Answered step by step

Verified Expert Solution

Question

1 Approved Answer

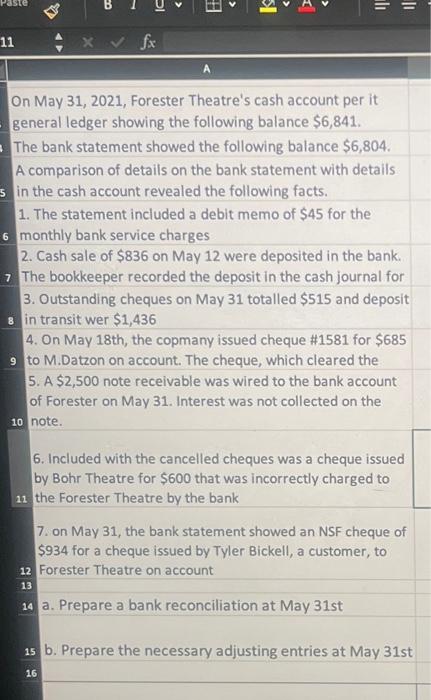

Paste 11 IC A > al 10 On May 31, 2021, Forester Theatre's cash account per it general ledger showing the following balance $6,841. The

Paste 11 IC A > al 10 On May 31, 2021, Forester Theatre's cash account per it general ledger showing the following balance $6,841. The bank statement showed the following balance $6,804. A comparison of details on the bank statement with details s in the cash account revealed the following facts. 1. The statement included a debit memo of $45 for the 6 monthly bank service charges 2. Cash sale of $836 on May 12 were deposited in the bank. 7 The bookkeeper recorded the deposit in the cash journal for 3. Outstanding cheques on May 31 totalled $515 and deposit 8 in transit wer $1,436 4. On May 18th, the copmany issued cheque #1581 for $685 9 to M.Datzon on account. The cheque, which cleared the 5. A $2,500 note receivable was wired to the bank account of Forester on May 31. Interest was not collected on the 10 note. 6. Included with the cancelled cheques was a cheque issued by Bohr Theatre for $600 that was incorrectly charged to 11 the Forester Theatre by the bank 7. on May 31, the bank statement showed an NSF cheque of $934 for a cheque issued by Tyler Bickell, a customer, to Forester Theatre on account 12 13 14 a. Prepare a bank reconciliation at May 31st 15 b. Prepare the necessary adjusting entries at May 31st 16

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started