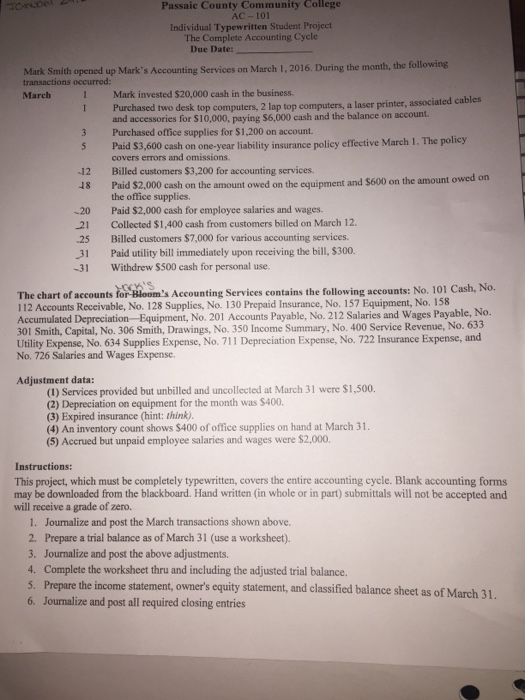

Passaic County Community College AC-101 Individual Typewritten Student Project The Complete Accounting Cycle Due Date: Mark Smith opened up Mark's Accounting Services on March 1,2016. During the month, the following transactions occurred: March 1 I Mark invested $20,000 cash in the business. Purchased two desk top computers, 2 and accessories for $10,000, paying $6,000 cash and the balance on account. 3 Purchased office supplies for $1,200 on account 5 Paid S3,600 cash on one-year liability insurance policy effective March 1. The policy covers errors and omissions -12 Billed customers $3,200 for accounting services 18 wed on Paid $2,000 cash on the amount owed on the equipment and $600 on the amount o the office supplies. 20 Paid $2,000 cash for employee salaries and wages. 21 Collected $1,400 cash from customers billed on March 12 25 Billed customers $7,000 for various accounting services. 31 Paid utility bill immediately upon receiving the bill, $300. 31 Withdrew $500 cash for personal use. The chart of accountsfomsAccounting Services contains the following aecounts: No. 101 Cash, No. 112 Accounts Receivable, No. 128 Supplies, No. 130 Prepaid Insurance, No. 157 Equipment, No. 158 Accumulated Depreciation-Equipment, No. 201 Accounts Payable, No. 212 Salaries and Wages Payable, No. 301 Smith, Capital, No. 306 Smith, Drawings, No. 350 Income Summary, No. 400 Service Revenue, No. 633 Utility Expense, No, 634 Supplies Expense, No. 711 Depreciation Expense, No. 722 Insurance Expense, and No. 726 Salaries and Wages Expense Adjustment data: (1) Services provided but unbilled and uncollected at March 31 were $1,500. (2) Depreciation on equipment for the month was $400. (3) Expired insurance (hint: think. (4) An inventory count shows $400 of office supplies on hand at March 31. (5) Accrued but unpaid employee salaries and wages were $2.000. Instructions: This project, which must be completely typewritten, covers the entire accounting cycle. Blank accounting forms may be downloaded from the blackboard. Hand written (in whole or in part) submittals will not be accepted and will receive a grade of zero. 1. Joumalize and post the March transactions shown above. 2. Prepare a trial balance as of March 31 (use a worksheet). 3. Journalize and post the above adjustments. 4. Complete the worksheet thru and including the adjusted trial balance. S. Prepare the income statement, owner's equity statement, and classified balance sheet as of March 31. 6. Journalize and post all required closing entries