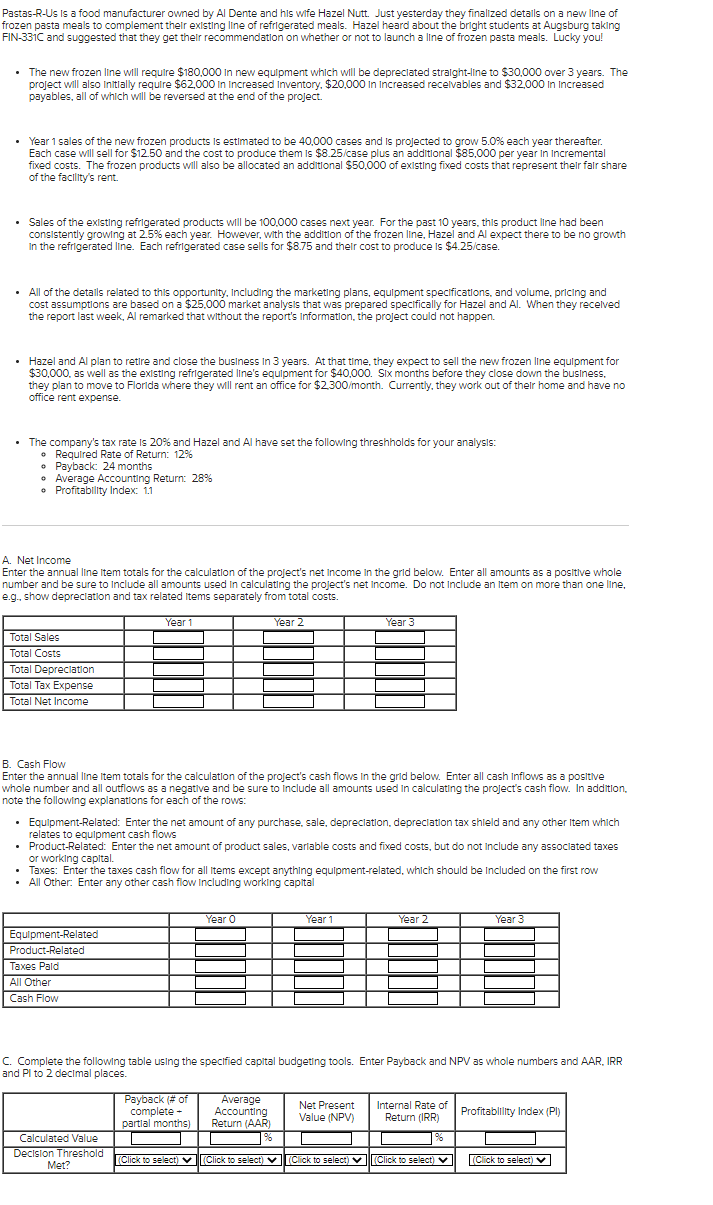

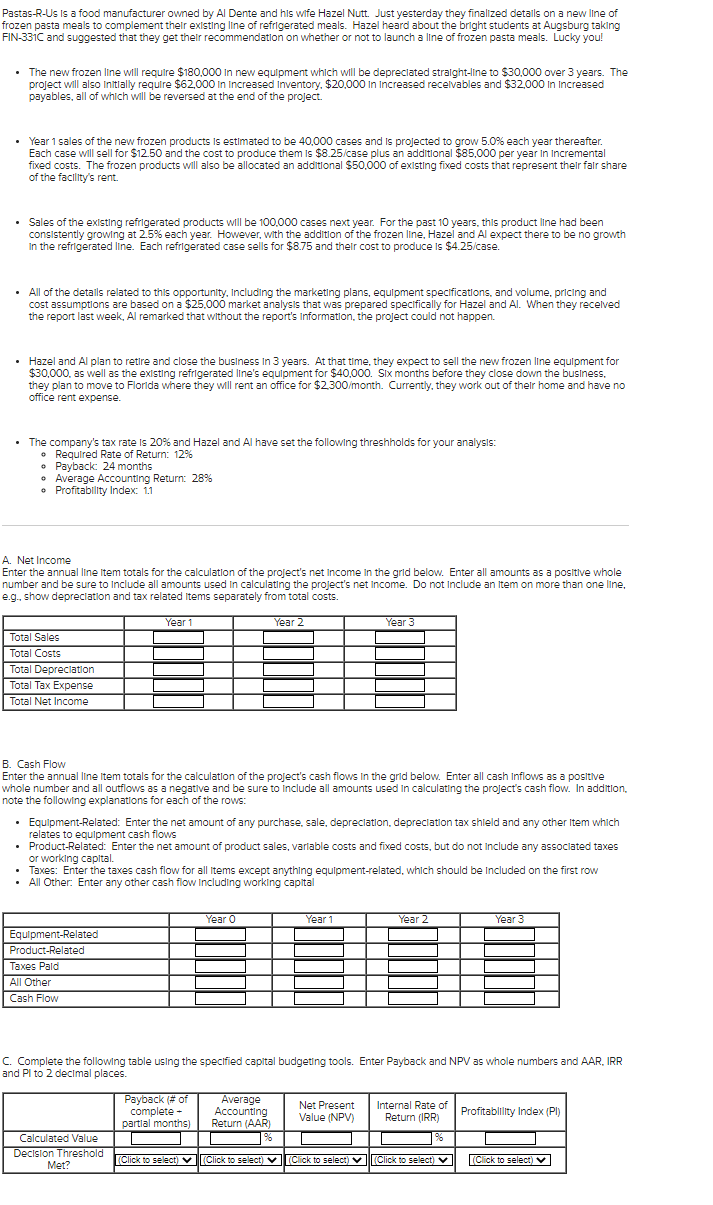

Pastas-R-Us is a food manufacturer owned by Al Dente and his wife Hazel Nutt. Just yesterday they finalized details on a new line of frozen pasta meals to complement their existing line of refrigerated meals. Hazel heard about the bright students at Augsburg taking FIN-331C and suggested that they get their recommendation on whether or not to launch a line of frozen pasta meals. Lucky you! The new frozen line will require $180.000 in new equipment which will be depreciated straight-line to $30,000 over 3 years. The project will also Initially require $62,000 in Increased Inventory, $20,000 in Increased receivables and $32,000 in Increased payables, all of which will be reversed at the end of the project. Year 1 sales of the new frozen products is estimated to be 40.000 cases and is projected to grow 5.0% each year thereafter. Each case will sell for $12.50 and the cost to produce them is $8.25/case plus an additional $85.000 per year In Incremental fixed costs. The frozen products will also be allocated an additional $50.000 of existing fixed costs that represent their fair share of the facility's rent. Sales of the existing refrigerated products will be 100.000 cases next year. For the past 10 years, this product line had been consistently growing at 2.5% each year. However, with the addition of the frozen line, Hazel and Al expect there to be no growth In the refrigerated line. Each refrigerated case sells for $8.75 and their cost to produce is $4.25/case. All of the details related to this opportunity, including the marketing plans, equipment specifications, and volume, pricing and cost assumptions are based on a $25.000 market analysis that was prepared specifically for Hazel and Al. When they recelved the report last week, Al remarked that without the report's Information, the project could not happen. Hazel and Al plan to retire and close the business In 3 years. At that time, they expect to sell the new frozen line equipment for $30,000, as well as the existing refrigerated line's equipment for $40,000. Six months before they close down the business, they plan to move to Florida where they will rent an office for $2.300/month. Currently, they work out of their home and have no office rent expense. The company's tax rate is 20% and Hazel and Al have set the following threshholds for your analysis: Required Rate of Return: 12% Payback 24 months Average Accounting Return: 28% Profitability Index: 1.1 A Net Income Enter the annual line item totals for the calculation of the project's net Income in the grid below. Enter all amounts as a positive whole number and be sure to include all amounts used in calculating the project's net Income. Do not include an item on more than one line, e.g., show depreciation and tax related items separately from