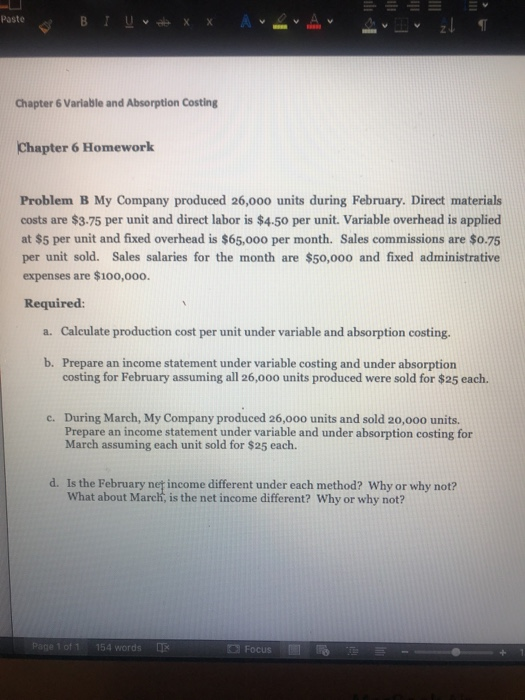

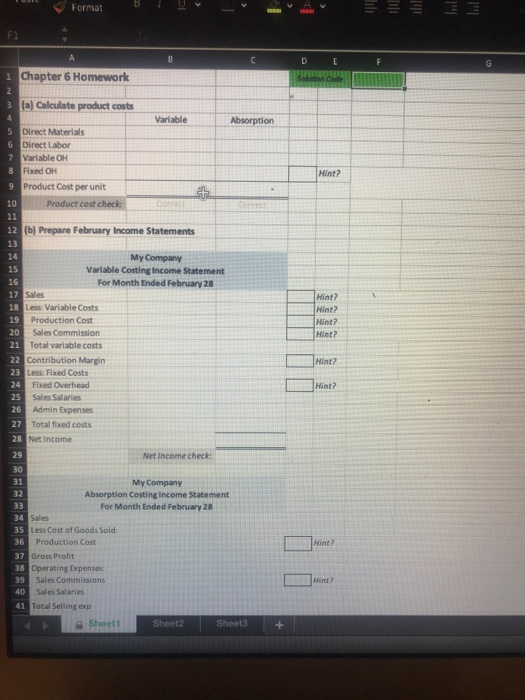

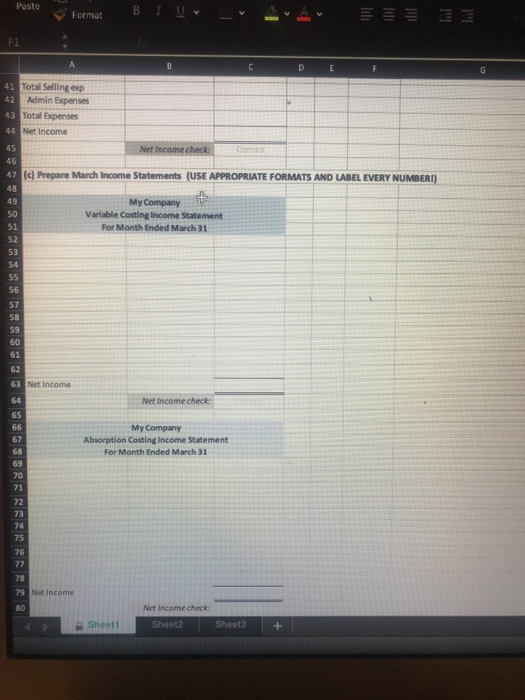

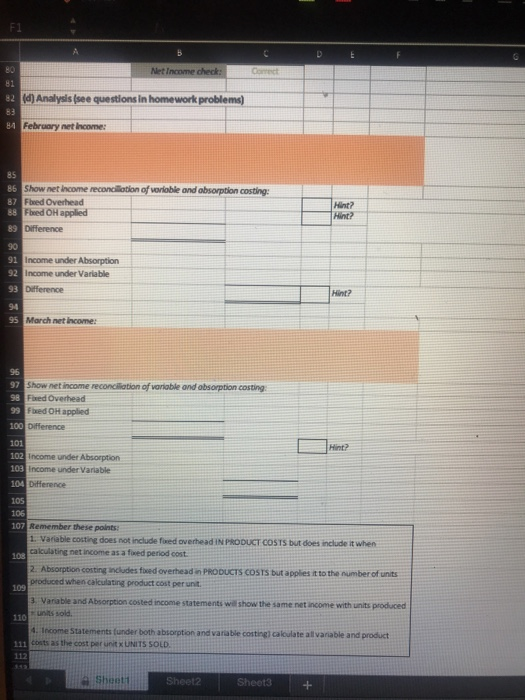

Paste Chapter 6 Variable and Absorption Costing Chapter 6 Homework Problem B My Company produced 26,000 units during February. Direct materials costs are $3-75 per unit and direct labor is $4.50 per unit. Variable overhead is applied at $5 per unit and fixed overhead is $65,000 per month. Sales commissions are $o.75 per unit sold. Sales salaries for the month are $50,ooo and fixed administrative expenses are $100,00o. Required a. Calculate production cost per unit under variable and absorption costing. b. Prepare an income statement under variable costing and under absorption costing for February assuming all 26,000 units produced were sold for $25 each. During March, My Company produced 26,oo0 units and sold 20,0o0 units. Prepare an income statement under variable and under absorption costing for March assuming each unit sold for $25 each. c. Is the February net income different under each method? Why or why not? What about March, is the net income different? Why or why not? d. 1 of 1 154 words Focus mg Format BL F1 Chapter 6 Homework (a) Calculate product costs Direct Materiails Variable 6 Direct Labor Variable OH Fixed OH Product Cost per unit Hint? Product cost chec (b) Prepare February Income Statements My Company Variable Costing Income Statement For Month Ended February 28 Hint? Hint? Hint? Hint? 18 Less: Variable Costs Production Cost Sales Commission Total variable costs Hint? Hint? Contribution Margin 24 Fixed Overhead Sales Salaries Admin Expenses Total fixed costs