Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paste BIU- - - A. 3 Merge & Center. . $ - % 2 0 898 00 Clipboard Font Conditional Format as Formatting Table Styles

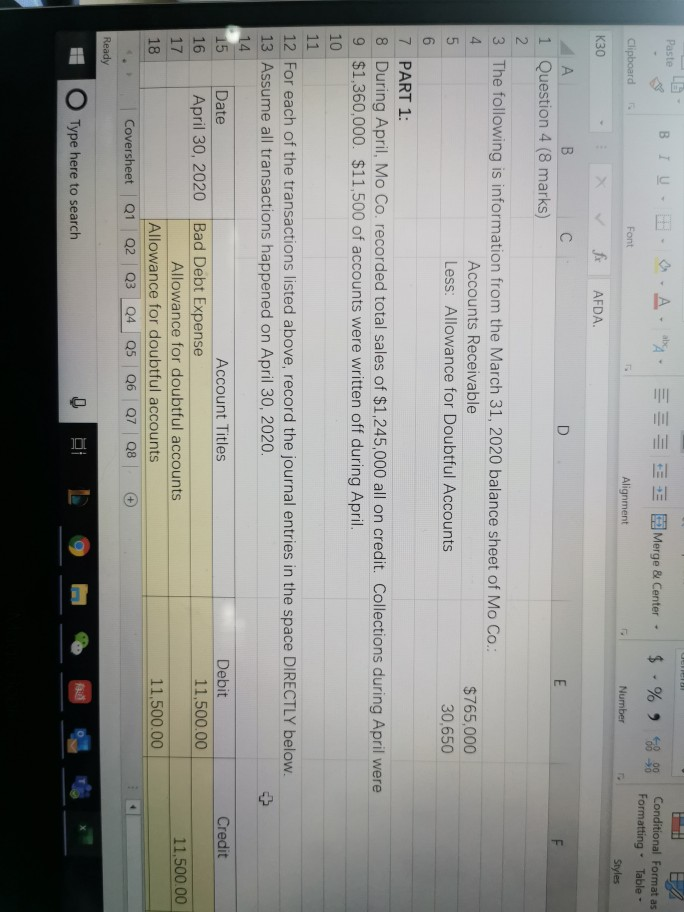

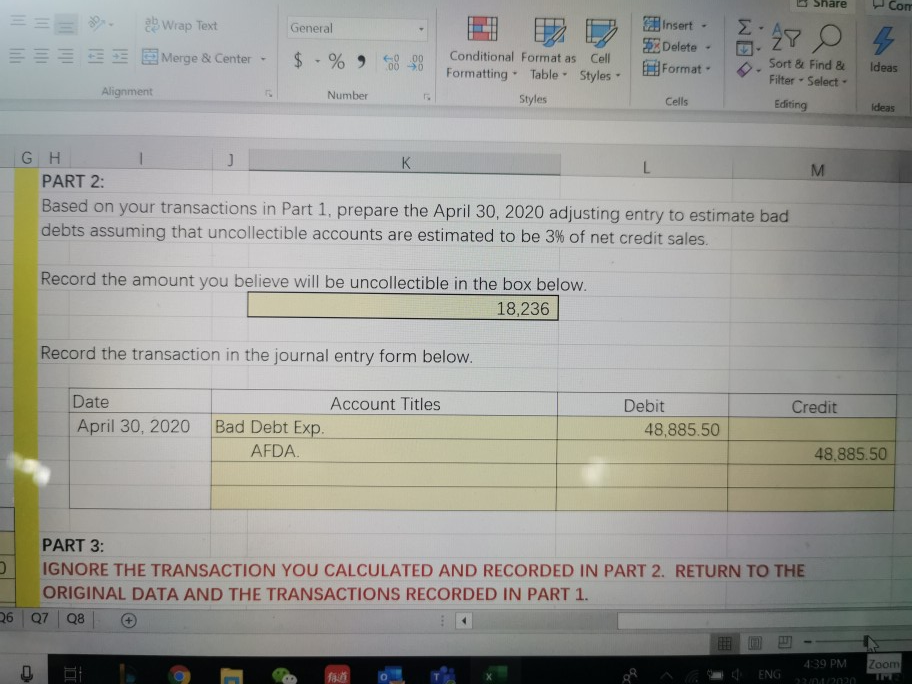

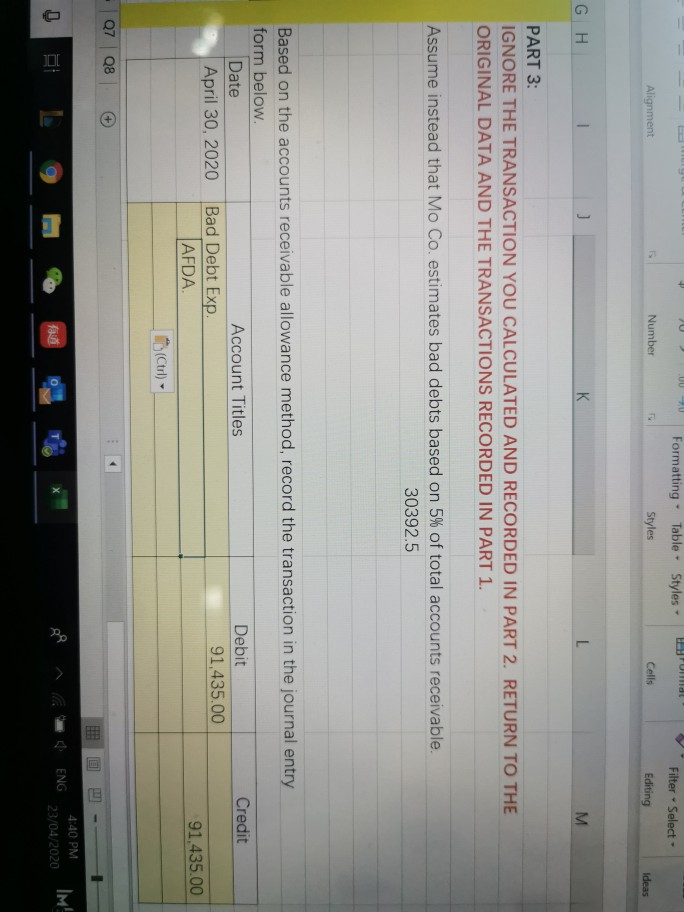

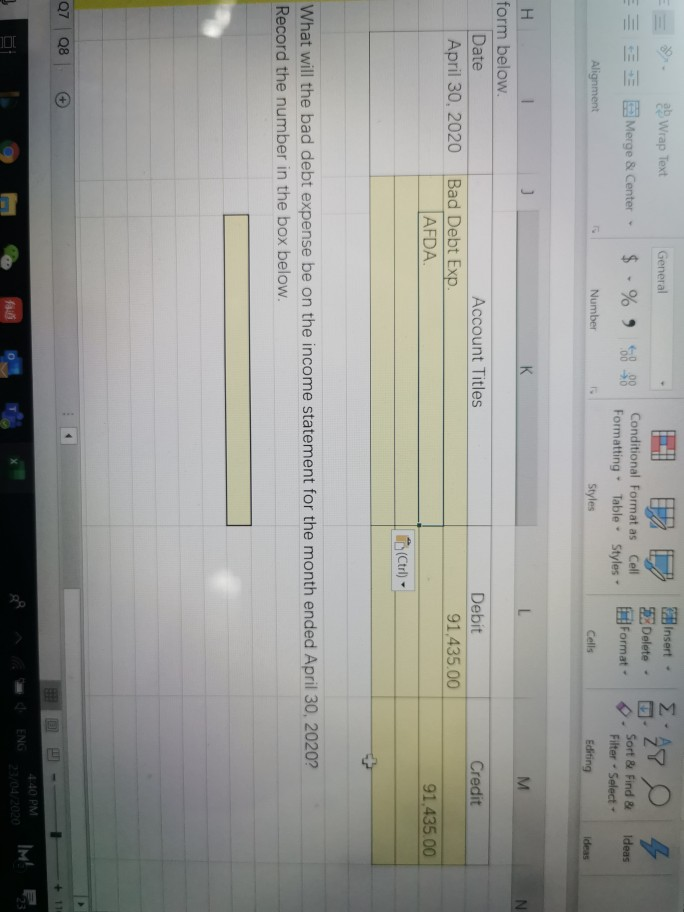

Paste BIU- - - A. 3 Merge & Center. . $ - % 2 0 898 00 Clipboard Font Conditional Format as Formatting Table Styles Alignment Number AFDA. K30 X ft Bc. 1 Question 4 (8 marks) D 3 The following is information from the March 31, 2020 balance sheet of Mo Co.: Accounts Receivable Less: Allowance for Doubtful Accounts $765,000 30.650 7 PART 1: 8 During April, Mo Co. recorded total sales of $1,245,000 all on credit. Collections during April were 9 $1,360,000. $11,500 of accounts were written off during April. 10 11 Credit 12 For each of the transactions listed above, record the journal entries in the space DIRECTLY below. 13 Assume all transactions happened on April 30, 2020. 