total costs. Year 1 Year 2 Year 3 Total Sales Total Costs Total Depreciation Total Tax Expense Total Net Income B. Cash Flow Enter the annual line item totals for the calculation of the project's cash flows in the grid below. Enter all cash Inflows as a positive whole number and all outflows as a negative and be sure to include all amounts used in calculating the project's cash flow. In addition, note the following explanations for each of the rows: Equipment-Related: Enter the net amount of any purchase, sale, depreciation depreciation tax shield and any other item which relates to equipment cash flows Product-Related: Enter the net amount of product sales, variable costs and fixed costs, but do not include any associated taxes or working capital. Taxes: Enter the taxes cash flow for all items except anything equipment-related, which should be included on the first row All Other: Enter any other cash flow Including working capital Year o Year 1 Year 2 Year 3 Equipment-Related Product-Related Taxes Pald All Other Cash Flow C. Complete the following table using the specified capital budgeting tools. Enter Payback and NPV as whole numbers and AAR. IRR and PI to 2 decimal places. Payback # of complete- partial months) Average Accounting Return (AAR) Net Present Value (NPV) Internal Rate of Return (IRR) Profitablility Index (Pl) % Calculated Value Decision Threshold Met? (Click to select) Click to select) Click to select) (Click to select) (Click to select ) Pastas-R-Us is a food manufacturer owned by Al Dente and his wife Hazel Nutt. Just yesterday they finalized details on a new line of frozen pasta meals to complement their existing line of refrigerated meals. Hazel heard about the bright students at Augsburg taking FIN-331C and suggested that they get their recommendation on whether or not to launch a line of frozen pasta meals. Lucky you! The new frozen line will require $180.000 in new equipment which will be depreciated straight-line to $30,000 over 3 years. The project will also Initially require $62,000 in Increased Inventory, $20,000 in Increased receivables and $32,000 in Increased payables, all of which will be reversed at the end of the project. Year 1 sales of the new frozen products is estimated to be 40.000 cases and is projected to grow 5.0% each year thereafter. Each case will sell for $12.50 and the cost to produce them is $8.25/case plus an additional $85.000 per year In Incremental fixed costs. The frozen products will also be allocated an additional $50.000 of existing fixed costs that represent their fair share of the facility's rent. Sales of the existing refrigerated products will be 100.000 cases next year. For the past 10 years, this product line had been consistently growing at 2.5% each year. However, with the addition of the frozen line, Hazel and Al expect there to be no growth In the refrigerated