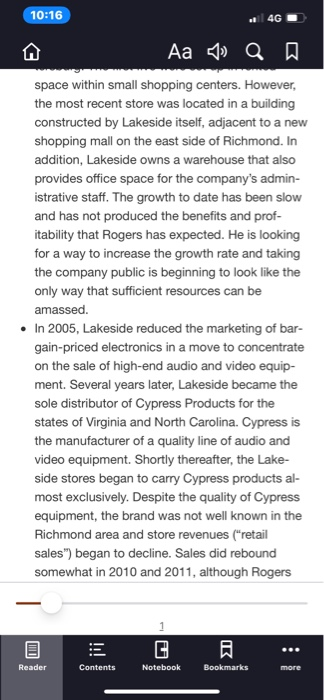

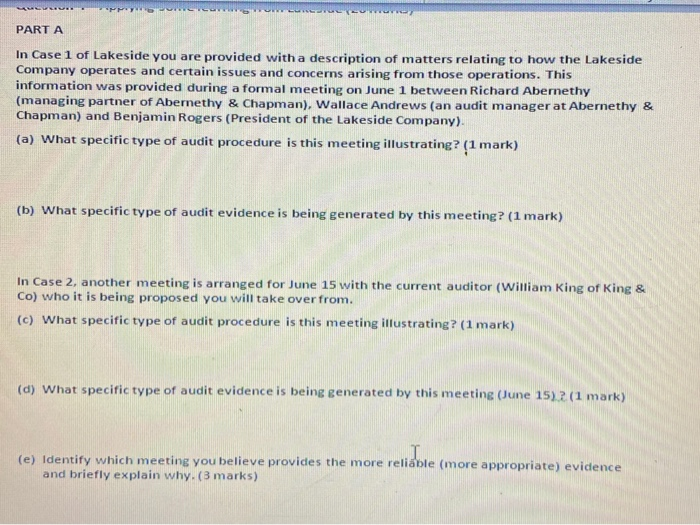

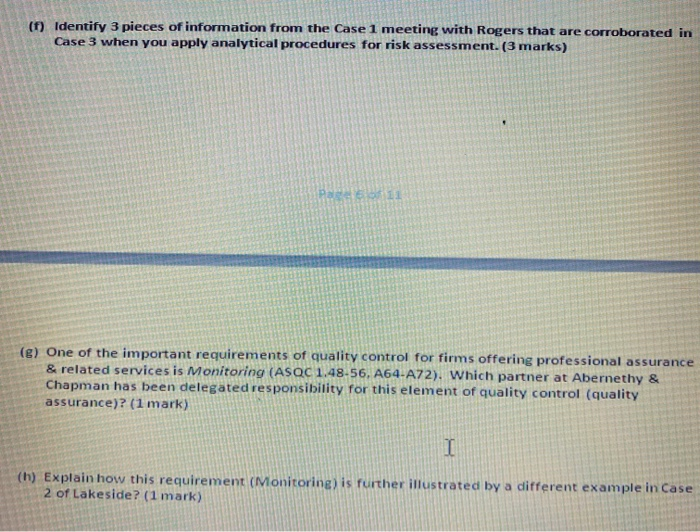

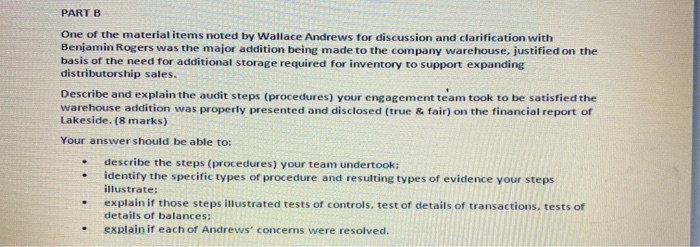

PARTA In Case 1 of Lakeside you are provided with a description of matters relating to how the Lakeside Company operates and certain issues and concerns arising froin those operations. This information was provided during a formal meeting on June 1 between Richard Abernethy (managing partner of Abernethy & Chapman), Wallace Andrews (an audit manager at Abernethy & Chapman) and Benjamin Rogers (President of the Lakeside Company). (a) What specific type of audit procedure is this meeting illustrating? (1 mark) (b) What specific type of audit evidence is being generated by this meeting? (1 mark) In Case 2, another meeting is arranged for June 15 with the current auditor (William King of King & Co) who it is being proposed you will take over from. (c) What specific type of audit procedure is this meeting illustrating? (1 mark) (d) What specific type of audit evidence is being generated by this meeting (June 15) (1 mark) (e) Identify which meeting you believe provides the more reliable (more appropriate) evidence and briefly explain why. (3 marks) (f) Identify 3 pieces of information from the Case 1 meeting with Rogers that are corroborated in Case 3 when you apply analytical procedures for risk assessment. (3 marks) (g) One of the important requirements of quality control for firms offering professional assurance & related services is Monitoring (ASQC 1.48-56, A64-A72). Which partner at Abernethy & Chapman has been delegated responsibility for this element of quality control (quality assurance)? (1 mark) (h) Explain how this requirement (Monitoring) is further illustrated by a different example in Case 2 of Lakeside? (1 mark) PART B One of the material items noted by Wallace Andrews for discussion and clarification with Benjamin Rogers was the major addition being made to the company warehouse, justified on the basis of the need for additional storage required for inventory to support expanding distributorship sales. Describe and explain the audit steps (procedures) your engagement team took to be satisfied the warehouse addition was properly presented and disclosed (true & fair) on the financial report of Lakeside. (8 marks) Your answer should be able to: describe the steps (procedures) your team undertook identify the specific types of procedure and resulting types of evidence your steps illustrate; explain if those steps illustrated tests of controls, test of details of transactions, tests of details of balances; explain if each of Andrews' concerns were resolved. . 10:16 4G Aa QD 1. Analysis of a Potential Audit Client Benjamin M. Rogers is the president of the Lakeside Company, a retailer and distributor of consumer electronics (such as televisions) based in Richmond, Virginia. Although King and Company CPAs, a Rich- mond firm, had previously audited Lakeside, Rogers has recently become aware of the CPA firm of Aber- nethy and Chapman from reading several advertise- ments. His interest in the firm was heightened when he discovered that Abernethy and Chapman audits the primary bank with which he does business. Dur- ing March of 2012, Rogers contacted his banker who arranged for Rogers to have lunch with one of the CPA firm's partners. At that time, a wide-ranging conversation was held concerning Lakeside as well as Abernethy and Chapman. Rogers discussed the history of the consumer electronics company along with his hopes for the future. The partner, in turn, described many of the attributes possessed by his public accounting firm. Subsequently, Rogers re- quested a formal appointment with Richard Aber- nethy, the managing partner of Abernethy and Chapman, in hopes of arriving at a final conclusion concernina Lakocide'e 2012 audit onesnament xiv B G Notebook Reader Contents Bookmarks more 10:16 4G Aa 40 Q A June 1 meeting was held at the accounting firm's Richmond office and was attended by Abernethy, Rogers, and Wallace Andrews, an audit manager with the CPA firm who would be assisting in the in- vestigation of this prospective client. Both auditors were quite interested in learning as much as possi- ble about the consumer electronics business. Al- though a number of similar operations are located in the Richmond area, Abernethy and Chapman has never had a client in this field. Thus, the Lakeside engagement would offer an excellent