Answered step by step

Verified Expert Solution

Question

1 Approved Answer

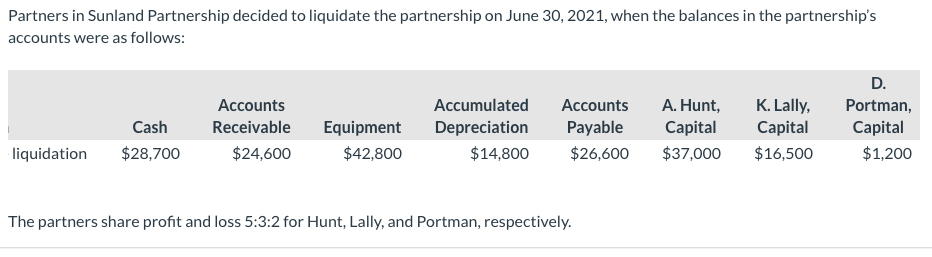

Partners in Sunland Partnership decided to liquidate the partnership on June 30, 2021, when the balances in the partnership's accounts were as follows: Cash

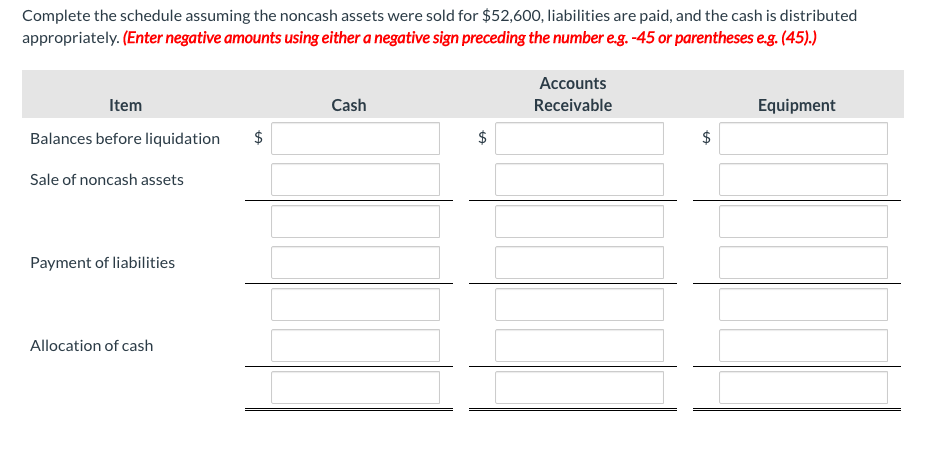

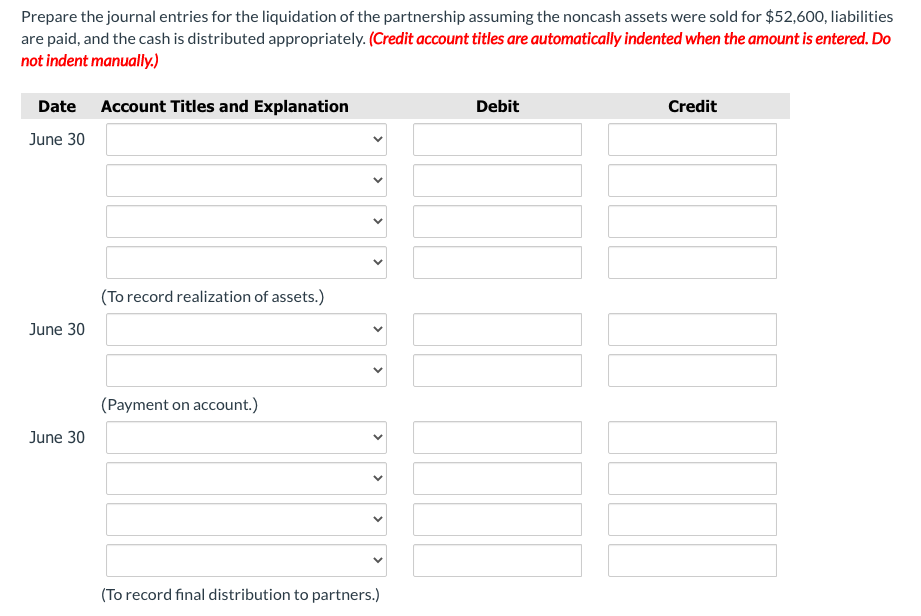

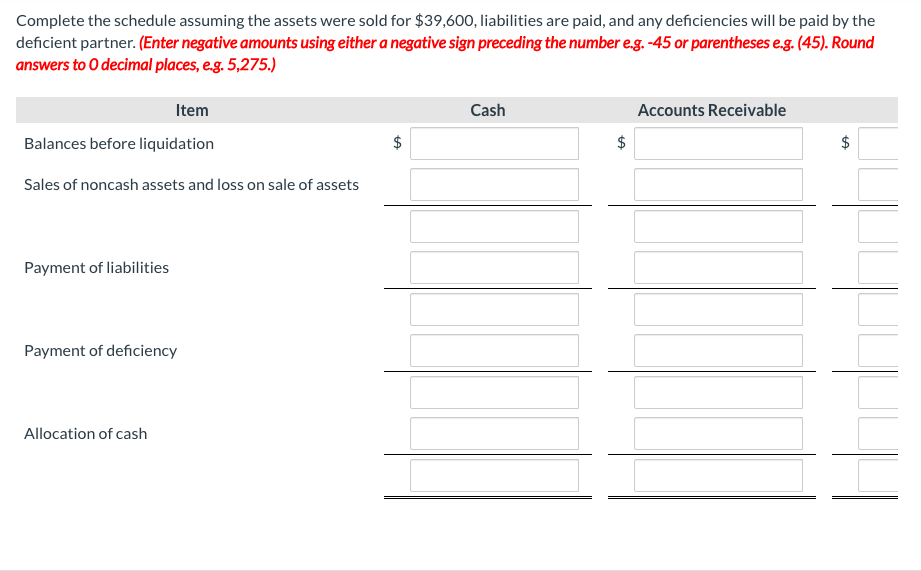

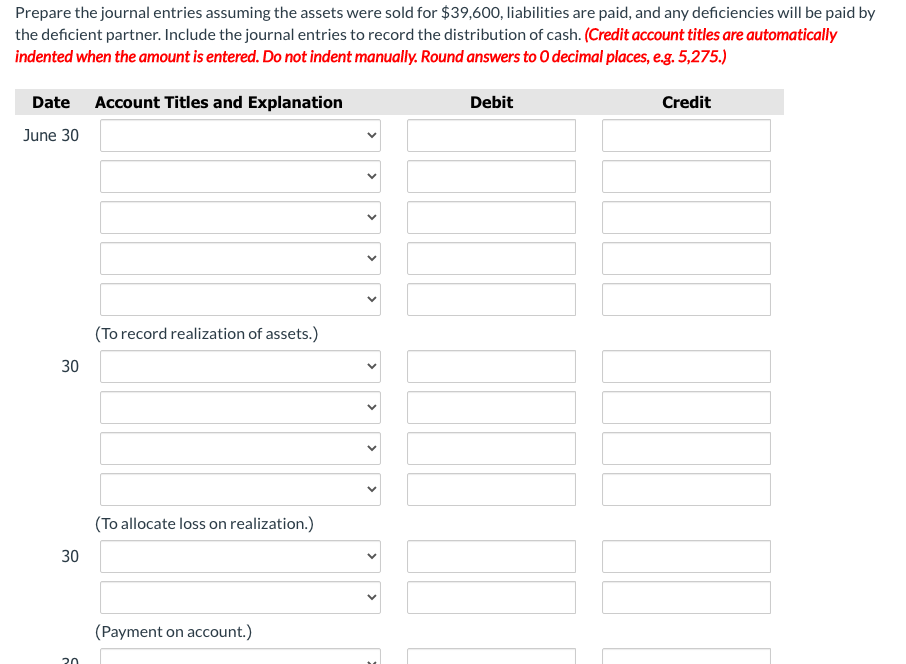

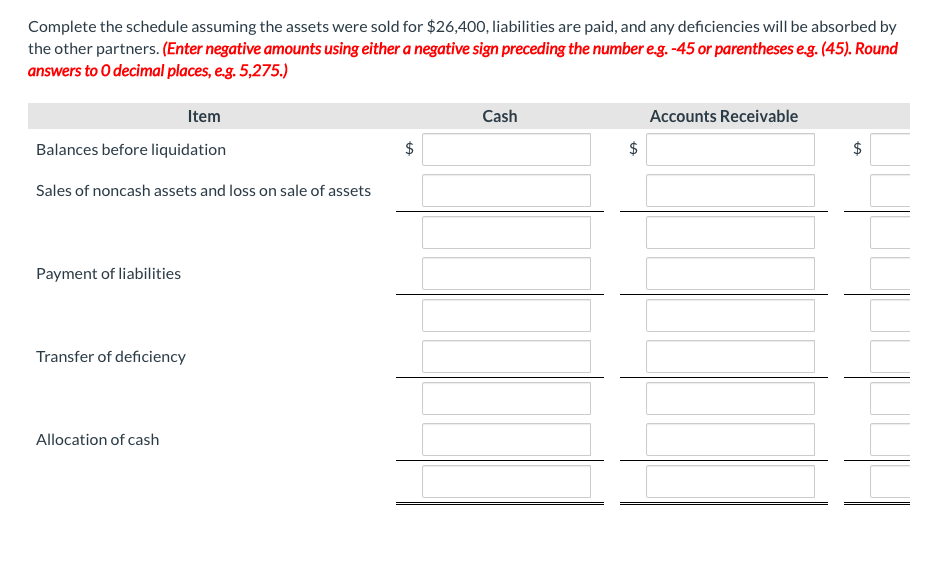

Partners in Sunland Partnership decided to liquidate the partnership on June 30, 2021, when the balances in the partnership's accounts were as follows: Cash liquidation $28,700 Accounts Receivable $24,600 Equipment $42,800 Accumulated Accounts A. Hunt, K.Lally, Depreciation Payable Capital Capital $14,800 $26,600 $37,000 $16,500 The partners share profit and loss 5:3:2 for Hunt, Lally, and Portman, respectively. D. Portman, Capital $1,200 Complete the schedule assuming the noncash assets were sold for $52,600, liabilities are paid, and the cash is distributed appropriately. