Answered step by step

Verified Expert Solution

Question

1 Approved Answer

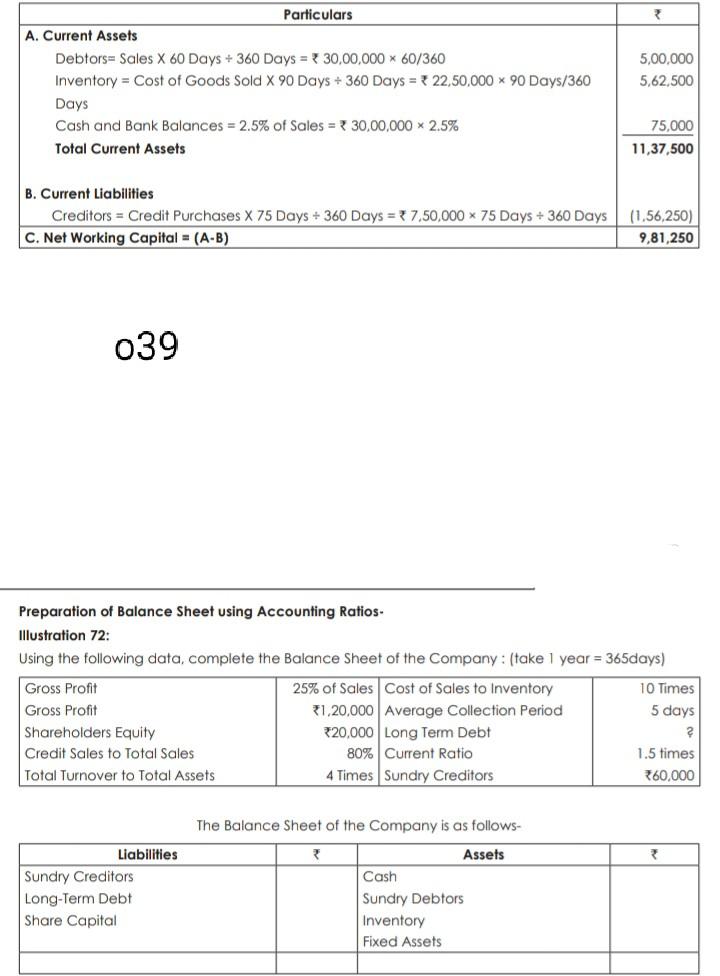

Particulars A. Current Assets Debtors= Sales X 60 Days + 360 Days = 30,00,000 x 60/360 Inventory = Cost of Goods Sold X 90 Days

Particulars A. Current Assets Debtors= Sales X 60 Days + 360 Days = 30,00,000 x 60/360 Inventory = Cost of Goods Sold X 90 Days + 360 Days = 22.50,000 * 90 Days/360 Days Cash and Bank Balances = 2.5% of Sales = 30,00,000 x 2.5% Total Current Assets 5,00,000 5,62,500 75.000 11,37,500 B. Current Liabilities Creditors = Credit Purchases X 75 Days + 360 Days = 37.50,000 x 75 Days + 360 Days C. Net Working Capital - (A-B) (1.56,250) 9,81,250 039 Preparation of Balance Sheet using Accounting Ratios. Illustration 72: Using the following data, complete the Balance Sheet of the Company: (take 1 year = 365days) Gross Profit 25% of Sales Cost of Sales to Inventory 10 Times Gross Profit 21,20,000 Average Collection Period 5 days Shareholders Equity 320,000 Long Term Debt 2 Credit Sales to Total Sales 80% Current Ratio 1.5 times Total Turnover to Total Assets 4 Times Sundry Creditors 360,000 The Balance Sheet of the Company is as follows- 3 Liabilities Sundry Creditors Long-Term Debt Share Capital Assets Cash Sundry Debtors Inventory Fixed Assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started