Partnership

Partnership

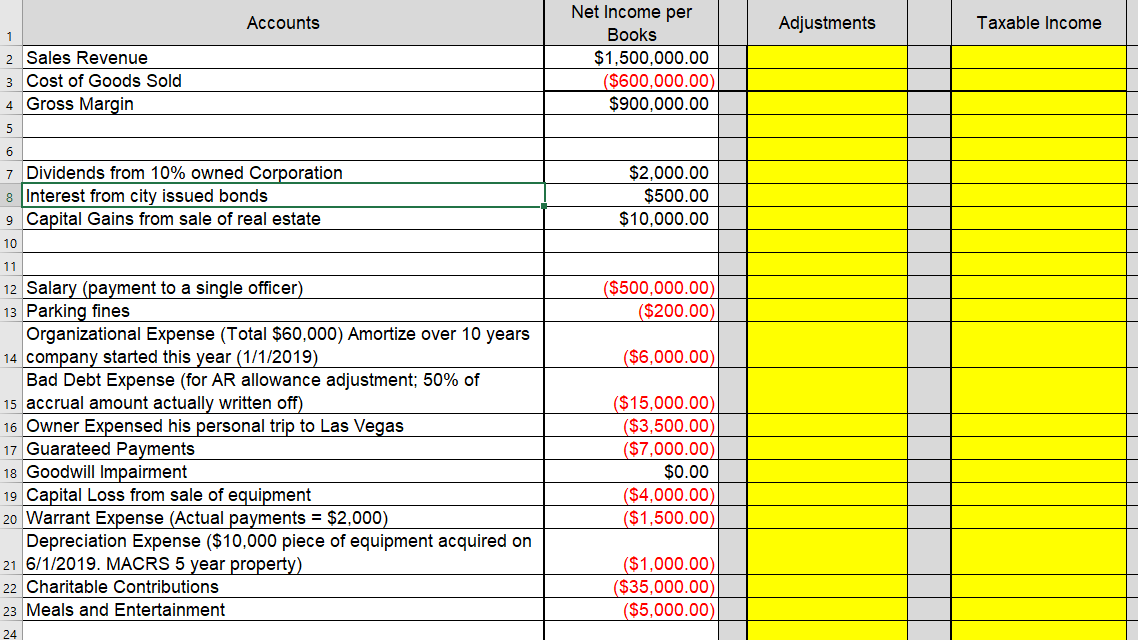

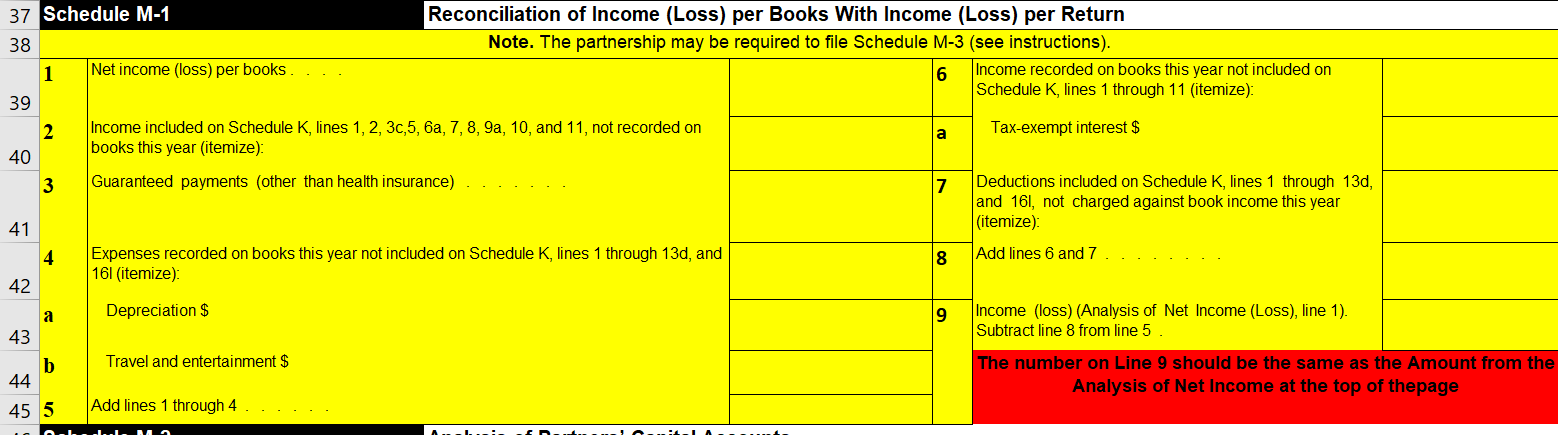

Accounts Adjustments Taxable income 2 Sales Revenue 3 Cost of Goods Sold 4 Gross Margin Net Income per Books $1,500,000.00 ($600,000.00) $900,000.00 7 Dividends from 10% owned Corporation Interest from city issued bonds 9 Capital Gains from sale of real estate $2,000.00 $500.00 $10,000.00 ($500,000.00) ($200.00) ($6,000.00) 12 Salary (payment to a single officer) 13 Parking fines Organizational Expense (Total $60,000) Amortize over 10 years 14 company started this year (1/1/2019) Bad Debt Expense (for AR allowance adjustment; 50% of 15 accrual amount actually written off) 16 Owner Expensed his personal trip to Las Vegas 17 Guarateed Payments 18 Goodwill Impairment 19 Capital Loss from sale of equipment 20 Warrant Expense (Actual payments = $2,000) Depreciation Expense ($10,000 piece of equipment acquired on 21 6/1/2019. MACRS 5 year property) 22 Charitable Contributions 23 Meals and Entertainment 24 ($15,000.00) ($3,500.00) ($7,000.00) $0.00 ($4,000.00) ($1,500.00 ($1,000.00) ($35,000.00) ($5,000.00) 37 Schedule M-1 Reconciliation of Income (Loss) per Books With Income (Loss) per Return Note. The partnership may be required to file Schedule M-3 (see instructions). Income recorded on books this year not included on Schedule K, lines 1 through 11 (itemize): Net income (loss) per books. ... Tax-exempt interest $ Income included on Schedule K, lines 1, 2, 3c,5, 6, 7, 8, 9a, 10, and 11, not recorded on books this year (itemize): 3 Guaranteed payments (other than health insurance) ....! Deductions included on Schedule K, lines 1 through 13d, and 161, not charged against book income this year (itemize): Add lines 6 and 7 Expenses recorded on books this year not included on Schedule K, lines 1 through 13d, and 161 (itemize) Depreciation $ Income (loss) (Analysis of Net Income (Loss), line 1). Subtract line 8 from line 5. 