Question

*Parts 1A, 2A, 3A and 1B have already been complete- I need assistance with parts 2B, 3B and 4B: 2B. Prepare a complete variance analysis

*Parts 1A, 2A, 3A and 1B have already been complete- I need assistance with parts 2B, 3B and 4B:

2B. Prepare a complete variance analysis for your product by preparing a variance report that includes sales variances, direct material variances, and direct labor variances.

3B. Come up with at least one feasible explanation for each variance you discover.

4B. Write a report to your company's CEO in which you present the product's sales performance, significant variances you discovered, and the reasons you found for the variances. Conclude your report by making suggestions for possible action to be taken towards solving the problems you found.

Thank you for your help!

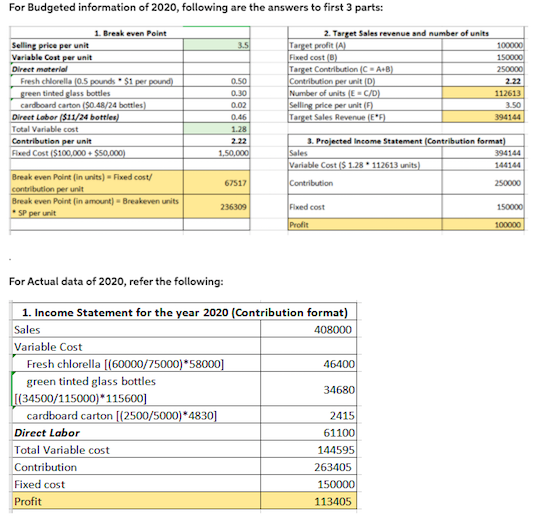

L Vitality Super Greenfood Supplement Budgeted information for 2020 Selling price: $3.50 per bomle of 100 capsules Direct Materials: main ingredient-fresh chlorella sea algae S1 per pound (1 pound of chlorella, after freeze drying, should yield 2 bottles of Vitality green-tinted glass bottles, S.30 each: cardboard carton for each case of 24 bottles 5.48 Direct Labor: 1 hour to freeze-dry algac, fill 24 boetles, and package them into a 24- bottle carton; factory workers cam S11 per hour Overhead (all fixed) $100,000 for the year Operating Expenses (all fixed): 550,000 Assume that all product produced is sold Your job as the new product financial team is to perform the following tasks: 1. Calculate breakeven point in units and sales for the product 2. Calculate the number of units and sales revenues required to achieve a target profit for the product of 100,000 3. Prepare a projected contribution-margin-format income statement for your target profit of $100.000 Actual results for the year 2020 Sales: 4800 cases; S408,000 Direct Materials: chlorella: 60.000 pounds purchased for $75,000, 58,000 pounds were used; bottles: 115,600 used, 115,000 were purchased for $34,500 cartons: 4830 used, 5,000 were purchased for $2,500 Direct Labor: 4700 hours were worked, total cost $61,100 Overhead: $100,000 Operating Expenses: $50,000 1. Prepare a contribution-margin-format income statement for your product's actual results for 2020 2. Prepare a complete variance analysis for your product by preparing a variance report that includes sales variances, direct material variances, and direct labor variances. 3. Come up with at least one feasible explanation for each variance you discover 4. Write a report to your company's CEO in which you present the product's sales performance, significant variances you discovered, and the reasons you found for the variances. Conclude your report by making suggestions for possible action to be taken towards solving the problems you found For Budgeted information of 2020, following are the answers to first 3 parts: 3.5 1. Break even Point Selling price per unit Variable Cost per unit Direct material Fresh chlorella (0.5 pounds $i per pound) green tinted glass bottles cardboard carton (50.48/24 bottles) Direct Labor ($11/24 bottles) Total Variable cost Contribution per unit Fixed Cost ($100,000 + $50,000) 2. Target Sales revenue and number of units Target profit (A) Fixed cost Target Contribution ( CA+B) Contribution per unit) Number of units E-C/D) Selling price per unit() Target Sales Revenue (E95) 0.50 0.30 0.02 0.46 1.28 2.22 1,50.000 100000 150000 250000 2 22 112613 3.50 394144 3. Projected Income Statement Contribution format) Sales 394144 Variable Cost ($ 1.28 112613 units) 144144 67517 Contribution 250000 Break even Point in units) - Fixed cost/ contribution per unit Break even Point (in amount) - Breakeven units SP per unit 236309 Fixed cost 150000 Profit 100000 For Actual data of 2020, refer the following: 1. Income Statement for the year 2020 (Contribution format) Sales 408000 Variable Cost Fresh chlorella [(60000/75000)*58000] 46400 green tinted glass bottles 34680 |(34500/115000)*115600) cardboard carton (2500/5000)* 4830] 2415 Direct Labor 61100 Total Variable cost 144595 Contribution 263405 Fixed cost 150000 Profit 113405Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started