Answered step by step

Verified Expert Solution

Question

1 Approved Answer

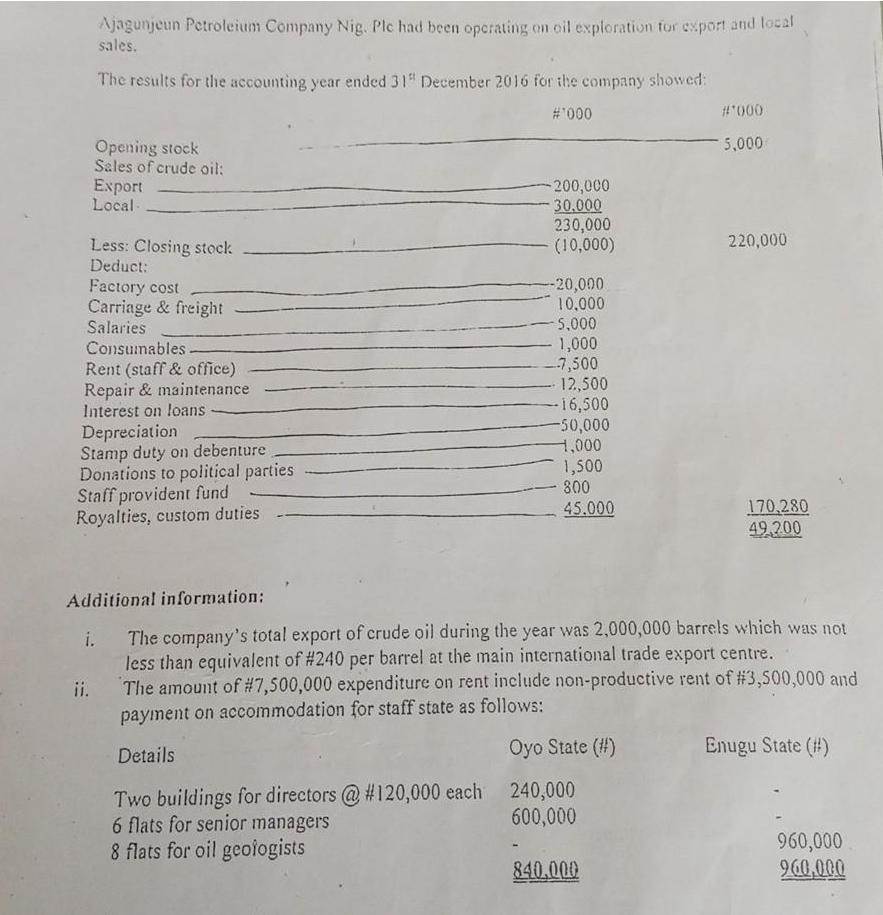

Ajagunjeun Petroleium Company Nig. Plc had been operating on oil exploration for export and local sales. The results for the accounting year ended 31

