Answered step by step

Verified Expert Solution

Question

1 Approved Answer

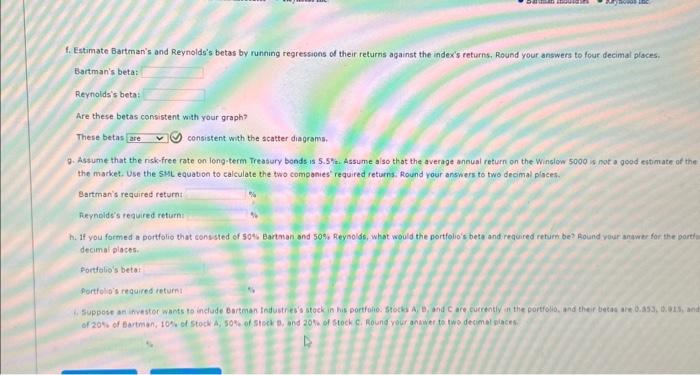

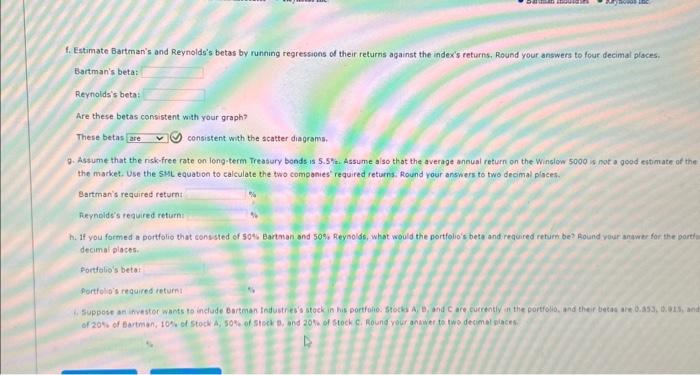

parts f, g, h, and i? Bartman's beta: Reynotds's beta: Are these betas consistent with your graph? These betas consistent inth the scatter diagrams. 0.

parts f, g, h, and i?

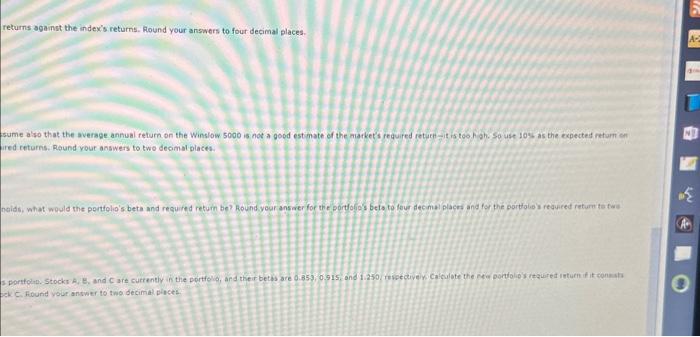

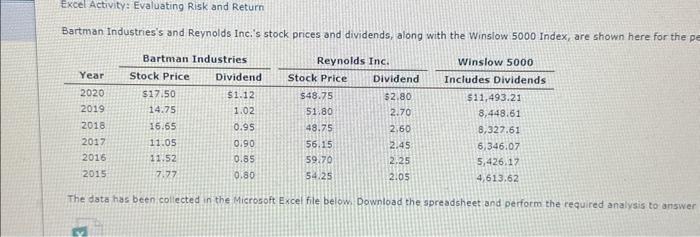

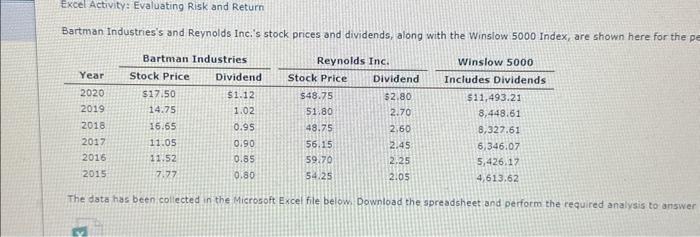

Bartman's beta: Reynotds's beta: Are these betas consistent with your graph? These betas consistent inth the scatter diagrams. 0. Assume that the nisk-free rate on long-term Treasury bonds is 5.5 tiz. Assume also that the average annual return on the Winslow 5000 is not a good eitimate of the the market. Use the SML equation to calculate the two companies' required returns: Round your answers to two decimal places. Bartman's required returnt furnolds's reaured return: decimal places. Fortalio's betar Portelo's required ieturn: returns sgainst the index's returns. Rlound your answers to four decimal places. sume also that the average annual return on the Winslow 5000 is not a good est mate of the market's required returf it is too h gh. So use 10s as the expectes refurn en ired enturns. Round your answers to twe deomal places. fek Fiound vour answer to two decimal places. Excel-Activity: Evaluating Risk and Return Bartman Industries's and Reynolds Inci's stock prices and dividends, along with the Winslow 5000 Index, are shown here for the p The data has been collected in the Microsoft Excel file below Download the spreadsheet and perform the required analysis to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started