Question

On March 31, 2024, management of Quality Appliances committed to a plan to sell equipment. The equipment was available for immediate sale, and an

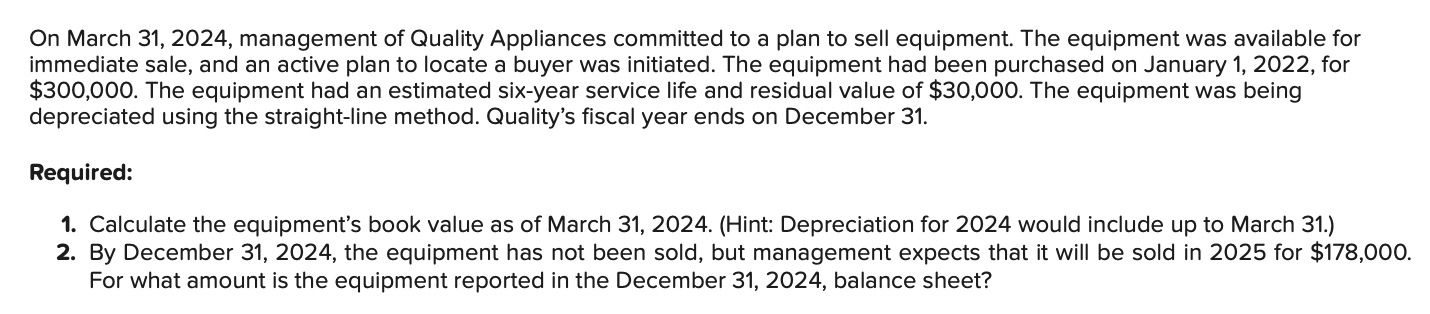

On March 31, 2024, management of Quality Appliances committed to a plan to sell equipment. The equipment was available for immediate sale, and an active plan to locate a buyer was initiated. The equipment had been purchased on January 1, 2022, for $300,000. The equipment had an estimated six-year service life and residual value of $30,000. The equipment was being depreciated using the straight-line method. Quality's fiscal year ends on December 31. Required: 1. Calculate the equipment's book value as of March 31, 2024. (Hint: Depreciation for 2024 would include up to March 31.) 2. By December 31, 2024, the equipment has not been sold, but management expects that it will be sold in 2025 for $178,000. For what amount is the equipment reported in the December 31, 2024, balance sheet?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: David Spiceland

11th Edition

1264134525, 9781264134526

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App