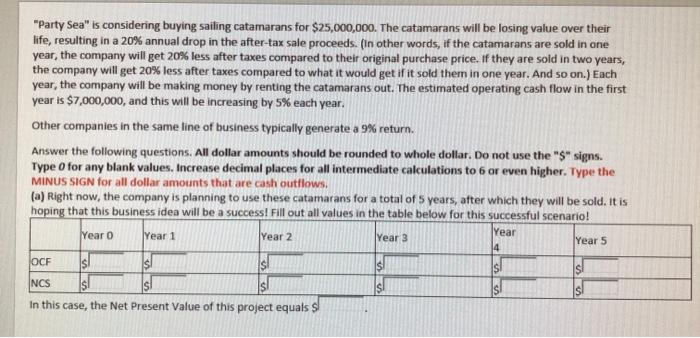

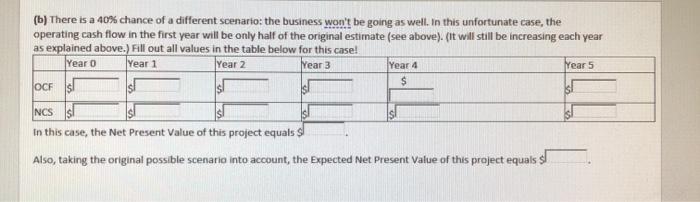

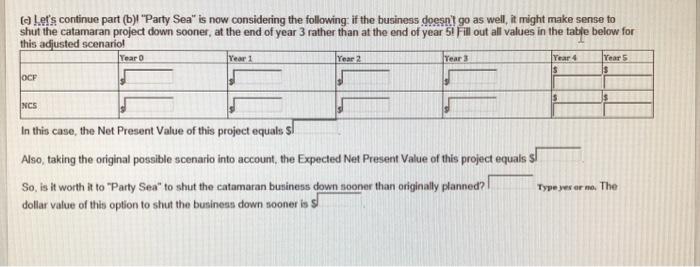

"Party Sea" is considering buying sailing catamarans for $25,000,000. The catamarans will be losing value over their life, resulting in a 20% annual drop in the after-tax sale proceeds. (In other words, if the catamarans are sold in one year, the company will get 20% less after taxes compared to their original purchase price. If they are sold in two years, the company will get 20% less after taxes compared to what it would get if it sold them in one year. And so on.) Each year, the company will be making money by renting the catamarans out. The estimated operating cash flow in the first year is $7,000,000, and this will be increasing by 5% each year. Other companies in the same line of business typically generate a 9% return. Answer the following questions. All dollar amounts should be rounded to whole dollar. Do not use the "S" signs. Type O for any blank values. Increase decimal places for all intermediate calculations to 6 or even higher. Type the MINUS SIGN for all dollar amounts that are cash outflows, (a) Right now, the company is planning to use these catamarans for a total of 5 years, after which they will be sold. It is hoping that this business idea will be a success! Fill out all values in the table below for this successful scenario! Year 2 Year 3 Year 5 Year o Year Year 1 4 OCF s! SI SI NCS s! In this case, the Net Present Value of this project equals s (b) There is a 40% chance of a different scenario: the business won't be going as well. In this unfortunate case, the operating cash flow in the first year will be only half of the original estimate (see above). (It will still be increasing each year as explained above. Fill out all values in the table below for this case! Year 0 Year 2 Year 3 Year 4 Year 5 $ OCFS Year 1 NCS In this case, the Net Present Value of this project equals Sl Also, taking the original possible scenario into account, the expected Net Present Value of this project equals s let's continue part (b) "Party Sea" is now considering the following if the business doesn't go as well, it might make sense to shut the catamaran project down sooner, at the end of year 3 rather than at the end of year 51 Fill out all values in the table below for this adjusted scenario! Year 0 Year 1 Year 2 Tears Year 4 Years is OCF 15 $ NCS In this case, the Net Present Value of this project equalss Also, taking the original possible scenario into account, the Expected Net Present Value of this project equals | So, is it worth it to "Party Sea" to shut the catamaran business down sooner than originally planned? | dollar value of this option to shut the business down sooner is sl Type yer or no. The