opportunity to break into a new market. During a rather lengthy conversation with Rogers, Abernethy and Andrews were able to obtain a sig- nificant quantity of data about the Lakeside Compa- ny and the possible audit engagement. Included in this information were the following facts: Rogers originally began Lakeside in 1993 as a single store that sold bargain-priced televisions and stereo equipment. This business did well and the company expanded thereafter at the rate of one new store every two or three years. Presently six stores are in operation, three in Richmond with one in each of three nearby cities: Charlottesville, Fredericksburg, and Pe- tersburg. The first five were set up in rented 1 3 Reader Contents Notebook Bookmarks more 10:16 4G Aa 7 QD space within small shopping centers. However, the most recent store was located in a building constructed by Lakeside itself, adjacent to a new shopping mall on the east side of Richmond. In addition, Lakeside owns a warehouse that also provides office space for the company's admin- istrative staff. The growth to date has been slow and has not produced the benefits and prof- itability that Rogers has expected. He is looking for a way to increase the growth rate and taking the company public is beginning to look like the only way that sufficient resources can be amassed. . In 2005, Lakeside reduced the marketing of bar- gain-priced electronics in a move to concentrate on the sale of high-end audio and video equip- ment. Several years later, Lakeside became the sole distributor of Cypress Products for the states of Virginia and North Carolina. Cypress is the manufacturer of a quality line of audio and video equipment. Shortly thereafter, the Lake- side stores began to carry Cypress products al- most exclusively. Despite the quality of Cypress equipment, the brand was not well known in the Richmond area and store revenues ("retail sales") began to decline. Sales did rebound somewhat in 2010 and 2011, although Rogers 1 3 A Reader Contents Notebook Bookmarks more LEWE LUX PART A In Case 1 of Lakeside you are provided with a description of matters relating to how the Lakeside Company operates and certain issues and concerns arising from those operations. This information was provided during a formal meeting on June 1 between Richard Abernethy (managing partner of Abernethy & Chapman), Wallace Andrews (an audit manager at Abernethy & Chapman) and Benjamin Rogers (President of the Lakeside Company) (a) What specific type of audit procedure is this meeting illustrating? (1 mark) (b) What specific type of audit evidence is being generated by this meeting? (1 mark) In Case 2, another meeting is arranged for June 15 with the current auditor (William King of King & Co) who it is being proposed you will take over from. (c) What specific type of audit procedure is this meeting illustrating? (1 mark) (d) What specific type of audit evidence is being generated by this meeting (June 15) (1 mark) (e) Identify which meeting you believe provides the more reliable (more appropriate) evidence and briefly explain why. (3 marks) (f) Identify 3 pieces of information from the Case 1 meeting with Rogers that are corroborated in Case 3 when you apply analytical procedures for risk assessment. (3 marks) Pace (e) One of the important requirements of quality control for firms offering professional assurance & related services is Monitoring (ASQC 1.48-56, A64-A72). Which partner at Abernethy & Chapman has been delegated responsibility for this element of quality control (quality assurance)? (1 mark) I (h) Explain how this requirement (Monitoring) is further illustrated by a different example in Case 2 of Lakeside? (1 mark) PART B One of the material items noted by Wallace Andrews for discussion and clarification with Benjamin Rogers was the major addition being made to the company warehouse, justified on the basis of the need for additional storage required for inventory to support expanding distributorship sales. Describe and explain the audit steps (procedures) your engagement team took to be satisfied the warehouse addition was properly presented and disclosed (true & fair) on the financial report of Lakeside. (8 marks) Your answer should be able to: describe the steps (procedures) your team undertook: identify the specific types of procedure and resulting types of evidence your steps illustrate; explain if those steps illustrated tests of controls, test of details of transactions, tests