Answered step by step

Verified Expert Solution

Question

1 Approved Answer

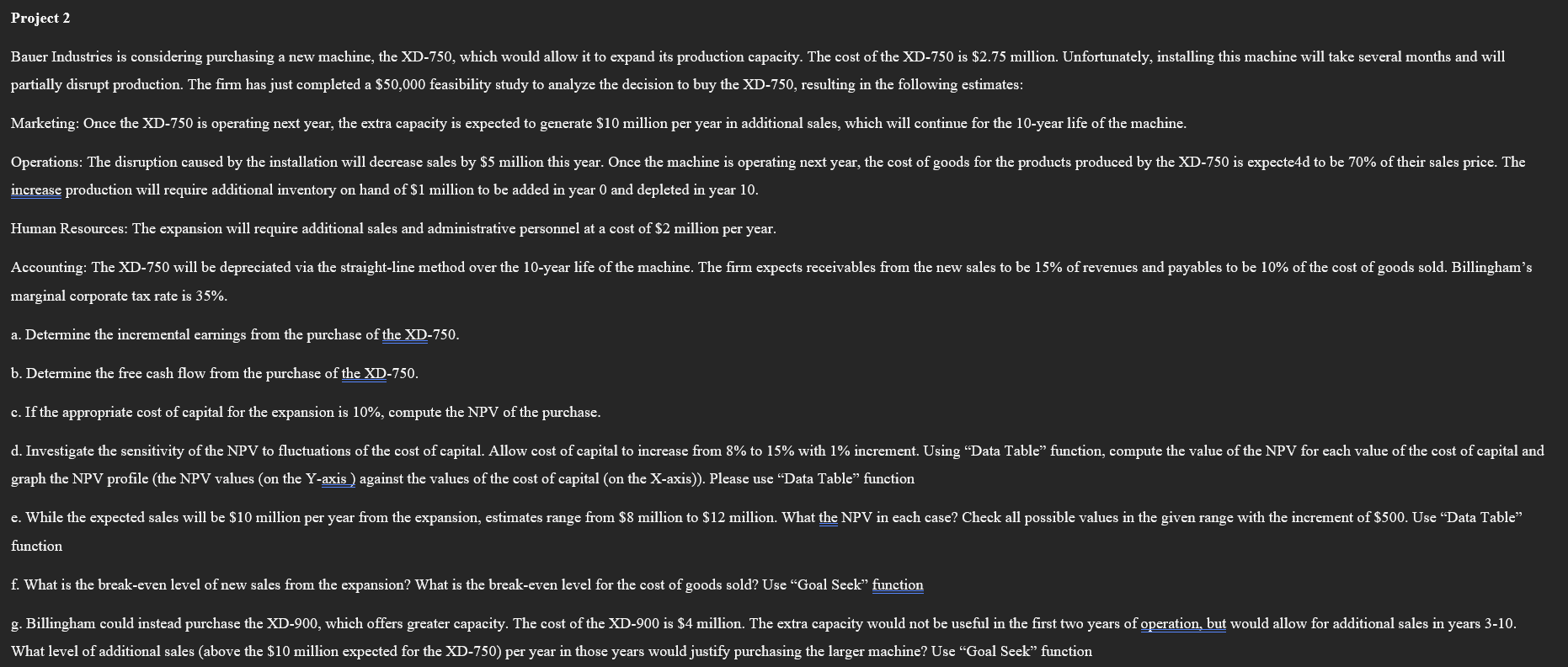

partially disrupt production. The firm has just completed a $50,000 feasibility study to analyze the decision to buy the XD-750, resulting in the following estimates:

partially disrupt production. The firm has just completed a $50,000 feasibility study to analyze the decision to buy the XD-750, resulting in the following estimates: Marketing: Once the XD-750 is operating next year, the extra capacity is expected to generate $10 million per year in additional sales, which will continue for the 10 -year life of the machine. increase production will require additional inventory on hand of $1 million to be added in year 0 and depleted in year 10. Human Resources: The expansion will require additional sales and administrative personnel at a cost of \$2 million per year. marginal corporate tax rate is 35%. a. Determine the incremental earnings from the purchase of the XD-750. b. Determine the free cash flow from the purchase of the XD-750. c. If the appropriate cost of capital for the expansion is 10%, compute the NPV of the purchase. graph the NPV profile (the NPV values (on the Y-axis) against the values of the cost of capital (on the X-axis)). Please use "Data Table" function function f. What is the break-even level of new sales from the expansion? What is the break-even level for the cost of goods sold? Use "Goal Seek" function What level of additional sales (above the $10 million expected for the XD-750) per year in those years would justify purchasing the larger machine? Use "Goal Seek" function

partially disrupt production. The firm has just completed a $50,000 feasibility study to analyze the decision to buy the XD-750, resulting in the following estimates: Marketing: Once the XD-750 is operating next year, the extra capacity is expected to generate $10 million per year in additional sales, which will continue for the 10 -year life of the machine. increase production will require additional inventory on hand of $1 million to be added in year 0 and depleted in year 10. Human Resources: The expansion will require additional sales and administrative personnel at a cost of \$2 million per year. marginal corporate tax rate is 35%. a. Determine the incremental earnings from the purchase of the XD-750. b. Determine the free cash flow from the purchase of the XD-750. c. If the appropriate cost of capital for the expansion is 10%, compute the NPV of the purchase. graph the NPV profile (the NPV values (on the Y-axis) against the values of the cost of capital (on the X-axis)). Please use "Data Table" function function f. What is the break-even level of new sales from the expansion? What is the break-even level for the cost of goods sold? Use "Goal Seek" function What level of additional sales (above the $10 million expected for the XD-750) per year in those years would justify purchasing the larger machine? Use "Goal Seek" function Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started