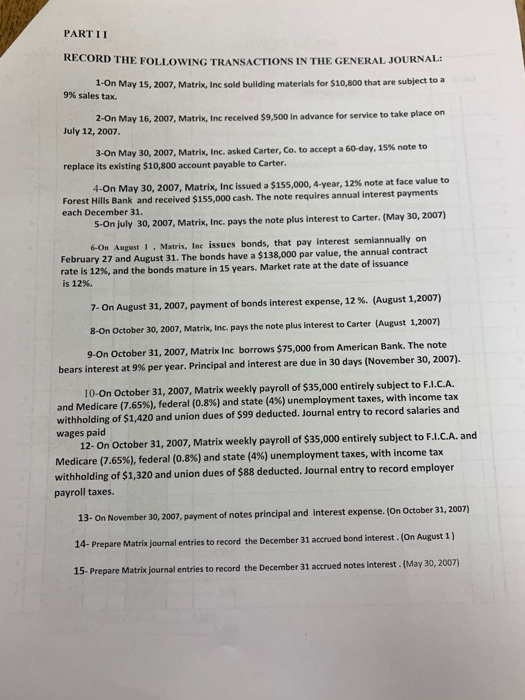

PARTIT RECORD THE FOLLOWING TRANSACTIONS IN THE GENERAL JOURNAL: 1-On May 15, 2007, Matrix, Inc sold building materials for $10.000 that are subject to a 9% sales tax 2-On May 16, 2007, Matrix, Inc received $9.500 in advance for service to take place on July 12, 2007. 3-On May 30, 2007, Matrix, Inc. asked Carter, Co to accept a 60-day, 15% note to replace its existing $10,800 account payable to Carter. 4-On May 30, 2007, Matrix, Inc issued a $155.000, 4 year, 12% note at face value to Forest Hills Bank and received $155,000 cash. The note requires annual interest payments each December 31. 5-On july 30, 2007, Matrix, Inc. pays the note plus interest to Carter. (May 30, 2007) 6-On August 1. Matrix, Inc issues bonds, that pay interest semiannually on February 27 and August 31. The bonds have a $138,000 par value, the annual contract rate is 12%, and the bonds mature in 15 years. Market rate at the date of issuance is 12% 7. On August 31, 2007, payment of bonds interest expense, 12%. (August 1,2007) 8-On October 30, 2007, Matrix, Inc. pays the note plus interest to Carter (August 1,2007) 9-On October 31, 2007, Matrix Inc borrows $75,000 from American Bank. The note bears interest at 9% per year. Principal and interest are due in 30 days (November 30, 2007). 10-On October 31, 2007, Matrix weekly payroll of $35,000 entirely subject to F.I.C.A. and Medicare (7.65%), federal (0.8%) and state (4%) unemployment taxes, with income tax withholding of $1,420 and union dues of $99 deducted. Journal entry to record salaries and wages paid 12- On October 31, 2007, Matrix weekly payroll of $35,000 entirely subject to F.I.C.A. and Medicare (7.65%), federal (0.8%) and state (4%) unemployment taxes, with income tax withholding of $1,320 and union dues of $88 deducted. Journal entry to record employer payroll taxes. 13- On November 30, 2007, payment of notes principal and interest expense. (On October 31, 2007) 14- Prepare Matrix journal entries to record the December 31 accrued bond interest. (On August 1) 15. Prepare Matrix journal entries to record the December 31 accrued notes interest. (May 30, 2007)