Answered step by step

Verified Expert Solution

Question

1 Approved Answer

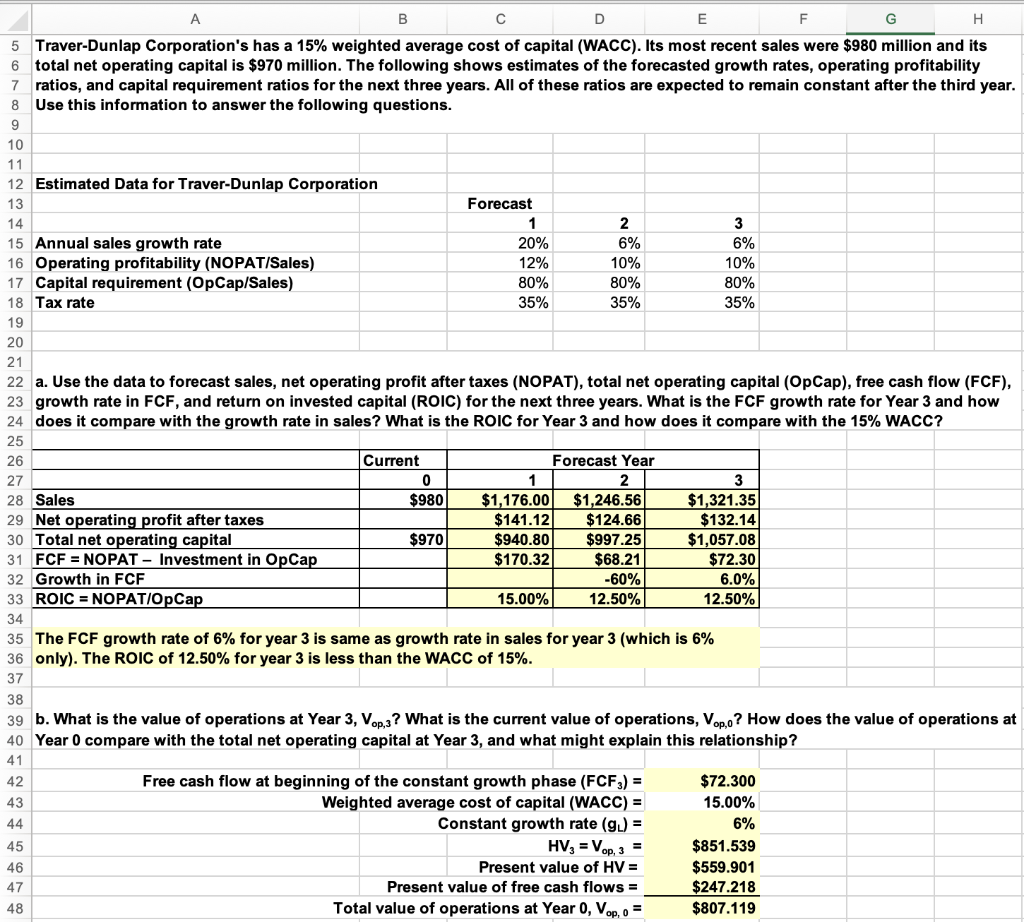

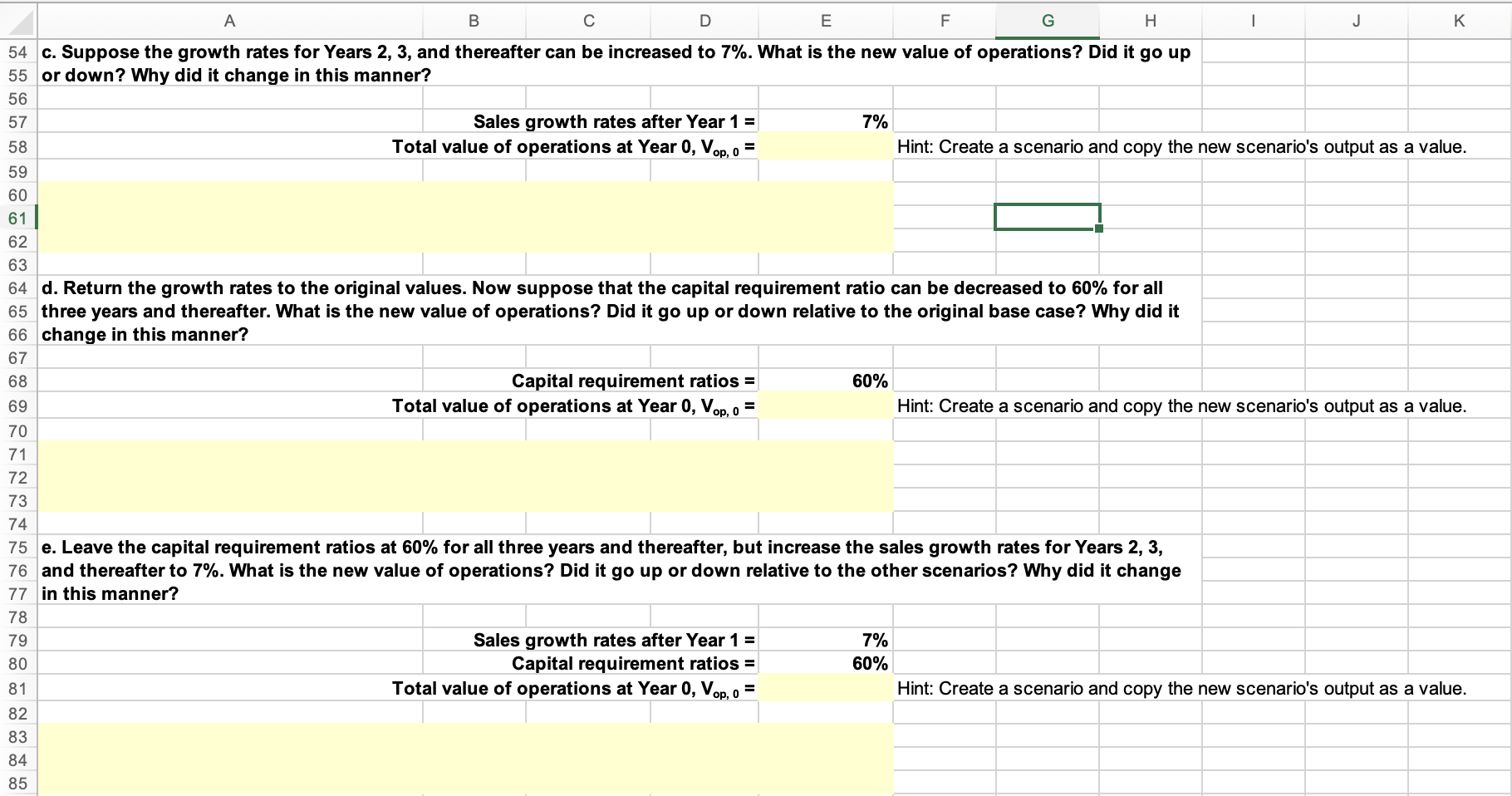

Parts C. D. and E. with formulas in excel please A B D E G . 5 Traver-Dunlap Corporation's has a 15% weighted average cost