line. Each refrigerated case sells for $8.75 and their cost to produce is $4.25/case. All of the details related to this opportunity, including the marketing plans, equipment specifications, and volume, pricing and cost assumptions are based on a $25.000 market analysis that was prepared specifically for Hazel and Al. When they recelved the report last week, Al remarked that without the report's Information, the project could not happen. Hazel and Al plan to retire and close the business In 3 years. At that time, they expect to sell the new frozen line equipment for $30,000, as well as the existing refrigerated line's equipment for $40,000. Six months before they close down the business, they plan to move to Florida where they will rent an office for $2.300/month. Currently, they work out of their home and have no office rent expense. The company's tax rate is 20% and Hazel and Al have set the following threshholds for your analysis: Required Rate of Return: 12% Payback 24 months Average Accounting Return: 28% Profitability Index: 1.1 A Net Income Enter the annual line item totals for the calculation of the project's net Income in the grid below. Enter all amounts as a positive whole number and be sure to include all amounts used in calculating the project's net Income. Do not include an item on more than one line, e.g., show depreciation and tax related items separately from total costs. Year 1 Year 2 Year 3 Total Sales Total Costs Total Depreciation Total Tax Expense Total Net Income B. Cash Flow Enter the annual line item totals for the calculation of the project's cash flows in the grid below. Enter all cash Inflows as a positive whole number and all outflows as a negative and be sure to include all amounts used in calculating the project's cash flow. In addition, note the following explanations for each of the rows: Equipment-Related: Enter the net amount of any purchase, sale, depreciation depreciation tax shield and any other item which relates to equipment cash flows Product-Related: Enter the net amount of product sales, variable costs and fixed costs, but do not include any associated taxes or working capital. Taxes: Enter the taxes cash flow for all items except anything equipment-related, which should be included on the first row All Other: Enter any other cash flow Including working capital Year o Year 1 Year 2 Year 3 Equipment-Related Product-Related Taxes Pald All Other Cash Flow C. Complete the following table using the specified capital budgeting tools. Enter Payback and NPV as whole numbers and AAR. IRR and PI to 2 decimal places. Payback # of complete- partial months) Average Accounting Return (AAR) Net Present Value (NPV) Internal Rate of Return (IRR) Profitablility Index (Pl) % Calculated Value Decision Threshold Met? (Click to select) Click to select) Click to select) (Click to select) (Click to select )