Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paste Insert Draw Design Layout q , A Font Paragraph Ab Y Comments Editing Share Adjusting Entries and Financial Statements Use the following information to

Paste

Insert

Draw

Design

Layout

A

Font

Paragraph

Ab

Y

Comments

Editing

Share

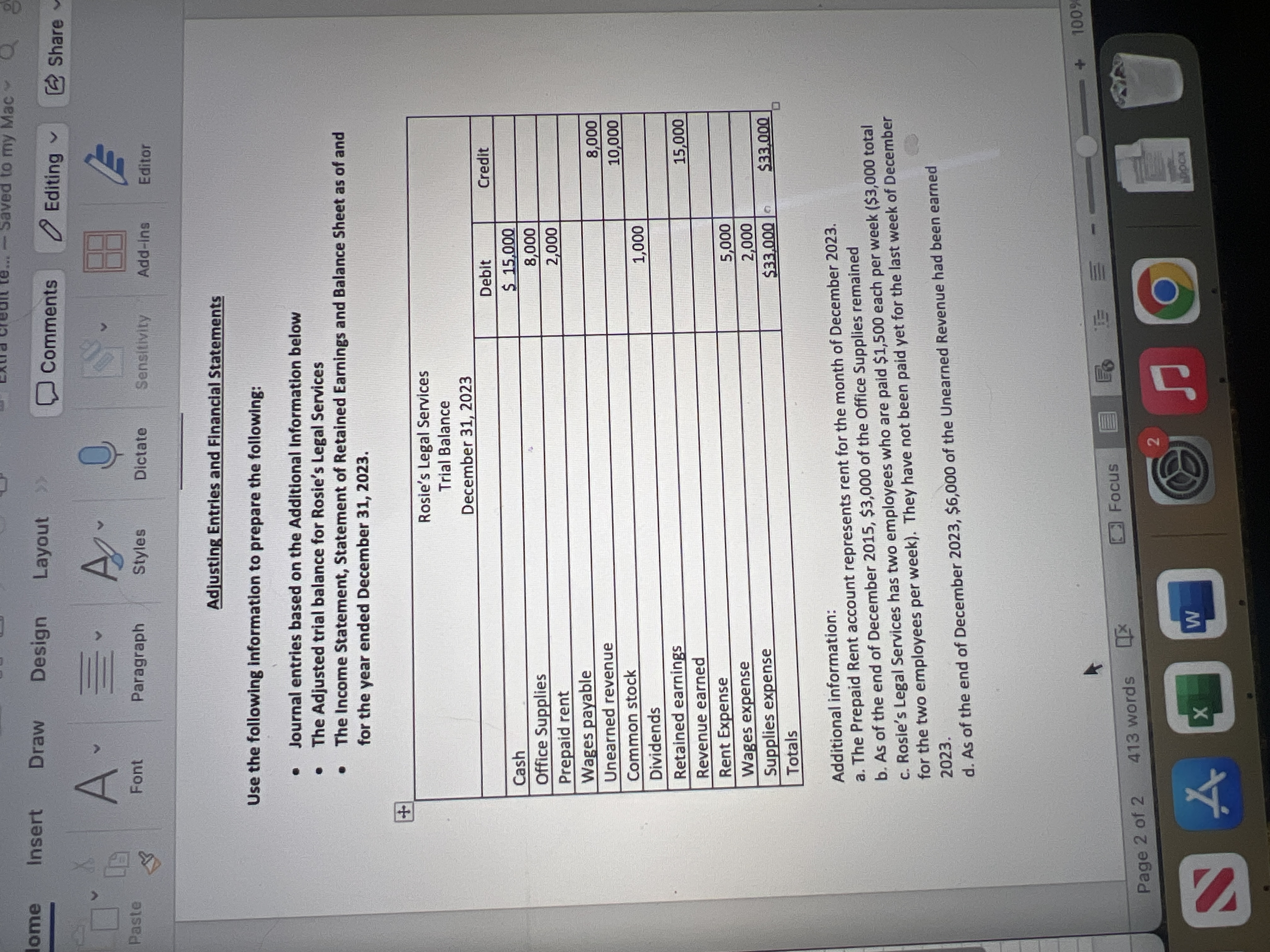

Adjusting Entries and Financial Statements

Use the following information to prepare the following:

Journal entries based on the Additional Information below

The Adjusted trial balance for Rosie's Legal Services

The Income Statement, Statement of Retained Earnings and Balance Sheet as of and for the year ended December

tabletableRosies Legal ServicesTrial BalanceDecember CashDebit,CreditOffice Supplies,Prepaid rent,Wages payable,Unearned revenue,,Common stock,,DividendsRetained earnings,Revenue earned,,Rent Expense,,Wages expense,Supplies expense,Totals$

Additional information:

a The Prepaid Rent account represents rent for the month of December

b As of the end of December $ of the Office Supplies remained

c Rosie's Legal Services has two employees who are paid $ each per week total for the two employees per week They have not been paid yet for the last week of December

d As of the end of December $ of the Unearned Revenue had been earned

Page of

words

Focus

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started