Parts C. D. and E. with formulas in excel please

A B D E G . 5 Traver-Dunlap Corporation's has a 15% weighted average cost of capital (WACC). Its most recent sales were $980 million and its 6 total net operating capital is $970 million. The following shows estimates of the forecasted growth rates, operating profitability 7 ratios, and capital requirement ratios for the next three years. All of these ratios are expected to remain constant after the third year. 8 Use this information to answer the following questions. 9 10 11 12 Estimated Data for Traver-Dunlap Corporation 13 Forecast 14 1 2 3 15 Annual sales growth rate 20% 6% 6% 16 Operating profitability (NOPAT/Sales) 12% 10% 10% 17 Capital requirement (OpCap/Sales) 80% 80% 80% 18 Tax rate 35% 35% 35% 19 20 21 22 a. Use the data to forecast sales, net operating profit after taxes (NOPAT), total net operating capital (OpCap), free cash flow (FCF), 23 growth rate in FCF, and return on invested capital (ROIC) for the next three years. What is the FCF growth rate for Year 3 and how 24 does it compare with the growth rate in sales? What is the ROIC for Year 3 and how does it compare with the 15% WACC? 25 26 Current Forecast Year 27 0 1 2 3 28 Sales $980 $1,176.00 $1,246.56 $1,321.35 29 Net operating profit after taxes $141.12 $124.66 $132.14) 30 Total net operating capital $970 $940.80 $997.25 $1,057.08 31 FCF = NOPAT - Investment in OpCap $170.32 $68.21 $72.30 32 Growth in FCF -60% 6.0% 33 ROIC = NOPAT/Op Cap 15.00% 12.50% 12.50% 34 35 The FCF growth rate of 6% for year 3 is same as growth rate in sales for year 3 (which is 6% 36 only). The ROIC of 12.50% for year 3 is less than the WACC of 15%. 37 38 39 b. What is the value of operations at Year 3, Vop,3? What is the current value of operations, Vop,0? How does the value of operations at 40 Year 0 compare with the total net operating capital at Year 3, and what might explain this relationship? 41 42 Free cash flow at beginning of the constant growth phase (FCF3) = $72.300 43 Weighted average cost of capital (WACC) = 15.00% 44 Constant growth rate (g) = 6% 45 HV, = Vop, 3 = $851.539 46 Present value of HV = $559.901 47 Present value of free cash flows = $247.218 48 Total value of operations at Year 0, Vop, o = $807.119 A B D E F G H J K 54 c. Suppose the growth rates for Years 3, and thereafter can be increased to 7%. What is the new value of operations? Did it go up 55 or down? Why did it change in this manner? 56 57 Sales growth rates after Year 1 = 7% 58 Total value of operations at Year 0, Vop, o = Hint: Create a scenario and copy the new scenario's output as a value. 59 60 61 62 63 64 d. Return the growth rates to the original values. Now suppose that the capital requirement ratio can be decreased to 60% for all 65 three years and thereafter. What is the new value of operations? Did it go up or down relative to the original base case? Why did it 66 change in this manner? 67 68 Capital requirement ratios = 60% 69 Total value of operations at Year 0, Vop, o = Hint: Create a scenario and copy the new scenario's output as a value. 70 71 72 73 74 75 e. Leave the capital requirement ratios at 60% for all three years and thereafter, but increase the sales growth rates for Years 2, 3, 76 and thereafter to 7%. What is the new value of operations? Did it go up or down relative to the other scenarios? Why did it change 77 in this manner? 78 79 Sales growth rates after Year 1 = 7% 80 Capital requirement ratios = 60% 81 Total value of operations at Year 0, Vop, o = Hint: Create a scenario and copy the new scenario's output as a value. 82 83 84 85 A B D E G . 