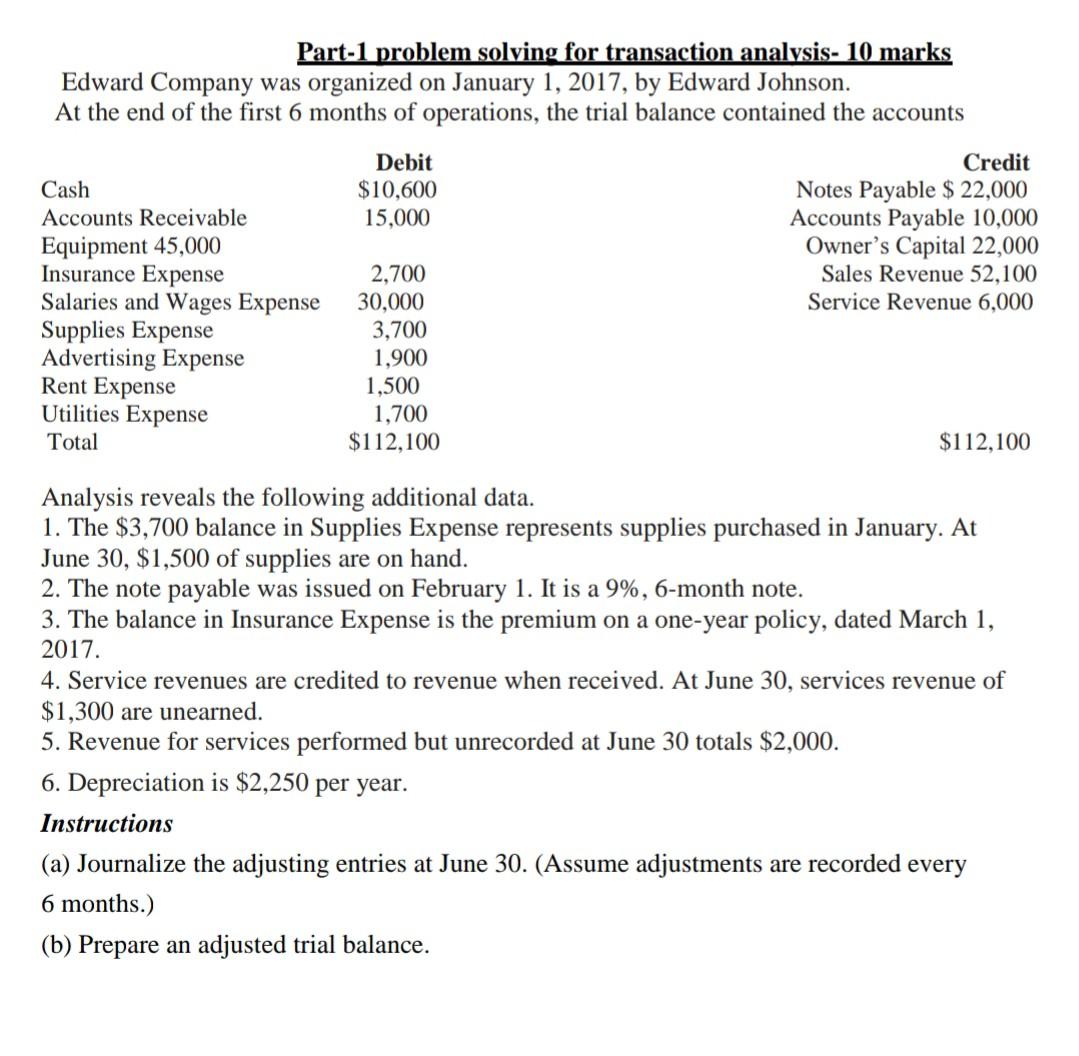

Part-1 problem solving for transaction analysis- 10 marks Edward Company was organized on January 1, 2017, by Edward Johnson. At the end of the first

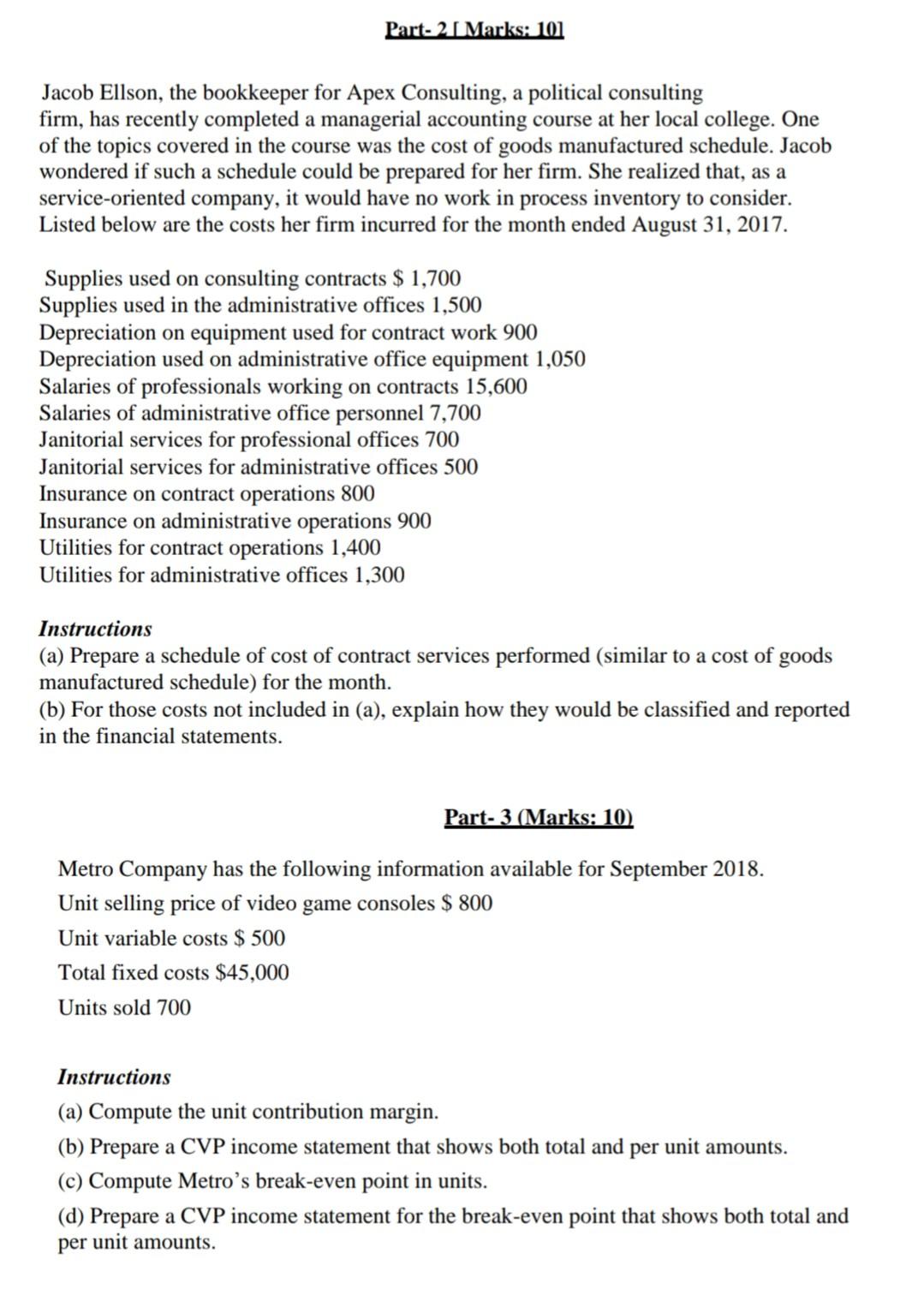

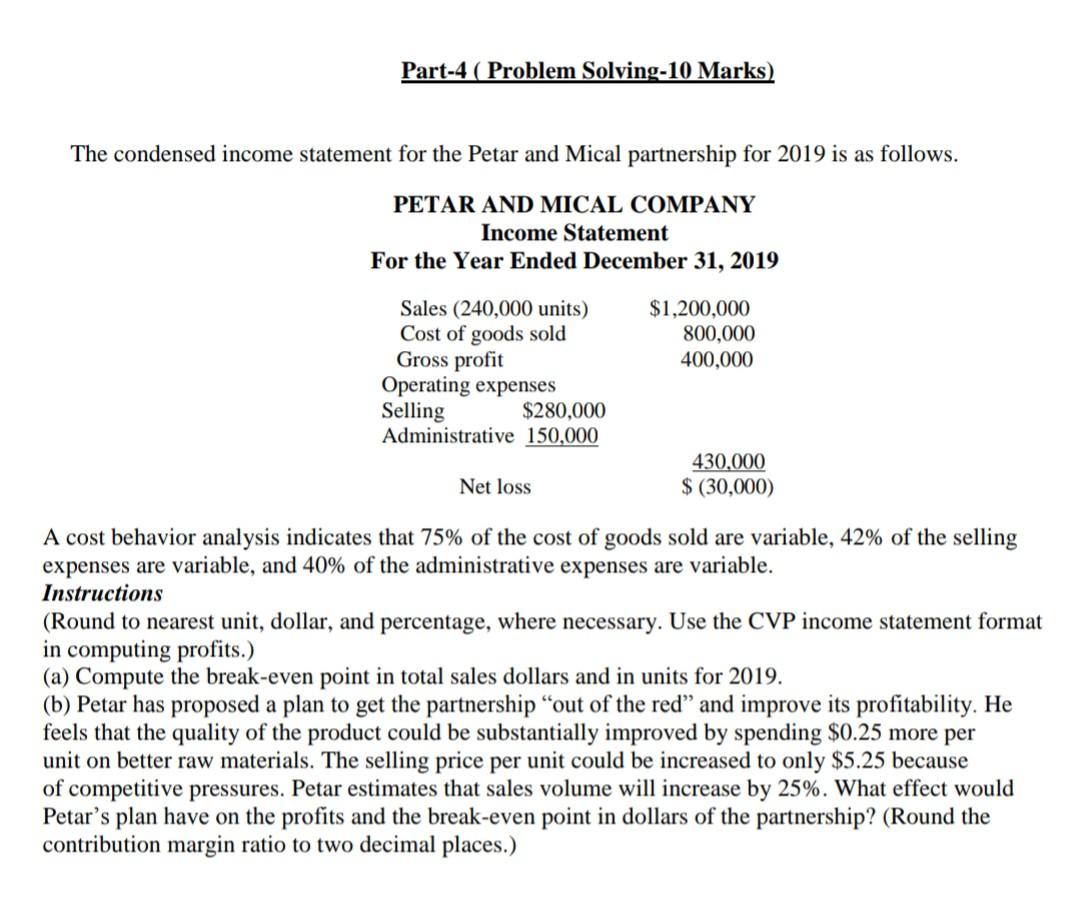

Part-1 problem solving for transaction analysis- 10 marks Edward Company was organized on January 1, 2017, by Edward Johnson. At the end of the first 6 months of operations, the trial balance contained the accounts Debit $10,600 15,000 Cash Accounts Receivable Equipment 45,000 Insurance Expense Salaries and Wages Expense Supplies Expense Advertising Expense Rent Expense Utilities Expense Total Credit Notes Payable $ 22,000 Accounts Payable 10,000 Owner's Capital 22,000 Sales Revenue 52,100 Service Revenue 6,000 2,700 30,000 3,700 1,900 1,500 1,700 $112,100 $112,100 Analysis reveals the following additional data. 1. The $3,700 balance in Supplies Expense represents supplies purchased in January. At June 30, $1,500 of supplies are on hand. 2. The note payable was issued on February 1. It is a 9%, 6-month note. 3. The balance in Insurance Expense is the premium on a one-year policy, dated March 1, 2017. 4. Service revenues are credited to revenue when received. At June 30, services revenue of $1,300 are unearned. 5. Revenue for services performed but unrecorded at June 30 totals $2,000. 