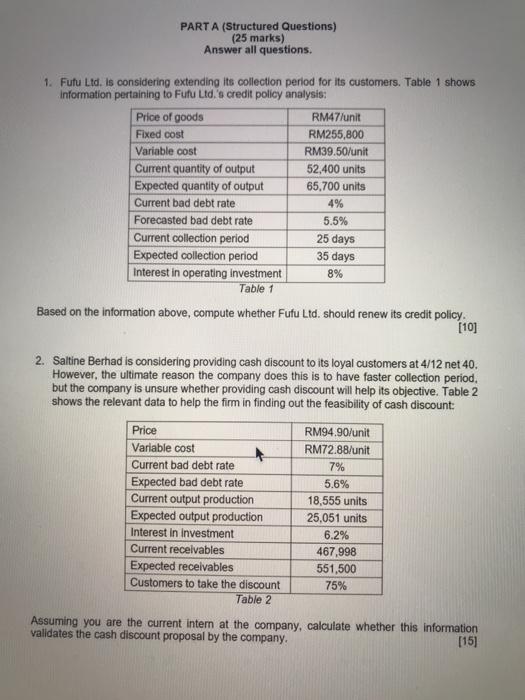

PARTA (Structured Questions) (25 marks) Answer all questions. 1. Futu Ltd. is considering extending its collection period for its customers. Table 1 shows Information pertaining to Futu Ltd.'s credit policy analysis: Price of goods RM47/unit Fixed cost RM255,800 Variable cost RM39.50/unit Current quantity of output 52,400 units Expected quantity of output 65.700 units Current bad debt rate 4% Forecasted bad debt rate 5.5% Current collection period 25 days Expected collection period 35 days Interest in operating investment 8% Table 1 Based on the information above, compute whether Fufu Ltd. should renew its credit policy. [10] 2. Saltine Berhad is considering providing cash discount to its loyal customers at 4/12 net 40. However, the ultimate reason the company does this is to have faster collection period, but the company is unsure whether providing cash discount will help its objective. Table 2 shows the relevant data to help the firm in finding out the feasibility of cash discount: Price RM94.90/unit Variable cost RM72.88/unit Current bad debt rate 7% Expected bad debt rate 5.6% Current output production 18,555 units Expected output production 25.051 units Interest in investment 6.2% Current receivables 467,998 Expected receivables 551,500 Customers to take the discount 75% Table 2 Assuming you are the current intern at the company, calculate whether this information validates the cash discount proposal by the company. [15] PARTA (Structured Questions) (25 marks) Answer all questions. 1. Futu Ltd. is considering extending its collection period for its customers. Table 1 shows Information pertaining to Futu Ltd.'s credit policy analysis: Price of goods RM47/unit Fixed cost RM255,800 Variable cost RM39.50/unit Current quantity of output 52,400 units Expected quantity of output 65.700 units Current bad debt rate 4% Forecasted bad debt rate 5.5% Current collection period 25 days Expected collection period 35 days Interest in operating investment 8% Table 1 Based on the information above, compute whether Fufu Ltd. should renew its credit policy. [10] 2. Saltine Berhad is considering providing cash discount to its loyal customers at 4/12 net 40. However, the ultimate reason the company does this is to have faster collection period, but the company is unsure whether providing cash discount will help its objective. Table 2 shows the relevant data to help the firm in finding out the feasibility of cash discount: Price RM94.90/unit Variable cost RM72.88/unit Current bad debt rate 7% Expected bad debt rate 5.6% Current output production 18,555 units Expected output production 25.051 units Interest in investment 6.2% Current receivables 467,998 Expected receivables 551,500 Customers to take the discount 75% Table 2 Assuming you are the current intern at the company, calculate whether this information validates the cash discount proposal by the company. [15]