Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Passerine Corporation signed a non - cancellable agreement to lease a combine harvester from Abyssinian Enterprises Inc. Abyssinian Enterprises is in the business of leasing

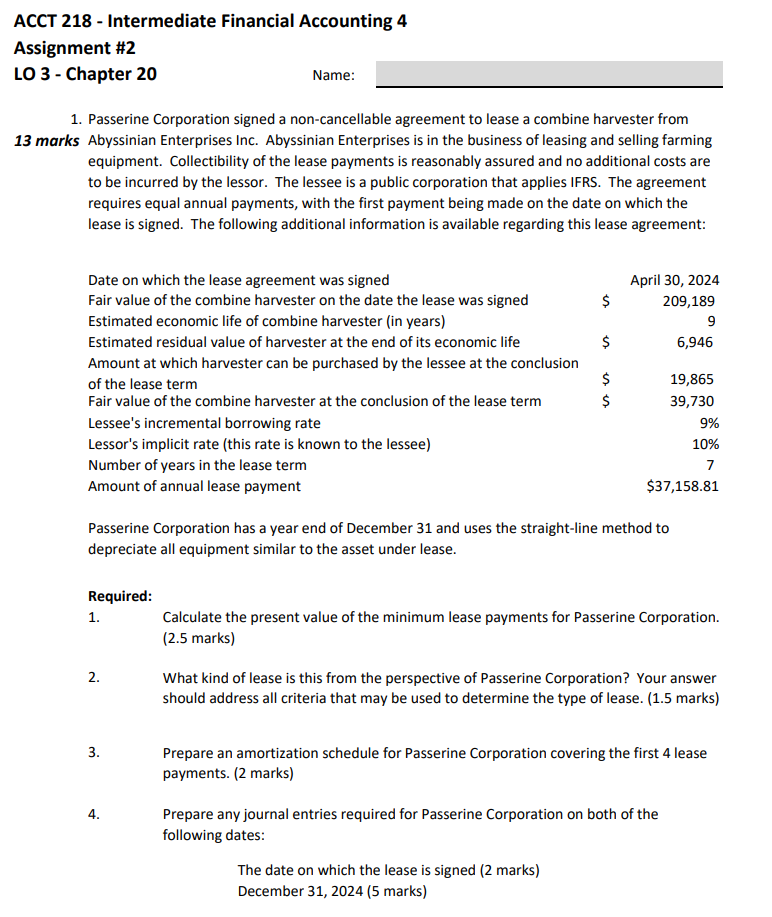

Passerine Corporation signed a noncancellable agreement to lease a combine harvester from Abyssinian Enterprises Inc. Abyssinian Enterprises is in the business of leasing and selling farming equipment. Collectibility of the lease payments is reasonably assured and no additional costs are to be incurred by the lessor. The lessee is a public corporation that applies IFRS. The agreement requires equal annual payments, with the first payment being made on the date on which the lease is signed. The following additional information is available regarding this lease agreement:

Date on which the lease agreement was signed: April

Fair value of the combine harvester on the date the lease was signed: $

Estimated economic life of combine harvester in years:

Estimated residual value of harvester at the end of its economic life:

Amount at which harvester can be purchased by the lessee at the conclusion

of the lease term: $

Fair value of the combine harvester at the conclusion of the lease term: $

Lessee's incremental borrowing rate:

Lessor's implicit rate this rate is known to the lessee:

Number of years in the lease term:

Amount of annual lease payment: $

Passerine Corporation has a year end of December and uses the straightline method to depreciate all equipment similar to the asset under lease.

Required:

Calculate the present value of the minimum lease payments for Passerine Corporation.

What kind of lease is this from the perspective of Passerine Corporation? Your answer should address all criteria that may be used to determine the type of lease.

Prepare an amortization schedule for Passerine Corporation covering the first lease payments.

Prepare any journal entries required for Passerine Corporation on both of the following dates:

The date on which the lease is signed

December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started