Question

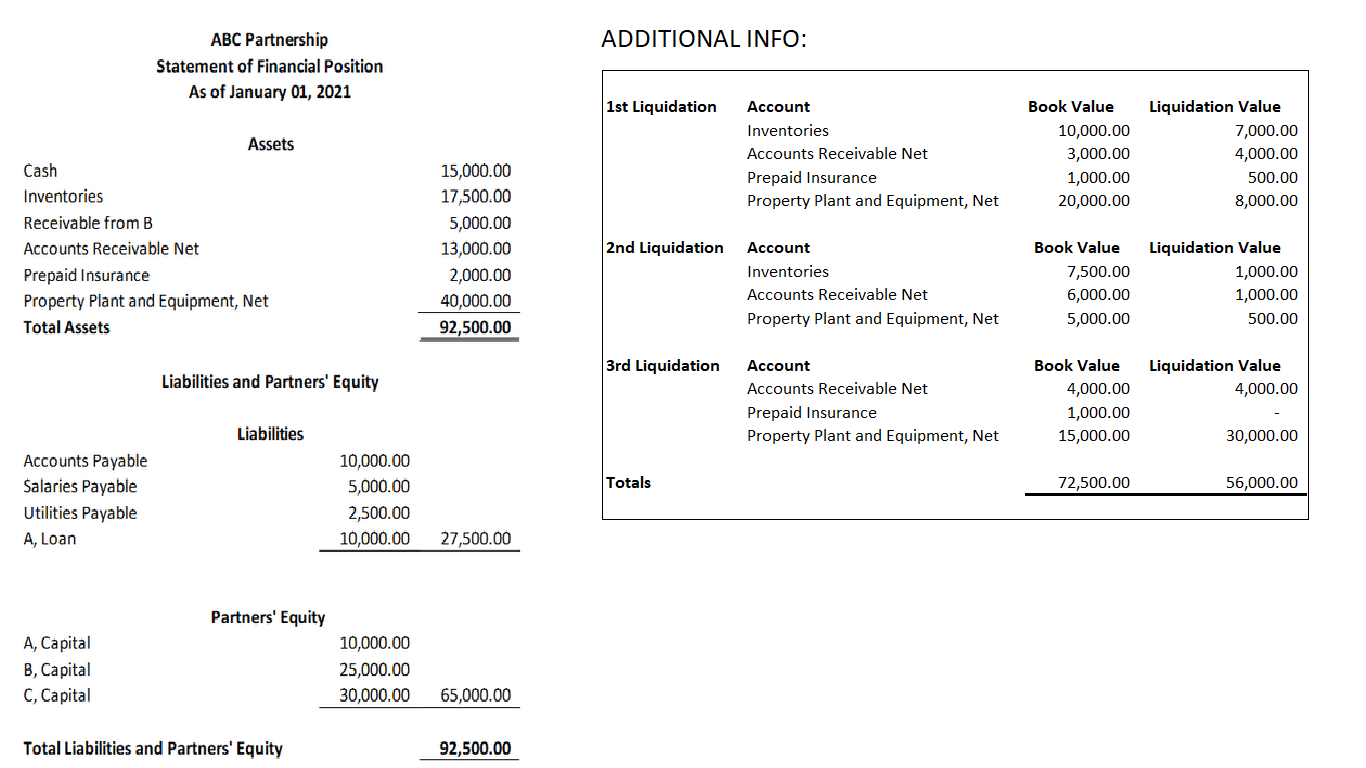

Partners A, B, and C who had an original profit sharing ratio of 40%, 30% and 30% respectively with an additional provision that Partner A

Partners A, B, and C who had an original profit sharing ratio of 40%, 30% and 30% respectively with an additional provision that Partner A should be given a salary of 10,000 every month, and a bonus for partner B amounting to 10% after salaries and bonuses decided to liquidate the partnership. The balance sheet before liquidation is presented below:

Questions:

1. How much was the total theoretical loss to be allocated to each partner during the first installment?

2. How much was the total theoretical loss to be allocated to each partner during the second installment?

3. How much was the total theoretical loss to be allocated to each partner during the third installment?

4. How much total cash was distributed to Partner A?

5. How much total cash was distributed to Partner B?

6. How much total cash was distributed to Partner C?

7. How much cash distribution should be given to partner B during the first installment liquidation?

8. How much cash distribution should be given to partner A during the second installment liquidation?

9. How much cash distribution should be given to partner C during the third installment liquidation?

ADDITIONAL INFO: ABC Partnership Statement of Financial Position As of January 01, 2021 1st Liquidation Account Inventories Accounts Receivable Net Prepaid Insurance Property Plant and Equipment, Net Book Value 10,000.00 3,000.00 1,000.00 20,000.00 Liquidation Value 7,000.00 4,000.00 500.00 8,000.00 Assets Cash Inventories Receivable from B Accounts Receivable Net Prepaid Insurance Property Plant and Equipment, Net Total Assets 15,000.00 17,500.00 5,000.00 13,000.00 2,000.00 40,000.00 92,500.00 2nd Liquidation Account Inventories Accounts Receivable Net Property Plant and Equipment, Net Book Value 7,500.00 6,000.00 5,000.00 Liquidation Value 1,000.00 1,000.00 500.00 3rd Liquidation Liabilities and Partners' Equity Liquidation Value 4,000.00 Account Accounts Receivable Net Prepaid Insurance Property Plant and Equipment, Net Book Value 4,000.00 1,000.00 15,000.00 Liabilities 30,000.00 Totals 72,500.00 56,000.00 Accounts Payable Salaries Payable Utilities Payable A, Loan 10,000.00 5,000.00 2,500.00 10,000.00 27,500.00 Partners' Equity A, Capital B, Capital C, Capital 10,000.00 25,000.00 30,000.00 65,000.00 Total Liabilities and Partners' Equity 92,500.00 ADDITIONAL INFO: ABC Partnership Statement of Financial Position As of January 01, 2021 1st Liquidation Account Inventories Accounts Receivable Net Prepaid Insurance Property Plant and Equipment, Net Book Value 10,000.00 3,000.00 1,000.00 20,000.00 Liquidation Value 7,000.00 4,000.00 500.00 8,000.00 Assets Cash Inventories Receivable from B Accounts Receivable Net Prepaid Insurance Property Plant and Equipment, Net Total Assets 15,000.00 17,500.00 5,000.00 13,000.00 2,000.00 40,000.00 92,500.00 2nd Liquidation Account Inventories Accounts Receivable Net Property Plant and Equipment, Net Book Value 7,500.00 6,000.00 5,000.00 Liquidation Value 1,000.00 1,000.00 500.00 3rd Liquidation Liabilities and Partners' Equity Liquidation Value 4,000.00 Account Accounts Receivable Net Prepaid Insurance Property Plant and Equipment, Net Book Value 4,000.00 1,000.00 15,000.00 Liabilities 30,000.00 Totals 72,500.00 56,000.00 Accounts Payable Salaries Payable Utilities Payable A, Loan 10,000.00 5,000.00 2,500.00 10,000.00 27,500.00 Partners' Equity A, Capital B, Capital C, Capital 10,000.00 25,000.00 30,000.00 65,000.00 Total Liabilities and Partners' Equity 92,500.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started