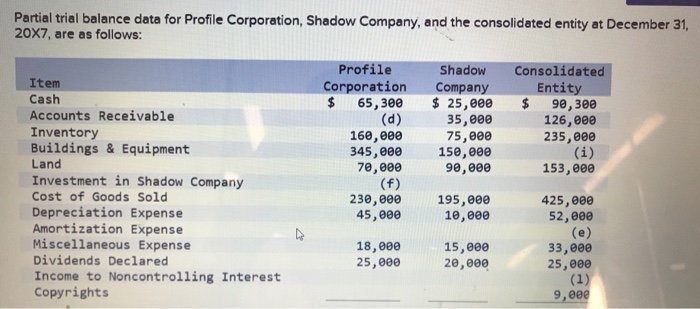

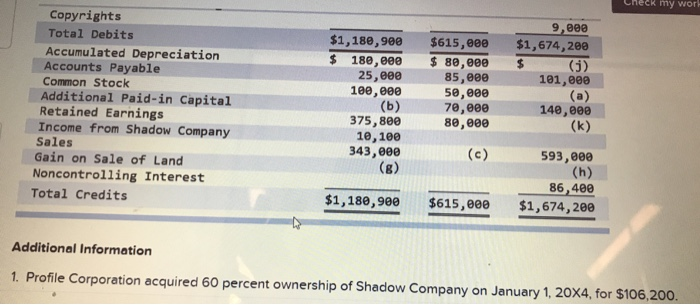

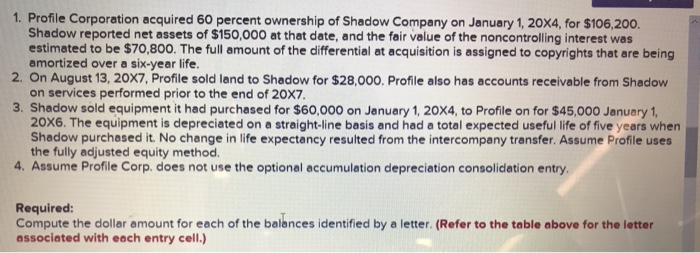

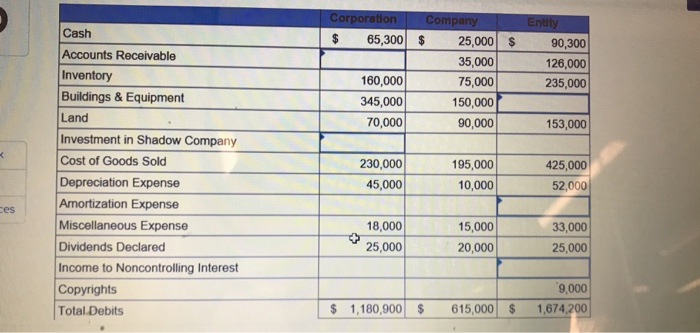

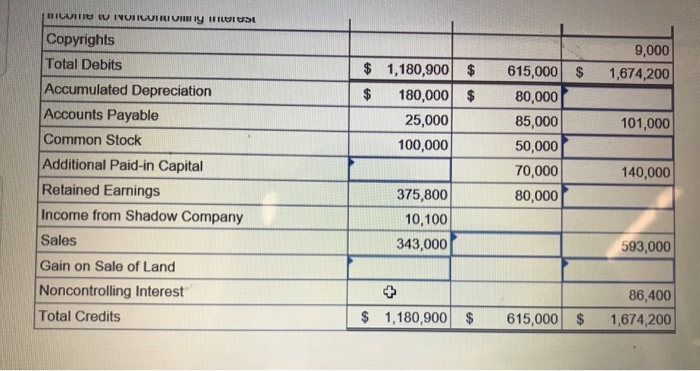

Partial trial balance data for Profile Corporation, Shadow Company, and the consolidated entity at December 31, 20X7, are as follows: Profile Shadow Consolidated Item Cash Accounts Receivable Inventory Buildings & Equipment Land Investment in Shadow Company Cost of Goods Sold Depreciation Expense Amortization Expense Miscellaneous Expense Dividends Declared Income to Noncontrolling Interest Copyrights Corporation Company Entity $65,300 25,000 $ 90,300 126,000 235,000 160,e00 70,000 230,000 35,000 75,000 345,00015e,ee0 9e,000 153,000 195,eee 10,000 425,000 52,000 45,000 18,0e0 15,000 20,000 33,e00 25,000 25,000 9,00e neck my wor Copyrights 9,800 Total Debits Accumulated Depreciation Accounts Payable Common Stock Additional Paid-in Capital Retained Earnings Income from Shadow Company Sales Gain on Sale of Land $1,180,90e $615,e00 $1,674,20e 101,000 140,000 180,0ee 88,888 25,ee0 100,000 85,880 58,88 70,000 80,800 375,800 10,100 343,600 593,080 Noncontrolling Interest Total Credits 86,400 $1,180,9ee $615,00 $1,674,20e Additional Information 1. Profile Corporation acquired 60 percent ownership of Shadow Company on January 1, 20X4, for $106,200 1. Profile Corporation acquired 60 percent ownership of Shadow Company on January 1, 20x4, for $106,200. Shadow reported net assets of $150,000 at that date, and the fair value of the noncontrolling interest was estimated to be $70,800. The full amount of the differential at acquisition is assigned to copyrights that are being amortized over a six-year life 2. On August 13, 20X7, Profile sold land to Shadow for $28,000. Profile also has accounts receivable from Shadovw on services performed prior to the end of 20X7 3. Shadow sold equipment it had purchased for $60,000 on January 1, 20x4, to Profile on for $45,000 Januery 1 20X6. The equipment is depreciated on a straight-line basis and had a total expected useful life of five years when Shadow purchased it. No change in life expectancy resulted from the intercompany transfer. Assume Profile uses the fully adjusted equity method 4. Assume Profile Corp. does not use the optional accumulation depreciation consolidation entry Required: Compute the dollar amount for each of the balances identified by a letter. (Refer to the table above for the letter associated with each entry cell.) Cash Accounts Receivable Inventory Buildings & Equipment Land Investment in Shadow Company Cost of Goods Sold Depreciation Expense Amortization Expense Miscellaneous Expense Dividends Declared Income to Noncontrolling Interest Copyrights Total Debits $ 65,300 25,000$ 90,300 126,000 235,000 160,000 345,000 70,000 35,000 75,000 150,000 90,000 153,000 230,000 195,000 425,000 45,000 10,0003200 es 8,000 25,000 15,000 33,000 25,000 20,000 9,000 $ 1,180,900615,0001,674,2 Copyrights Total Debits Accumulated Depreciation Accounts Payable Common Stock Additional Paid-in Capital Retained Earnings Income from Shadow Company Sales Gain on Sale of Land Noncontrolling Interest Total Credits 9,000 1,180,900615,000 1,674,200 $180,00080,000 $ 180,000$ 25,000 100,000 85,000 50,000 70,000 80,000 101,000 140,000 375,800 10,100 343,000 593,000 86,400 $1,180,900615,000 1,674,200