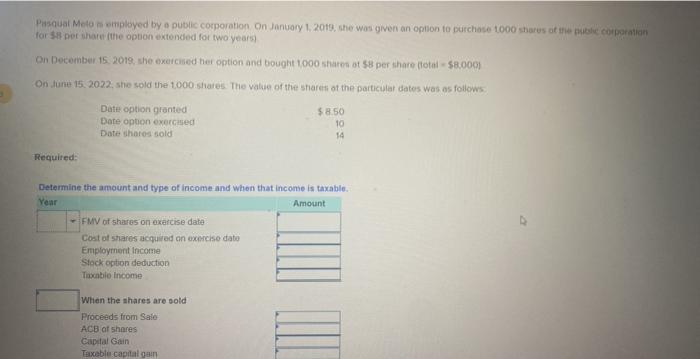

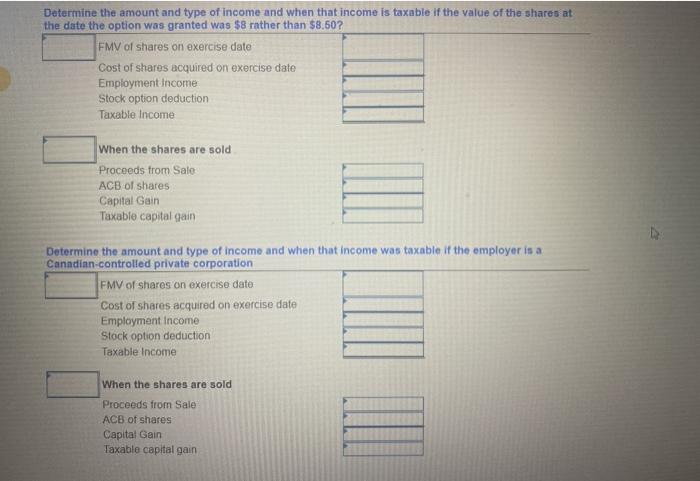

Pasqual Metons omployed by a public corporation on January 1, 2019, she was given an option to purchase 1000 shares of the use corporation for not share the option extended for two years) On December 15, 2019, she exercised her option and bought 1000 shares ot 58 per share total 58.000 On June 15, 2022, she sold the 1,000 shares. The value of the shareit at the particular Gates was as follows: Date option granted Date option exercised Date shares sold $8.50 10 14 Required: Determine the amount and type of income and when that income is taxable. Year Amount - FMV of shares on exercise date Cost of shares acquired an exercise date Employment income Stock option deduction Taxable income When the shares are sold Proceeds from Salo ACB of shares Capital Gain Taxable capital gain Determine the amount and type of income and when that income is taxable if the value of the shares at the date the option was granted was $8 rather than $8.50? FMV of shares on exercise date Cost of shares acquired on exercise date Employment Income Stock option deduction Taxable income When the shares are sold Proceeds from Sale ACB of shares Capital Gain Taxable capital gain Determine the amount and type of income and when that income was taxable if the employer is a Canadian-controlled private corporation FMV of shares on exercise date Cost of shares acquired on exercise date Employment Income Stock option deduction Taxable income When the shares are sold Proceeds from Sale ACB of shares Capital Gain Taxable capital gain Pasqual Metons omployed by a public corporation on January 1, 2019, she was given an option to purchase 1000 shares of the use corporation for not share the option extended for two years) On December 15, 2019, she exercised her option and bought 1000 shares ot 58 per share total 58.000 On June 15, 2022, she sold the 1,000 shares. The value of the shareit at the particular Gates was as follows: Date option granted Date option exercised Date shares sold $8.50 10 14 Required: Determine the amount and type of income and when that income is taxable. Year Amount - FMV of shares on exercise date Cost of shares acquired an exercise date Employment income Stock option deduction Taxable income When the shares are sold Proceeds from Salo ACB of shares Capital Gain Taxable capital gain Determine the amount and type of income and when that income is taxable if the value of the shares at the date the option was granted was $8 rather than $8.50? FMV of shares on exercise date Cost of shares acquired on exercise date Employment Income Stock option deduction Taxable income When the shares are sold Proceeds from Sale ACB of shares Capital Gain Taxable capital gain Determine the amount and type of income and when that income was taxable if the employer is a Canadian-controlled private corporation FMV of shares on exercise date Cost of shares acquired on exercise date Employment Income Stock option deduction Taxable income When the shares are sold Proceeds from Sale ACB of shares Capital Gain Taxable capital gain