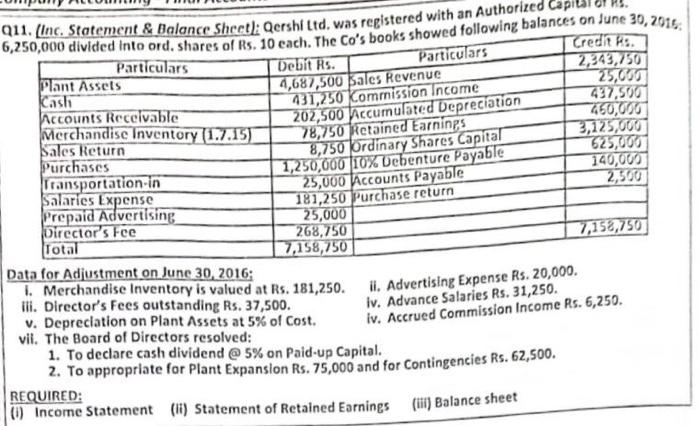

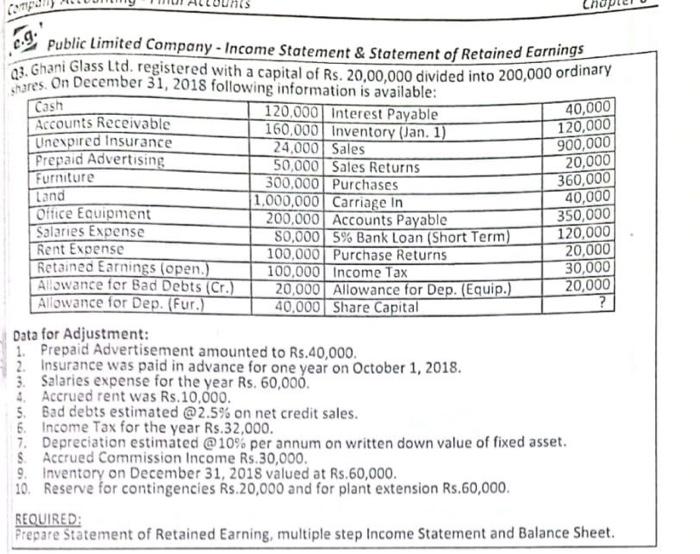

Particulars 4,687,500 Sales Revenue 431,250 Kommission Income 202,500 Accumulated Depreciation 78,750 Retained Earnings 8,750 Ordinary Shares Capital 1,250,000 10X Debenture Payable 6,250,000 divided into ord, shares of Rs. 10 each. The Co's books showed following balances on June 30, 2016 11. (Inc. Statement & Balance Sheet): Qershi ttd. was registered with an Authorized Credit HS Particulars Debit Rs. 2,343,750 Plant Assets 25,000 Kashi 437,500 Accounts Receivable 250,000 Merchandise Inventory (1.7.15) 3,125,000 Sales Return 625,000 Purchases 140,000 Transportation in 25,000 Accounts Payable 2,500 Salaries Expense 181,250 Purchase return Prepaid Advertising 25,000 Director's Fee 268,750 7,152,750 Total 27,158,750 Data for Adjustment on June 30, 2016: I. Merchandise Inventory is valued at Rs. 181,250. ili. Director's Fees outstanding Rs. 37,500. v. Depreciation on Plant Assets at 5% of Cost. vil. The Board of Directors resolved: 1. To declare cash dividend @5% on Paid-up Capital. 2. To appropriate for Plant Expansion Rs. 75,000 and for contingencies Rs. 62,500. REQUIRED: Income Statement (li) Statement of Retained Earnings (1) Balance sheet ii. Advertising Expense Rs.20,000. iv. Advance Salaries Rs. 31,250. iv. Accrued Commission Income Rs. 6,250. c.g. 40,000 120,000 900,000 20,000 360,000 40,000 350,000 Public Limited Company - Income Statement & Statement of Retained Earnings 23. Ghani Glass Ltd. registered with a capital of Rs. 20,00,000 divided into 200,000 ordinary Shares on December 31, 2018 following information is available: Cash 120,000 Interest Payable Accounts Receivable 160,000 Inventory (Jan. 1) Unexpired Insurance 24,000 Sales Prepaid Advertising 50,000 Sales Returns Furniture 300,000 Purchases Land 1,000,000 Carriage in Office Equipment 200,000 Accounts Payable Salaries Expense 80,000 5% Bank Loan (Short Term) 120,000 Rent Expense 100,000 Purchase Returns 20,000 Retained Earnings (open.) 100,000 Income Tax 30,000 Allowance for Bad Debts (Cr.) 20,000 Allowance for Dep. (Equip.) 20,000 Allowance for Dep. (Fur.) 40,000 Share Capital Data for Adjustment: 1. Prepaid Advertisement amounted to Rs.40,000. 2. Insurance was paid in advance for one year on October 1, 2018. 5. Salaries expense for the year Rs. 60,000. 4 Accrued rent was Rs.10,000. 5. Bad debts estimated @ 2.5% on net credit sales. 6. Income Tax for the year Rs.32,000. 7. Depreciation estimated @ 10% per annum on written down value of fixed asset. S Accrued Commission Income Rs.30,000. 9. Inventory on December 31, 2018 valued at Rs 60,000 10. Reserve for contingencies Rs.20,000 and for plant extension Rs.60,000. REQUIRED: Prepare Statement of Retained Earning, multiple step Income Statement and Balance Sheet