Answered step by step

Verified Expert Solution

Question

1 Approved Answer

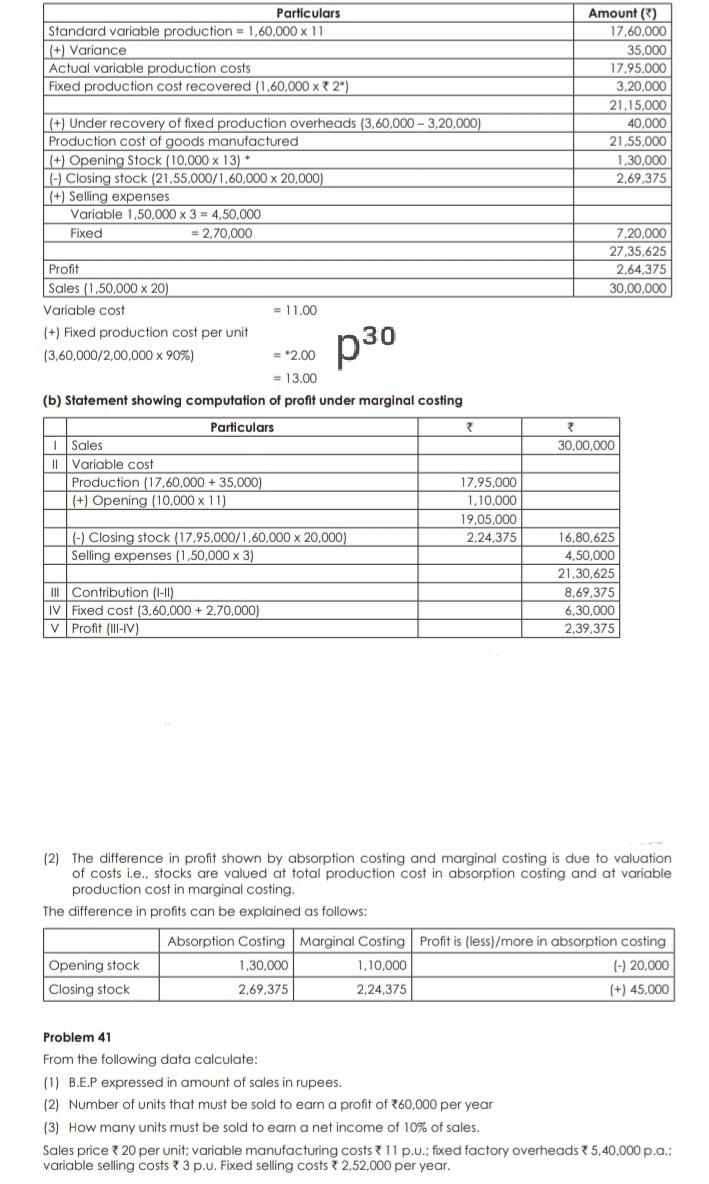

Particulars Standard variable production = 1,60,000 x 11 (+) Variance Actual variable production costs Fixed production cost recovered (1,60,000 x 2) Amount () 17,60,000 35,000

Particulars Standard variable production = 1,60,000 x 11 (+) Variance Actual variable production costs Fixed production cost recovered (1,60,000 x 2") Amount () 17,60,000 35,000 17,95.000 3,20,000 21.15,000 40,000 21,55,000 1,30,000 2,69,375 (+) Under recovery of fixed production overheads (3,60,000 - 3,20,000) Production cost of goods manufactured (+) Opening Stock (10,000 x 13) * (-) Closing stock (21,55,000/1,60,000 x 20,000) (+) Seling expenses Variable 1,50,000 x 3 = 4,50,000 Fixed = 2.70,000 7,20,000 27.35.625 2.64,375 30,00,000 p 30 Profit Sales (1.50,000 x 20) Variable cost = 11.00 (+) Fixed production cost per unit (3,60,000/2,00,000 x 90%) = 2.00 = 13.00 (b) Statement showing computation of profit under marginal costing Particulars 1 Sales II Variable cost Production (17,60,000 + 35,000) 17,95,000 (+) Opening (10,000 x 11) 1.10,000 19,05,000 (-) Closing stock (17.95,000/1,60,000 x 20,000) 2.24,375 Selling expenses (1,50,000 x 3) 2 30,00,000 16,80,625 4,50,000 21.30,625 8,69,375 6,30,000 2.39,375 III Contribution (1-11). IV Fixed cost (3,60,000 + 2,70,000) V Profit (III-IV) (2) The difference in profit shown by absorption costing and marginal costing is due to valuation of costs i.e., stocks are valued at total uction cost in absorption costing and at variable production cost in marginal costing. The difference in profits can be explained as follows: Absorption Costing Marginal Costing Profit is (less)/more in absorption costing Opening stock 1.30,000 1,10,000 (-) 20,000 Closing stock 2,69,375 2.24,375 (+) 45,000 Problem 41 From the following data calculate: (1) B.E.P expressed in amount of sales in rupees. (2) Number of units that must be sold to earn a profit of 60,000 per year (3) How many units must be sold to earn a net income of 10% of sales. Sales price 20 per unit: variable manufacturing costs 11 p.u.; fixed factory overheads 5,40,000 p.a.: variable selling costs3 p.u. Fixed selling costs 2,52,000 per year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started