5 Traver-Dunlap Corporation's has a 15% weighted average cost of capital (WACC). Its most recent sales were $980 million and its 6 total net operating capital is $970 million. The following shows estimates of the forecasted growth rates, operating profitability 7 ratios, and capital requirement ratios for the next three years. All of these ratios are expected to remain constant after the third year. 8 Use this information to answer the following questions. 9 10 11 12 Estimated Data for Traver-Dunlap Corporation 13 Forecast 14 1 2 3 15 Annual sales growth rate 20% 6% 6% 16 Operating profitability (NOPAT/Sales) 12% 10% 10% 17 Capital requirement (OpCap/Sales) 80% 80% 80% 18 Tax rate 35% 35% 35% 19 20 21 22 a. Use the data to forecast sales, net operating profit after taxes (NOPAT), total net operating capital (OpCap), free cash flow (FCF), 23 growth rate in FCF, and return on invested capital (ROIC) for the next three years. What is the FCF growth rate for Year 3 and how 24 does it compare with the growth rate in sales? What is the ROIC for Year 3 and how does it compare with the 15% WACC? 25 26 Current Forecast Year 27 0 1 2 3 28 Sales $980 $1,176.00 $1,246.56 $1,321.35 29 Net operating profit after taxes $141.12 $124.66 $132.14) 30 Total net operating capital $970 $940.80 $997.25 $1,057.08 31 FCF = NOPAT - Investment in OpCap $170.32 $68.21 $72.30 32 Growth in FCF -60% 6.0% 33 ROIC = NOPAT/Op Cap 15.00% 12.50% 12.50% 34 35 The FCF growth rate of 6% for year 3 is same as growth rate in sales for year 3 (which is 6% 36 only). The ROIC of 12.50% for year 3 is less than the WACC of 15%. 37 38 39 b. What is the value of operations at Year 3, Vop,3? What is the current value of operations, Vop,0? How does the value of operations at 40 Year 0 compare with the total net operating capital at Year 3, and what might explain this relationship? 41 42 Free cash flow at beginning of the constant growth phase (FCF3) = $72.300 43 Weighted average cost of capital (WACC) = 15.00% 44 Constant growth rate (g) = 6% 45 HV, = Vop, 3 = $851.539 46 Present value of HV = $559.901 47 Present value of free cash flows = $247.218 48 Total value of operations at Year 0, Vop, o = $807.119 A B D E F G H J K 54 c. Suppose the growth rates for Years 3, and thereafter can be increased to 7%. What is the new value of operations? Did it go up 55 or down? Why did it change in this manner? 56 57 Sales growth rates after Year 1 = 7% 58 Total value of operations at Year 0, Vop, o = Hint: Create a scenario and copy the new scenario's output as a value. 59 60 61 62 63 64 d. Return the growth rates to the original values. Now suppose that the capital requirement ratio can be decreased to 60% for all 65 three years and thereafter. What is the new value of operations? Did it go up or down relative to the original base case? Why did it 66 change in this manner? 67 68 Capital requirement ratios = 60% 69 Total value of operations at Year 0, Vop, o = Hint: Create a scenario and copy the new scenario's output as a value. 70 71 72 73 74 75 e. Leave the capital requirement ratios at 60% for all three years and thereafter, but increase the sales growth rates for Years 2, 3, 76 and thereafter to 7%. What is the new value of operations? Did it go up or down relative to the other scenarios? Why did it change 77 in this manner? 78 79 Sales growth rates after Year 1 = 7% 80 Capital requirement ratios = 60% 81 Total value of operations at Year 0, Vop, o = Hint: Create a scenario and copy the new scenario's output as a value. 82 83 84 85Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started