Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Past Paper 2 0 2 3 ZB Q 2 0 & Past Paper 2 0 2 2 ZB Q 2 0 2 0 .

Past Paper ZB Q& Past Paper ZB Q

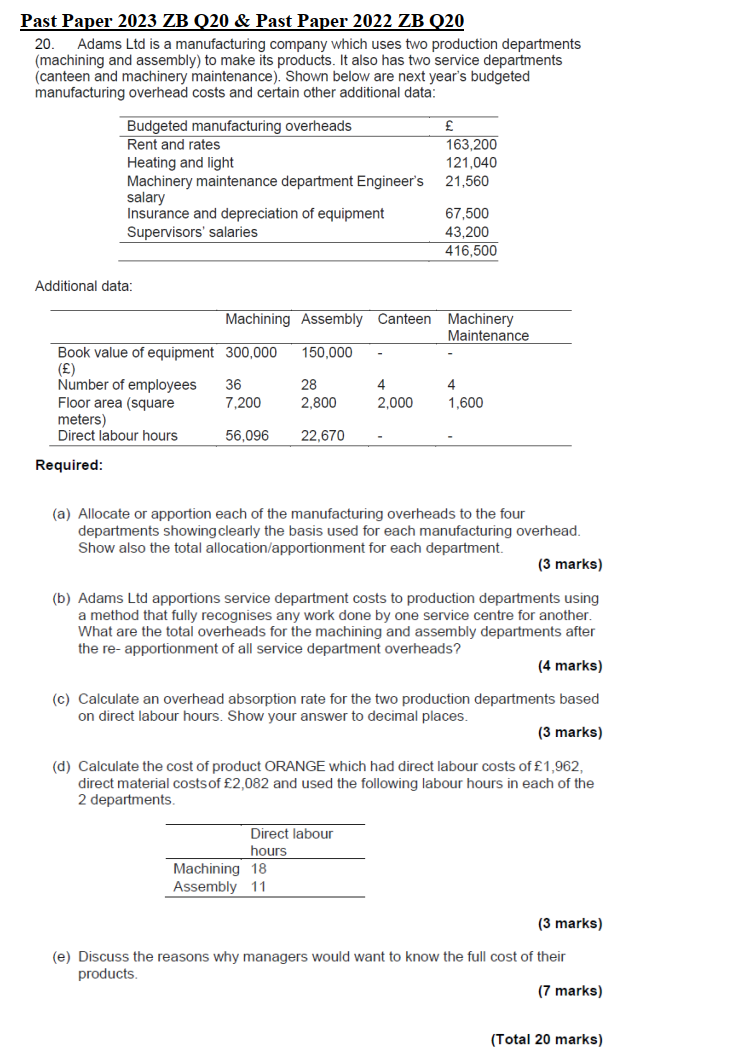

Adams Ltd is a manufacturing company which uses two production departments machining and assembly to make its products. It also has two service departments canteen and machinery maintenance Shown below are next year's budgeted manufacturing overhead costs and certain other additional data:

Additional data:

Required:

a Allocate or apportion each of the manufacturing overheads to the four departments showing clearly the basis used for each manufacturing overhead. Show also the total allocationapportionment for each department.

marks

b Adams Ltd apportions service department costs to production departments using a method that fully recognises any work done by one service centre for another. What are the total overheads for the machining and assembly departments after the reapportionment of all service department overheads?

marks

c Calculate an overhead absorption rate for the two production departments based on direct labour hours. Show your answer to decimal places.

marks

d Calculate the cost of product ORANGE which had direct labour costs of direct material costs of and used the following labour hours in each of the departments.

marks

e Discuss the reasons why managers would want to know the full cost of their products.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started