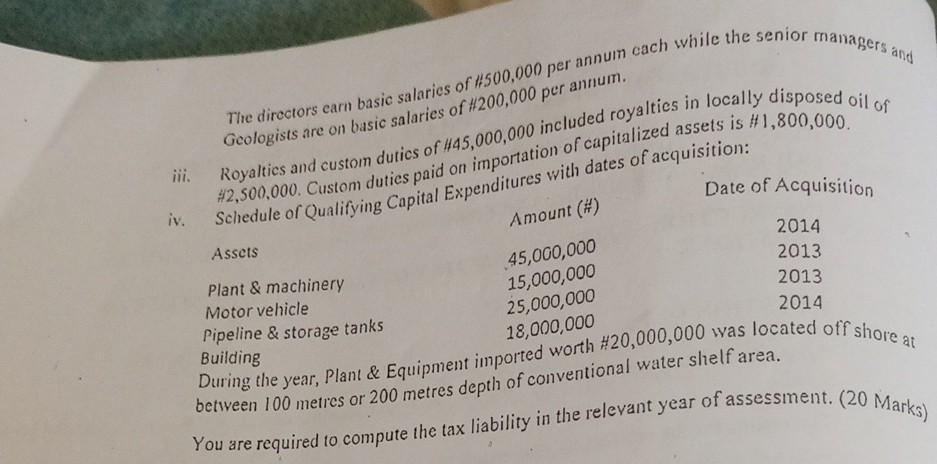

Ajagunjeun Petroleium Company Nig. Plc had been operating on oil exploration for export and local sales. The results for the accounting year ended 31" December 2016 for the company showed: #1000 Opening stock Sales of crude oil: Export Local- Less: Closing stock Deduct: Factory cost Carriage & freight Salaries ii. Consumables. Rent (staff & office) Repair & maintenance Interest on loans Depreciation Stamp duty on debenture Donations to political parties Staff provident fund Royalties, custom duties -200,000 30,000 230,000 (10,000) -20,000 10,000 -5,000 1,000 --7,500 12,500 -16,500 -50,000 1,000 1,500 800 45.000 #*000 *5,000 Additional information: The company's total export of crude oil during the year was 2,000,000 barrels which was not less than equivalent of # 240 per barrel at the main international trade export centre. Oyo State (#) Two buildings for directors @ #120,000 each 240,000 6 flats for senior managers 600,000 8 flats for oil geologists 220,000 840,000 170,280 49,200 The amount of #7,500,000 expenditure on rent include non-productive rent of # 3,500,000 and payment on accommodation for staff state as follows: Details Enugu State (#) 960,000 960,000 The directors earn basic salaries of #500,000 per annum cach while the senior managers and Royalties and custom dutics of #45,000,000 included royalties in locally disposed oil of Geologists are on basic salaries of #200,000 per annum. #2,500,000. Custom duties paid on importation of capitalized assets is #1,800,000. iv. Schedule of Qualifying Capital Expenditures with dates of acquisition: Assets Plant & machinery Motor vehicle Pipeline & storage tanks Building Amount (#) 45,000,000 15,000,000 25,000,000 18,000,000 Date of Acquisition 2014 2013 2013 2014 During the year, Plant & Equipment imported worth #20,000,000 was located off shore at between 100 metres or 200 metres depth of conventional water shelf area. You are required to compute the tax liability in the relevant year of assessment. (20 Marks) Ajagunjeun Petroleium Company Nig. Plc had been operating on oil exploration for export and local sales. The results for the accounting year ended 31" December 2016 for the company showed: #1000 Opening stock Sales of crude oil: Export Local- Less: Closing stock Deduct: Factory cost Carriage & freight Salaries ii. Consumables. Rent (staff & office) Repair & maintenance Interest on loans Depreciation Stamp duty on debenture Donations to political parties Staff provident fund Royalties, custom duties -200,000 30,000 230,000 (10,000) -20,000 10,000 -5,000 1,000 --7,500 12,500 -16,500 -50,000 1,000 1,500 800 45.000 #*000 *5,000 Additional information: The company's total export of crude oil during the year was 2,000,000 barrels which was not less than equivalent of # 240 per barrel at the main international trade export centre. Oyo State (#) Two buildings for directors @ #120,000 each 240,000 6 flats for senior managers 600,000 8 flats for oil geologists 220,000 840,000 170,280 49,200 The amount of #7,500,000 expenditure on rent include non-productive rent of # 3,500,000 and payment on accommodation for staff state as follows: Details Enugu State (#) 960,000 960,000 The directors earn basic salaries of #500,000 per annum cach while the senior managers and Royalties and custom dutics of #45,000,000 included royalties in locally disposed oil of Geologists are on basic salaries of #200,000 per annum. #2,500,000. Custom duties paid on importation of capitalized assets is #1,800,000. iv. Schedule of Qualifying Capital Expenditures with dates of acquisition: Assets Plant & machinery Motor vehicle Pipeline & storage tanks Building Amount (#) 45,000,000 15,000,000 25,000,000 18,000,000 Date of Acquisition 2014 2013 2013 2014 During the year, Plant & Equipment imported worth #20,000,000 was located off shore at between 100 metres or 200 metres depth of conventional water shelf area. You are required to compute the tax liability in the relevant year of assessment. (20 Marks) Ajagunjeun Petroleium Company Nig. Plc had been operating on oil exploration for export and local sales. The results for the accounting year ended 31" December 2016 for the company showed: #1000 Opening stock Sales of crude oil: Export Local- Less: Closing stock Deduct: Factory cost Carriage & freight Salaries ii. Consumables. Rent (staff & office) Repair & maintenance Interest on loans Depreciation Stamp duty on debenture Donations to political parties Staff provident fund Royalties, custom duties -200,000 30,000 230,000 (10,000) -20,000 10,000 -5,000 1,000 --7,500 12,500 -16,500 -50,000 1,000 1,500 800 45.000 #*000 *5,000 Additional information: The company's total export of crude oil during the year was 2,000,000 barrels which was not less than equivalent of # 240 per barrel at the main international trade export centre. Oyo State (#) Two buildings for directors @ #120,000 each 240,000 6 flats for senior managers 600,000 8 flats for oil geologists 220,000 840,000 170,280 49,200 The amount of #7,500,000 expenditure on rent include non-productive rent of # 3,500,000 and payment on accommodation for staff state as follows: Details Enugu State (#) 960,000 960,000 The directors earn basic salaries of #500,000 per annum cach while the senior managers and Royalties and custom dutics of #45,000,000 included royalties in locally disposed oil of Geologists are on basic salaries of #200,000 per annum. #2,500,000. Custom duties paid on importation of capitalized assets is #1,800,000. iv. Schedule of Qualifying Capital Expenditures with dates of acquisition: Assets Plant & machinery Motor vehicle Pipeline & storage tanks Building Amount (#) 45,000,000 15,000,000 25,000,000 18,000,000 Date of Acquisition 2014 2013 2013 2014 During the year, Plant & Equipment imported worth #20,000,000 was located off shore at between 100 metres or 200 metres depth of conventional water shelf area. You are required to compute the tax liability in the relevant year of assessment. (20 Marks)

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The tax liability ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started