Question

Partial adjusted trial balance data for Flint Corporation at December 31, 2025, includes the following accounts: Retained Earnings $17,700, Dividends $5,600, Service Revenue $38,800,

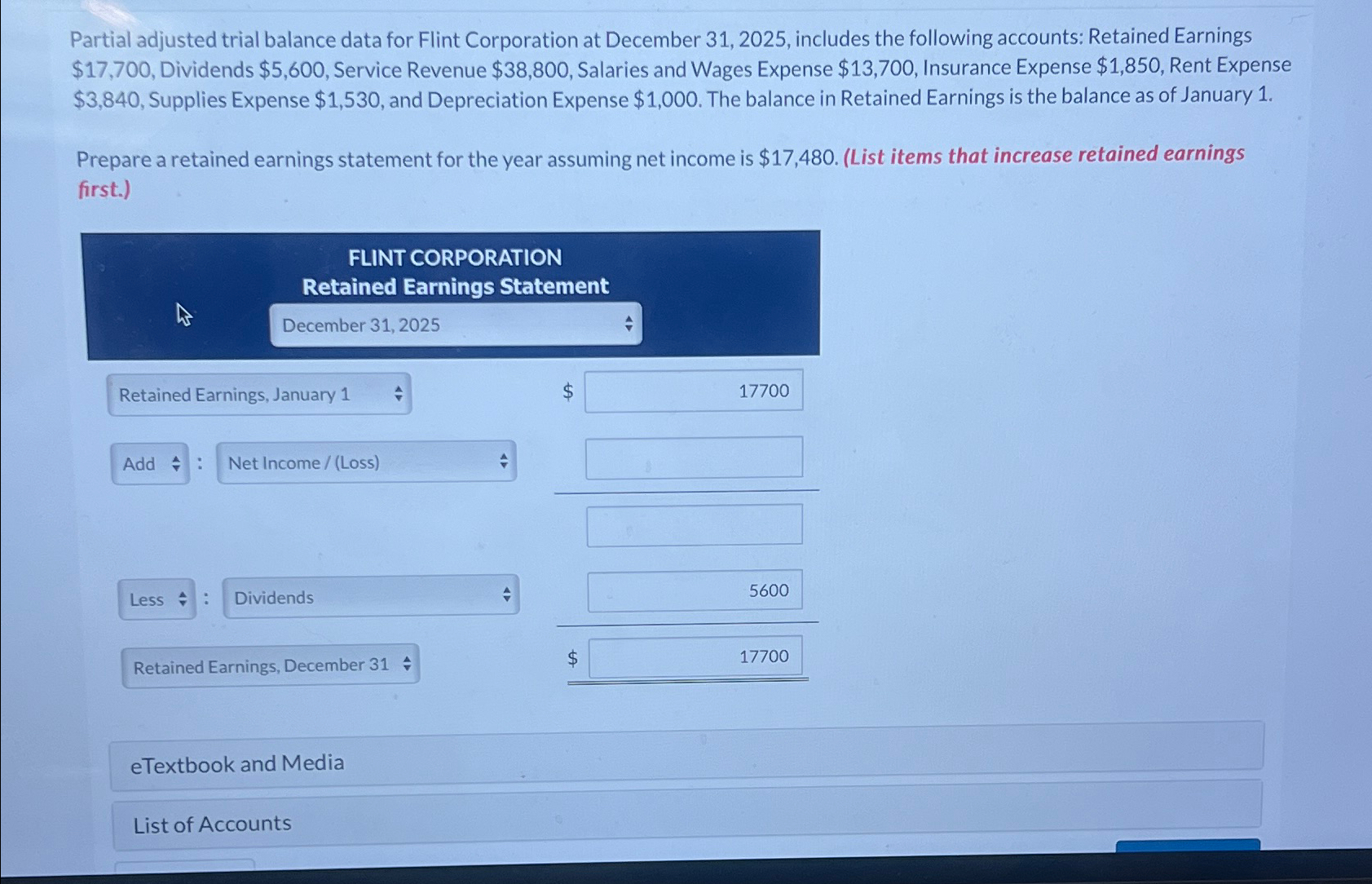

Partial adjusted trial balance data for Flint Corporation at December 31, 2025, includes the following accounts: Retained Earnings $17,700, Dividends $5,600, Service Revenue $38,800, Salaries and Wages Expense $13,700, Insurance Expense $1,850, Rent Expense $3,840, Supplies Expense $1,530, and Depreciation Expense $1,000. The balance in Retained Earnings is the balance as of January 1. Prepare a retained earnings statement for the year assuming net income is $17,480. (List items that increase retained earnings first.) FLINT CORPORATION Retained Earnings Statement December 31, 2025 Retained Earnings, January 1 Add : Net Income/(Loss) Less : Dividends 17700 5600 Retained Earnings, December 31+ $ 17700 eTextbook and Media List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Tools For Business Decision Making

Authors: Paul D. Kimmel, Jerry J. Weygandt, Jill E. Mitchell

8th Edition

1119791057, 978-1119791058

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App