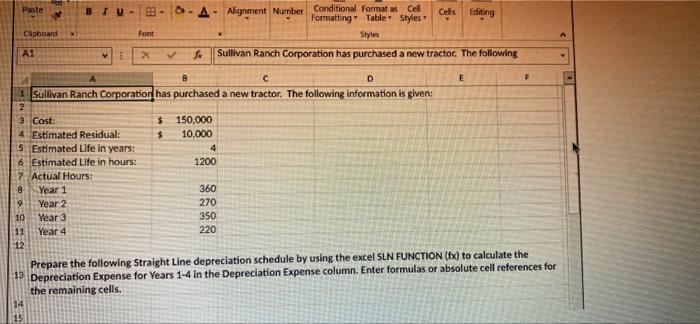

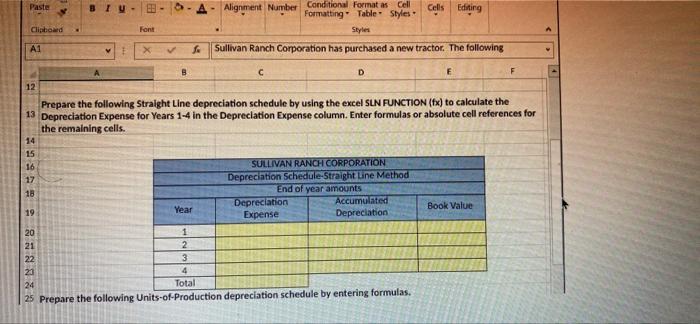

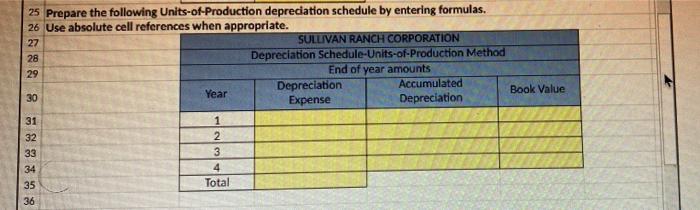

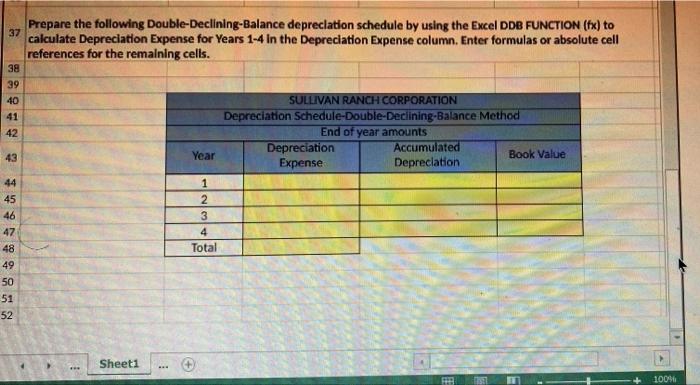

Paste BIU- Clipboard Font Alignment Number Conditional Formats Cell Cells Editing Formatting Table Styles Styles Sullivan Ranch Corporation has purchased a new tractor. The following A1 so A E B D 1 Sullivan Ranch Corporation has purchased a new tractor. The following information is given: 2 3 Cost: $ 150,000 4 Estimated Residual: $ 10,000 5 Estimated Life in years: 4 6 Estimated Life in hours: 1200 7 Actual Hours: 8 Year 1 360 Year 2 270 10 Year 3 350 11 Year 4 220 12 Prepare the following Straight Line depreciation schedule by using the excel SLN FUNCTION (Ex) to calculate the 13 Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. INOO 14 15 Paste BIU A Cells Editing Alignment Number Conditional Format as Cell Formatting Table Styles Styles Clipboard Font A1 X Sullivan Ranch Corporation has purchased a new tractor. The following D E F 12 Prepare the following Straight Line depreciation schedule by using the excel SLN FUNCTION (fx) to calculate the 13 Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. 14 15 16 SULLIVAN RANCH CORPORATION 17 Depreciation Schedule Straight Line Method 18 End of year amounts Depreciation Accumulated 19 Year Book Value Expense Depreciation 20 1 21 2 22 3 21 4 24 Total 25 Prepare the following Units-of-Production depreciation schedule by entering formulas. 25 Prepare the following Units-of-Production depreciation schedule by entering formulas. 26 Use absolute cell references when appropriate. 27 SULLIVAN RANCH CORPORATION 28 Depreciation Schedule-Units-of-Production Method 29 End of year amounts Depreciation Accumulated 30 Year Book Value Expense Depreciation 31 1 32 2 33 3 34 4 35 Total 36 Prepare the following Double-Declining-Balance depreciation schedule by using the Excel DDB FUNCTION (fx) to 37 calculate Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. 38 39 40 SULLIVAN RANCH CORPORATION 41 Depreciation Schedule-Double-Declining-Balance Method 42 End of year amounts Depreciation Accumulated Year Book Value Expense Depreciation 44 1 45 2 46 3 47 48 Total 49 50 51 52 Sheet1 100%