Net Income Net Income check 31 My Company Absorption Costing Income State For Month Ended February 28 Less Cost of Goods Sold Production Cost Hint? Gross Profit Operating Expenses Hint ? Sales Commissions 41 a Sheett Sheet2 Paste Format Total Selling exp 42 Admin Expenses Total Expenses Net Income 43 45 46 47 48 49 S0 51 52 53 54 S5 56 (c) Prepare March Income Statements (USE APPROPRIATE FORMATS AND LABEL EVERY NUMBERI My Company Variable Costing Income Statement For Month Ended March 31 S8 59 60 61 62 63 64 65 Net Income Net Income check 67 68 My Company Absorption Costing Income Statement For Month Ended March 31 70 71 72 73 74 75 76 78 79 80 Net Income Net Income check: e Sheett d) Analysis (see questions in homework problems) Febraary net Income Show net Income reconciliotion of vorioble and absorption costing Fbed Overhead Fbeed OH applied 87 Hint? Income under Absorption Income under Variable Difference Hint? March net income: Show net income reconciliation of variable and absorption costing Fixed Overhead Fixed OH applied Income under Absorption ncome under Variable Remember these points 1. Variable costing does not include fxed overhead IN PRODUCT COSTS but does include it when cakculating net income as a fwed period cost 2 Absorption costing ancludes fwed overhead in PRODUCTS COSTS but applies it to the number of units produced when calculating product cost per unt Varable and Absorption costed income statements will show the same net income with units produced r units sold. t. Income Statements tunder both absorption and varia ble costing) caloulate all variable and product Costs as the cost per untx UNITS SOLD. Sheet2 Sheet3 +