6. Depreciation is $2,250 per year. Instructions (a) Journalize the adjusting entries at June 30. (Assume adjustments are recorded every 6 months.) (b) Prepare an adjusted trial balance. Part. 21 Marks: 101 Jacob Ellson, the bookkeeper for Apex Consulting, a political consulting firm, has recently completed a managerial accounting course at her local college. One of the topics covered in the course was the cost of goods manufactured schedule. Jacob wondered if such a schedule could be prepared for her firm. She realized that, as a service-oriented company, it would have no work in process inventory to consider. Listed below are the costs her firm incurred for the month ended August 31, 2017. Supplies used on consulting contracts $ 1,700 Supplies used in the administrative offices 1,500 Depreciation on equipment used for contract work 900 Depreciation used on administrative office equipment 1,050 Salaries of professionals working on contracts 15,600 Salaries of administrative office personnel 7,700 Janitorial services for professional offices 700 Janitorial services for administrative offices 500 Insurance on contract operations 800 Insurance on administrative operations 900 Utilities for contract operations 1,400 Utilities for administrative offices 1,300 Instructions (a) Prepare a schedule of cost of contract services performed (similar to a cost of goods manufactured schedule) for the month. (b) For those costs not included in (a), explain how they would be classified and reported in the financial statements. Part- 3 (Marks: 10) Metro Company has the following information available for September 2018. Unit selling price of video game consoles $ 800 Unit variable costs $ 500 Total fixed costs $45,000 Units sold 700 Instructions (a) Compute the unit contribution