of details of balances: explain if each of Andrews' concerns were resolved. PARTA In Case 1 of Lakeside you are provided with a description of matters relating to how the Lakeside Company operates and certain issues and concerns arising froin those operations. This information was provided during a formal meeting on June 1 between Richard Abernethy (managing partner of Abernethy & Chapman), Wallace Andrews (an audit manager at Abernethy & Chapman) and Benjamin Rogers (President of the Lakeside Company). (a) What specific type of audit procedure is this meeting illustrating? (1 mark) (b) What specific type of audit evidence is being generated by this meeting? (1 mark) In Case 2, another meeting is arranged for June 15 with the current auditor (William King of King & Co) who it is being proposed you will take over from. (c) What specific type of audit procedure is this meeting illustrating? (1 mark) (d) What specific type of audit evidence is being generated by this meeting (June 15) (1 mark) (e) Identify which meeting you believe provides the more reliable (more appropriate) evidence and briefly explain why. (3 marks) (f) Identify 3 pieces of information from the Case 1 meeting with Rogers that are corroborated in Case 3 when you apply analytical procedures for risk assessment. (3 marks) (g) One of the important requirements of quality control for firms offering professional assurance & related services is Monitoring (ASQC 1.48-56, A64-A72). Which partner at Abernethy & Chapman has been delegated responsibility for this element of quality control (quality assurance)? (1 mark) (h) Explain how this requirement (Monitoring) is further illustrated by a different example in Case 2 of Lakeside? (1 mark) PART B One of the material items noted by Wallace Andrews for discussion and clarification with Benjamin Rogers was the major addition being made to the company warehouse, justified on the basis of the need for additional storage required for inventory to support expanding distributorship sales. Describe and explain the audit steps (procedures) your engagement team took to be satisfied the warehouse addition was properly presented and disclosed (true & fair) on the financial report of Lakeside. (8 marks) Your answer should be able to: describe the steps (procedures) your team undertook identify the specific types of procedure and resulting types of evidence your steps illustrate; explain if those steps illustrated tests of controls, test of details of transactions, tests of details of balances; explain if each of Andrews' concerns were resolved. . 10:16 4G Aa QD 1. Analysis of a Potential Audit Client Benjamin M. Rogers is the president of the Lakeside Company, a retailer and distributor of consumer electronics (such as televisions) based in Richmond, Virginia. Although King and Company CPAs, a Rich- mond firm, had previously audited Lakeside, Rogers has recently become aware of the CPA firm of Aber- nethy and Chapman from reading several advertise- ments. His interest in the firm was heightened when he discovered that Abernethy and Chapman audits the primary bank with which he does business. Dur- ing March of 2012, Rogers contacted his banker who arranged for Rogers to have lunch with one of the CPA firm's partners. At that time, a wide-ranging conversation was held concerning Lakeside as well as Abernethy and Chapman. Rogers discussed the history of the consumer electronics company along with his hopes for the future. The partner, in turn, described many of the attributes possessed by his public accounting firm. Subsequently, Rogers re- quested a formal appointment with Richard Aber- nethy, the managing partner of Abernethy and Chapman, in hopes of arriving at a final conclusion concernina Lakocide'e 2012 audit onesnament xiv B G Notebook Reader Contents Bookmarks more 10:16 4G Aa 40 Q A June 1 meeting was held at the accounting firm's Richmond office and was attended by Abernethy, Rogers, and Wallace Andrews, an audit manager with the CPA firm who would be assisting in the in- vestigation of this prospective client. Both auditors were quite interested in learning as much as possi- ble about the consumer electronics business. Al- though a number of similar operations are located in the Richmond area, Abernethy and Chapman has never had a client in this field. Thus, the Lakeside engagement would offer an excellent opportunity to break into a new market. During a rather lengthy conversation with