14 15 Date Account Titles Debit April 30, 2020 Bad Debt Expense 11,500.00 17 Allowance for doubtful accounts 18 Allowance for doubtful accounts 11,500.00 Coversheet Q1 Q2 Q3 04 05 06 07 08 Ready 11,500.00 O Type here to search = = P 2 General insert 2 Wrap Text Merge & Center 48 4 33 $ -% 9 00 Conditional Format as Cell Formatting Table - Styles 52 Delete - Format Ideas Sort & Find & Filter - Select - Editing Alignment Number Styles Cells Ideas G H I PART 2: Based on your transactions in Part 1, prepare the April 30, 2020 adjusting entry to estimate bad debts assuming that uncollectible accounts are estimated to be 3% of net credit sales. Record the amount you believe will be uncollectible in the box below 18,236 Record the transaction in the journal entry form below. Credit Date April 30, 2020 Account Titles Bad Debt Exp. AFDA Debit 48,885.50 48.885.50 PART 3 IGNORE THE TRANSACTION YOU CALCULATED AND RECORDED IN PART 2. RETURN TO THE ORIGINAL DATA AND THE TRANSACTIONS RECORDED IN PART 1. 26 27 28 439 PM Zoom TIN fan ENG 3 0 0 0 Formatting Styles EL FUM Table Styles Filter Select Editing Alignment Number Cells Ideas GH PART 3 IGNORE THE TRANSACTION YOU CALCULATED AND RECORDED IN PART 2. RETURN TO THE ORIGINAL DATA AND THE TRANSACTIONS RECORDED IN PART 1. Assume instead that Mo Co. estimates bad debts based on 5% of total accounts receivable. 30392.5 Based on the accounts receivable allowance method, record the transaction in the journal entry form below. Date Account Titles Debit Credit April 30, 2020 Bad Debt Exp. 91,435.00 AFDA 91.435.00 (Ctrl) - | 07 | 08 | 4:40 PM M 23/04/2020 IM EEP General Wrap Text Merge & Center - insert 22 Delete - Format E. As 5.27 O $ . % 9 1 D Conditional Format as Cell Formatting Table Styles Styles 8 Sort & Find & Filter -Select- Ideas Alignment Number Cells Editing Ideas M H form below. Date April 30, 2020 Credit Account Titles Bad Debt Exp. AFDA Debit 91.435.00 91.435.00 (Ctrl) What will the bad debt expense be on the income statement for the month ended April 30, 2020? Record the number in the box below. 07 08 4:40 PM 0422020 IM23 g ENG

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started