43 Travel and entertainment $ 44 45 5 The number on Line 9 should be the same as the Amount from the Analysis of Net Income at the top of thepage Add lines 1 through 4 ..... ALI: A LA- Accounts Adjustments Taxable income 2 Sales Revenue 3 Cost of Goods Sold 4 Gross Margin Net Income per Books $1,500,000.00 ($600,000.00) $900,000.00 7 Dividends from 10% owned Corporation Interest from city issued bonds 9 Capital Gains from sale of real estate $2,000.00 $500.00 $10,000.00 ($500,000.00) ($200.00) ($6,000.00) 12 Salary (payment to a single officer) 13 Parking fines Organizational Expense (Total $60,000) Amortize over 10 years 14 company started this year (1/1/2019) Bad Debt Expense (for AR allowance adjustment; 50% of 15 accrual amount actually written off) 16 Owner Expensed his personal trip to Las Vegas 17 Guarateed Payments 18 Goodwill Impairment 19 Capital Loss from sale of equipment 20 Warrant Expense (Actual payments = $2,000) Depreciation Expense ($10,000 piece of equipment acquired on 21 6/1/2019. MACRS 5 year property) 22 Charitable Contributions 23 Meals and Entertainment 24 ($15,000.00) ($3,500.00) ($7,000.00) $0.00 ($4,000.00) ($1,500.00 ($1,000.00) ($35,000.00) ($5,000.00) 37 Schedule M-1 Reconciliation of Income (Loss) per Books With Income (Loss) per Return Note. The partnership may be required to file Schedule M-3 (see instructions). Income recorded on books this year not included on Schedule K, lines 1 through 11 (itemize): Net income (loss) per books. ... Tax-exempt interest $ Income included on Schedule K, lines 1, 2, 3c,5, 6, 7, 8, 9a, 10, and 11, not recorded on books this year (itemize): 3 Guaranteed payments (other than health insurance) ....! Deductions included on Schedule K, lines 1 through 13d, and 161, not charged against book income this year (itemize): Add lines 6 and 7 Expenses recorded on books this year not included on Schedule K, lines 1 through 13d, and 161 (itemize) Depreciation $ Income (loss) (Analysis of Net Income (Loss), line 1). Subtract line 8 from line 5. 43 Travel and entertainment $ 44 45 5 The number on Line 9 should be the same as the Amount from the Analysis of Net Income at the top of thepage Add lines 1 through 4 ..... ALI: A LA

Partnership

Partnership