Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Partial Question 7 0 . 7 5 / 1 . 5 pt Pan Demic, Inc. ( PDI ) manufactures and sells cast iron skillets. A

Partial

Question

pt

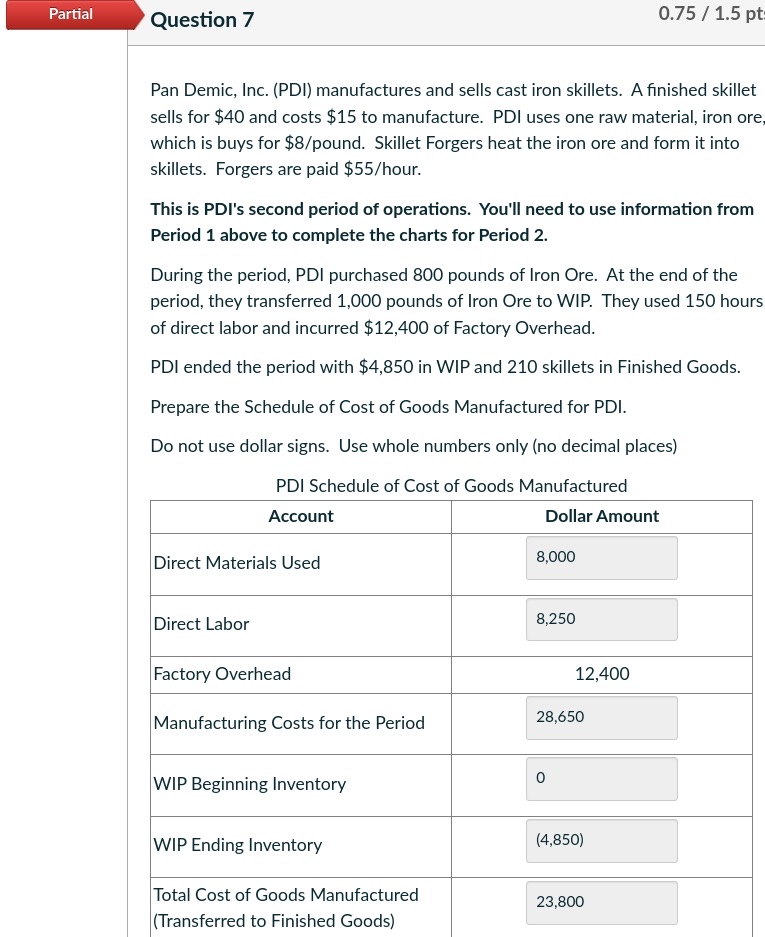

Pan Demic, Inc. PDI manufactures and sells cast iron skillets. A finished skillet sells for $ and costs $ to manufacture. PDI uses one raw material, iron ore which is buys for $ pound. Skillet Forgers heat the iron ore and form it into skillets. Forgers are paid $ hour.

This is PDI's second period of operations. You'll need to use information from Period above to complete the charts for Period

During the period, PDI purchased pounds of Iron Ore. At the end of the period, they transferred pounds of Iron Ore to WIP. They used hours of direct labor and incurred $ of Factory Overhead.

PDI ended the period with $ in WIP and skillets in Finished Goods.

Prepare the Schedule of Cost of Goods Manufactured for PDI.

Do not use dollar signs. Use whole numbers only no decimal places

PDI Schedule of Cost of Goods Manufactured

tableAccountDollar AmountDirect Materials Used,Direct Labor,Factory Overhead,Manufacturing Costs for the Period,WIP Beginning Inventory,WIP Ending Inventory,tableTotal Cost of Goods ManufacturedTransferred to Finished Goods

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started