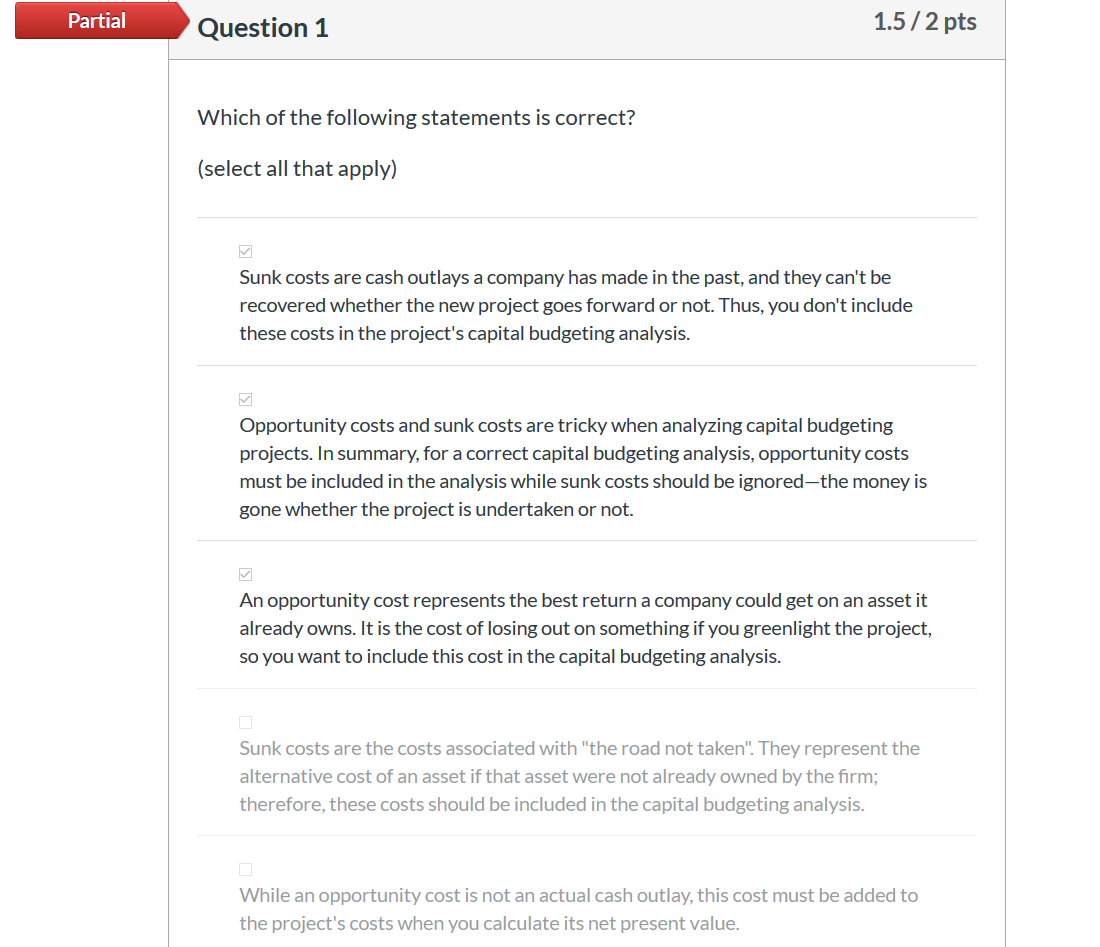

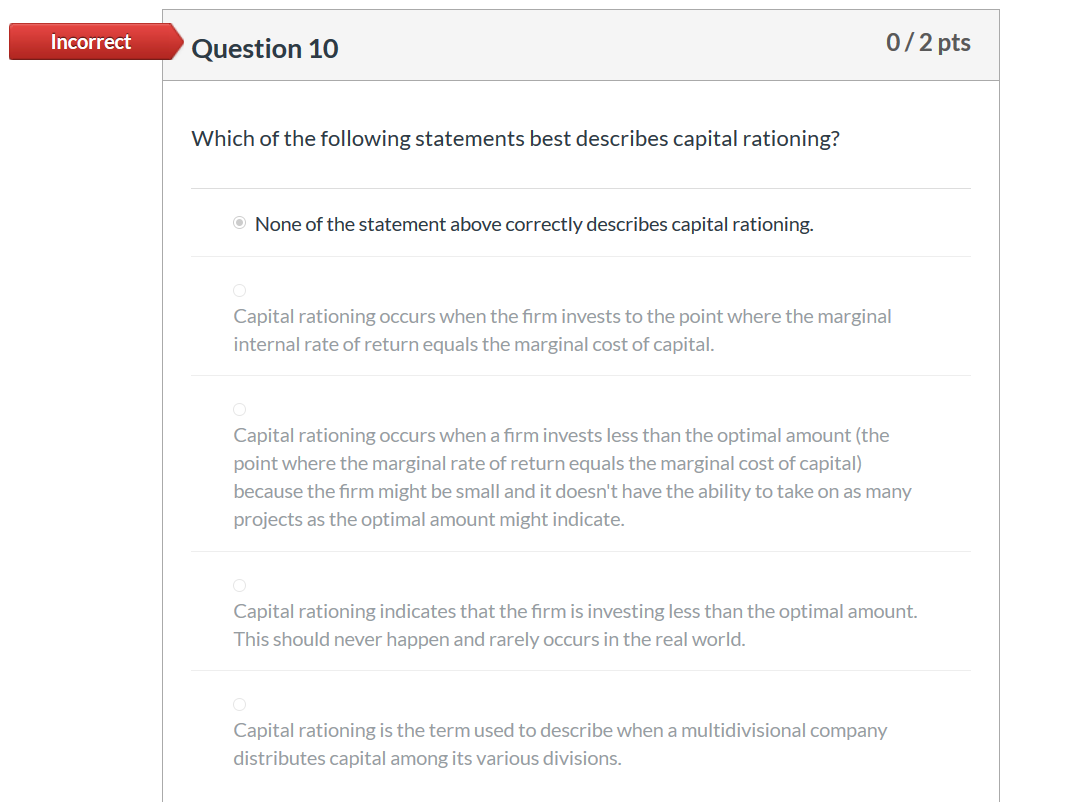

Partial Question 1 1.5/2 pts Which of the following statements is correct? (select all that apply) Sunk costs are cash outlays a company has made in the past, and they can't be recovered whether the new project goes forward or not. Thus, you don't include these costs in the project's capital budgeting analysis. Opportunity costs and sunk costs are tricky when analyzing capital budgeting projects. In summary, for a correct capital budgeting analysis, opportunity costs must be included in the analysis while sunk costs should be ignored-the money is gone whether the project is undertaken or not. An opportunity cost represents the best return a company could get on an asset it already owns. It is the cost of losing out on something if you greenlight the project, so you want to include this cost in the capital budgeting analysis. Sunk costs are the costs associated with "the road not taken". They represent the alternative cost of an asset if that asset were not already owned by the firm; therefore, these costs should be included in the capital budgeting analysis. While an opportunity cost is not an actual cash outlay, this cost must be added to the project's costs when you calculate its net present value. Incorrect Question 10 0/2 pts Which of the following statements best describes capital rationing? None of the statement above correctly describes capital rationing. Capital rationing occurs when the firm invests to the point where the marginal internal rate of return equals the marginal cost of capital. Capital rationing occurs when a firm invests less than the optimal amount (the point where the marginal rate of return equals the marginal cost of capital) because the firm might be small and it doesn't have the ability to take on as many projects as the optimal amount might indicate. Capital rationing indicates that the firm is investing less than the optimal amount. This should never happen and rarely occurs in the real world. Capital rationing is the term used to describe when a multidivisional company distributes capital among its various divisions