Answered step by step

Verified Expert Solution

Question

1 Approved Answer

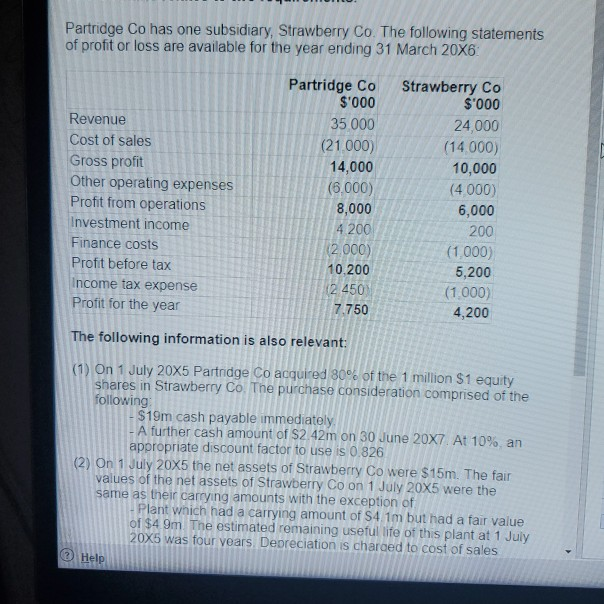

Partridge Co has one subsidiary, Strawberry Co. The following statements of profit or loss are available for the year ending 31 March 20X6 Revenue Cost

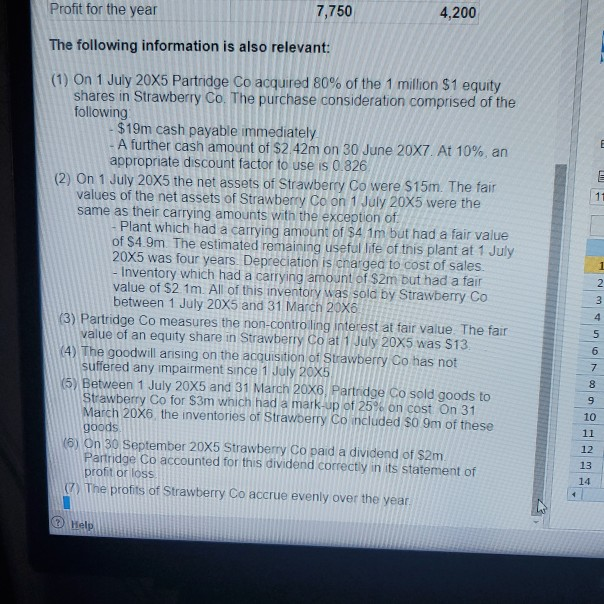

Partridge Co has one subsidiary, Strawberry Co. The following statements of profit or loss are available for the year ending 31 March 20X6 Revenue Cost of sales Gross profit Other operating expenses Profit from operations Investment income Finance costs Profit before tax Income tax expense Profit for the year Partridge Co $'000 35 000 (21 000) 14,000 (6.000) 8,000 4 200 (2.000) 10.200 12.450 7.750 Strawberry Co $'000 24,000 (14000) 10,000 (4000) 6,000 200 (1.000) 5,200 (1000) 4,200 The following information is also relevant: (1) On 1 July 20X5 Partridge Co acquired 80% of the 1 million $1 equity shares in Strawberry Co. The purchase consideration comprised of the following $19m cash payable immediately - A further cash amount of $2.42m on 30 June 20X7 At 10% an appropriate discount factor to use is 0.826 (2) On 1 July 20x5 the net assets of Strawberry Co were $15m. The fair values of the net assets of Strawberry Co on 1 July 20X5 were the same as their carrying amounts with the exception of Plant which had a carrying amount of S4.1m but had a fair value of $4 9m The estimated remaining useful life of this plant at 1 July 20X5 was four years Depreciation is charged to cost of sales Help Profit for the year 7,750 4,200 The following information is also relevant: 1 (1) On 1 July 20X5 Partridge Co acquired 80% of the 1 million $1 equity shares in Strawberry Co. The purchase consideration comprised of the following $19m cash payable immediately A further cash amount of $2.42m on 30 June 20X7 At 10%, an appropriate discount factor to use is 0.826 (2) On 1 July 20x5 the net assets of Strawberry Co were $15m. The fair values of the net assets of Strawberry Co on 1 July 20X5 were the same as their carrying amounts with the exception of - Plant which had a carrying amount of $41m but had a fair value of $4.9m The estimated remaining useful life of this plant at 1 July 20X5 was four years. Depreciation is charged to cost of sales - Inventory which had a carrying amount of $2m but had a fair value of $2 1m. All of this inventory was sold by Strawberry Co between 1 July 20X5 and 31 March 20X6 (3) Partridge Co measures the non-controling interest at fair value. The fair value of an equity share in Strawberry Co at 1 July 20X5 was $13. (4) The goodwill arising on the acquisition of Strawberry Co has not suffered any impairment since 1 July 20X5 (5) Between 1 July 20X5 and 31 March 20X6, Partridge Co sold goods to Strawberry Co for $3m which had a mark-up of 25% on cost On 31 March 20X6 the inventories of Strawberry Co included $0 9m of these goods (6) On 30 September 2005 Strawberry Co paid a dividend of $2m Partridge Co accounted for this dividend correctly in its statement of profit or loss (7) The profits of Strawberry Co accrue evenly over the year. 2 3 4 5 6 7 8 9 10 11 12 13 14 Yelp Close All P Flag for R (a) Calculate the goodwill arising on the acquisition of Strawberry Co on 1 July 20X5. (5 marks) (b) Prepare the consolidated statement of profit or loss for the Partridge group for the year ended 31 March 20X6. (15 marks) (20 marks) Edit Format be e 100% 11 B 7 U A .00 % 12 A1 B D E F G 1 H 1 2 3 4 5 6 7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started