Rogers, Abernethy and Andrews were able to obtain a sig- nificant quantity of data about the Lakeside Compa- ny and the possible audit engagement. Included in this information were the following facts: Rogers originally began Lakeside in 1993 as a single store that sold bargain-priced televisions and stereo equipment. This business did well and the company expanded thereafter at the rate of one new store every two or three years. Presently six stores are in operation, three in Richmond with one in each of three nearby cities: Charlottesville, Fredericksburg, and Pe- tersburg. The first five were set up in rented 1 3 Reader Contents Notebook Bookmarks more 10:16 4G Aa 7 QD space within small shopping centers. However, the most recent store was located in a building constructed by Lakeside itself, adjacent to a new shopping mall on the east side of Richmond. In addition, Lakeside owns a warehouse that also provides office space for the company's admin- istrative staff. The growth to date has been slow and has not produced the benefits and prof- itability that Rogers has expected. He is looking for a way to increase the growth rate and taking the company public is beginning to look like the only way that sufficient resources can be amassed. . In 2005, Lakeside reduced the marketing of bar- gain-priced electronics in a move to concentrate on the sale of high-end audio and video equip- ment. Several years later, Lakeside became the sole distributor of Cypress Products for the states of Virginia and North Carolina. Cypress is the manufacturer of a quality line of audio and video equipment. Shortly thereafter, the Lake- side stores began to carry Cypress products al- most exclusively. Despite the quality of Cypress equipment, the brand was not well known in the Richmond area and store revenues ("retail sales") began to decline. Sales did rebound somewhat in 2010 and 2011, although Rogers 1 3 A Reader Contents Notebook Bookmarks more LEWE LUX PART A In Case 1 of Lakeside you are provided with a description of matters relating to how the Lakeside Company operates and certain issues and concerns arising from those operations. This information was provided during a formal meeting on June 1 between Richard Abernethy (managing partner of Abernethy & Chapman), Wallace Andrews (an audit manager at Abernethy & Chapman) and Benjamin Rogers (President of the Lakeside Company) (a) What specific type of audit procedure is this meeting illustrating? (1 mark) (b) What specific type of audit evidence is being generated by this meeting? (1 mark) In Case 2, another meeting is arranged for June 15 with the current auditor (William King of King & Co) who it is being proposed you will take over from. (c) What specific type of audit procedure is this meeting illustrating? (1 mark) (d) What specific type of audit evidence is being generated by this meeting (June 15) (1 mark) (e) Identify which meeting you believe provides the more reliable (more appropriate) evidence and briefly explain why. (3 marks) (f) Identify 3 pieces of information from the Case 1 meeting with Rogers that are corroborated in Case 3 when you apply analytical procedures for risk assessment. (3 marks) Pace (e) One of the important requirements of quality control for firms offering professional assurance & related services is Monitoring (ASQC 1.48-56, A64-A72). Which partner at Abernethy & Chapman has been delegated responsibility for this element of quality control (quality assurance)? (1 mark) I (h) Explain how this requirement (Monitoring) is further illustrated by a different example in Case 2 of Lakeside? (1 mark) PART B One of the material items noted by Wallace Andrews for discussion and clarification with Benjamin Rogers was the major addition being made to the company warehouse, justified on the basis of the need for additional storage required for inventory to support expanding distributorship sales. Describe and explain the audit steps (procedures) your engagement team took to be satisfied the warehouse addition was properly presented and disclosed (true & fair) on the financial report of Lakeside. (8 marks) Your answer should be able to: describe the steps (procedures) your team undertook: identify the specific types of procedure and resulting types of evidence your steps illustrate; explain if those steps illustrated tests of controls, test of details of transactions, tests of details of balances: explain if each of Andrews' concerns were resolved