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Item Balances before liquidation Sale of noncash assets Payment of liabilities Allocation of cash $ Cash Accounts Receivable Equipment Prepare the journal entries for the liquidation of the partnership assuming the noncash assets were sold for $52,600, liabilities are paid, and the cash is distributed appropriately. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation June 30 June 30 June 30 (To record realization of assets.) (Payment on account.) < < > (To record final distribution to partners.) Debit Credit Complete the schedule assuming the assets were sold for $39,600, liabilities are paid, and any deficiencies will be paid by the deficient partner. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Round answers to 0 decimal places, e.g. 5,275.) Item Balances before liquidation Sales of noncash assets and loss on sale of assets Payment of liabilities Payment of deficiency Allocation of cash GA Cash $ Accounts Receivable GA Prepare the journal entries assuming the assets were sold for $39,600, liabilities are paid, and any deficiencies will be paid by the deficient partner. Include the journal entries to record the distribution of cash. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to O decimal places, e.g. 5,275.) Date Account Titles and Explanation June 30 30 30 20 (To record realization of assets.) (To allocate loss on realization.) (Payment on account.) < < < < < < < < Debit Credit Complete the schedule assuming the assets were sold for $26,400, liabilities are paid, and any deficiencies will be absorbed by the other partners. (Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45). Round answers to O decimal places, e.g. 5,275.) Item Balances before liquidation Sales of noncash assets and loss on sale of assets Payment of liabilities Transfer of deficiency Allocation of cash Cash $ tA Accounts Receivable GA Jypypy

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Item Cash Accounts Receivable Equipment Accumulated Depreciation Accounts Payable A Hunt capital K L...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started