margin. (b) Prepare a CVP income statement that shows both total and per unit amounts. (c) Compute Metro's break-even point in units. (d) Prepare a CVP income statement for the break-even point that shows both total and per unit amounts. Part-4 ( Problem Solving-10 Marks) The condensed income statement for the Petar and Mical partnership for 2019 is as follows. PETAR AND MICAL COMPANY Income Statement For the Year Ended December 31, 2019 Sales (240,000 units) $1,200,000 Cost of goods sold 800,000 Gross profit 400,000 Operating expenses Selling $280,000 Administrative 150,000 430,000 Net loss $ (30,000) A cost behavior analysis indicates that 75% of the cost of goods sold are variable, 42% of the selling expenses are variable, and 40% of the administrative expenses are variable. Instructions (Round to nearest unit, dollar, and percentage, where necessary. Use the CVP income statement format in computing profits.) (a) Compute the break-even point in total sales dollars and in units for 2019. (b) Petar has proposed a plan to get the partnership "out of the red and improve its profitability. He feels that the quality of the product could be substantially improved by spending $0.25 more per unit on better raw materials. The selling price per unit could be increased to only $5.25 because of competitive pressures. Petar estimates that sales volume will increase by 25%. What effect would Petar's plan have on the profits and the break-even point in dollars of the partnership? (Round the contribution margin ratio to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started