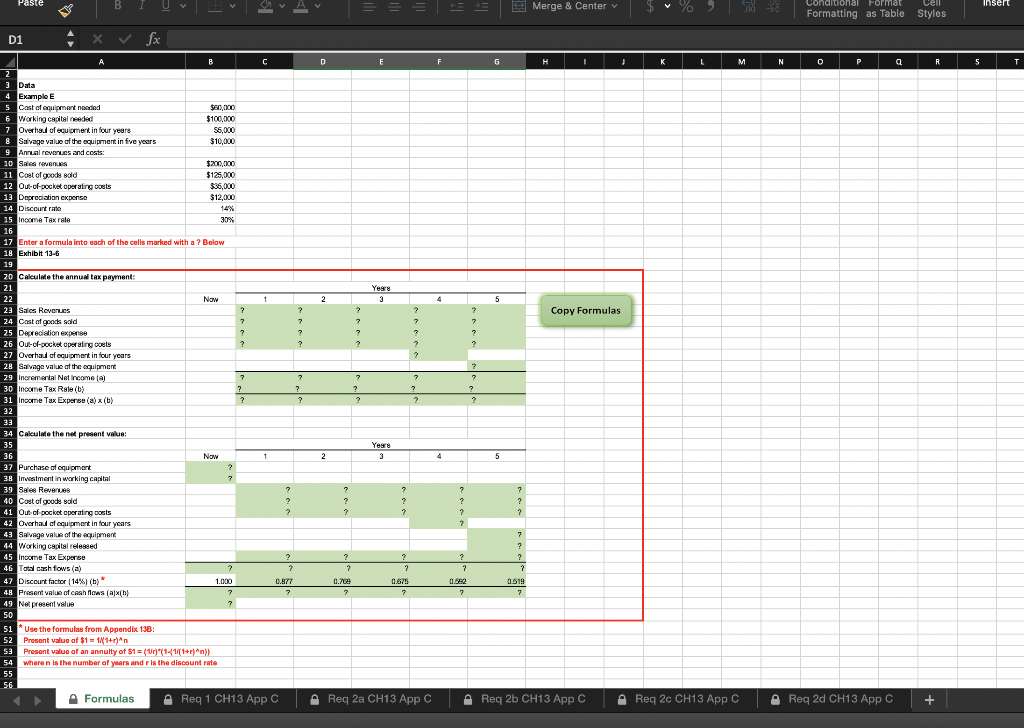

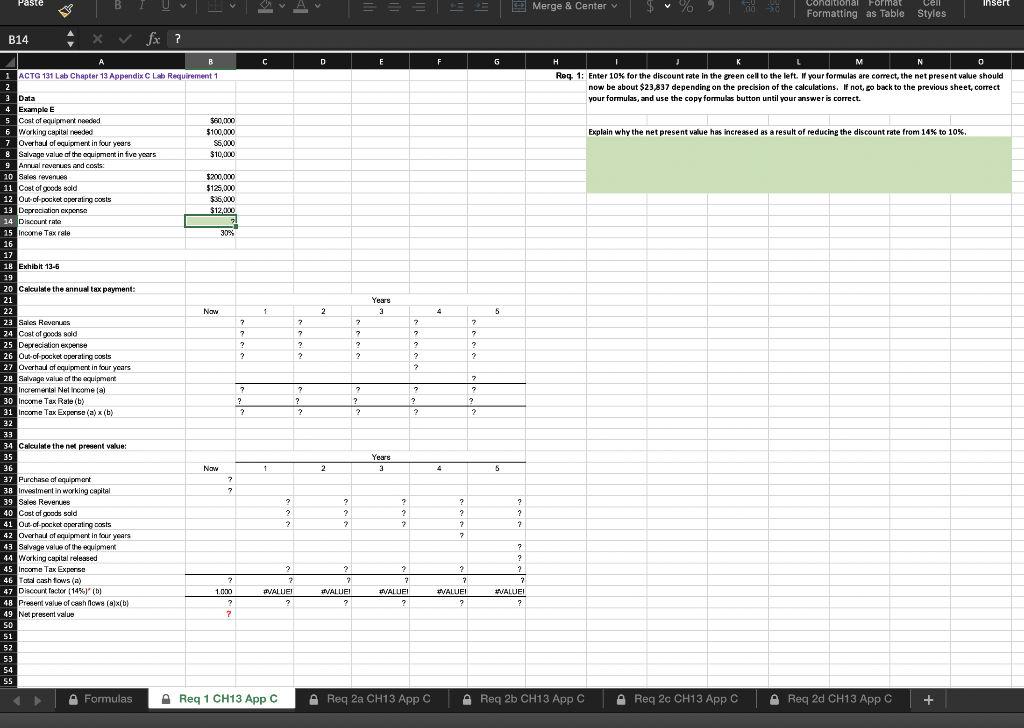

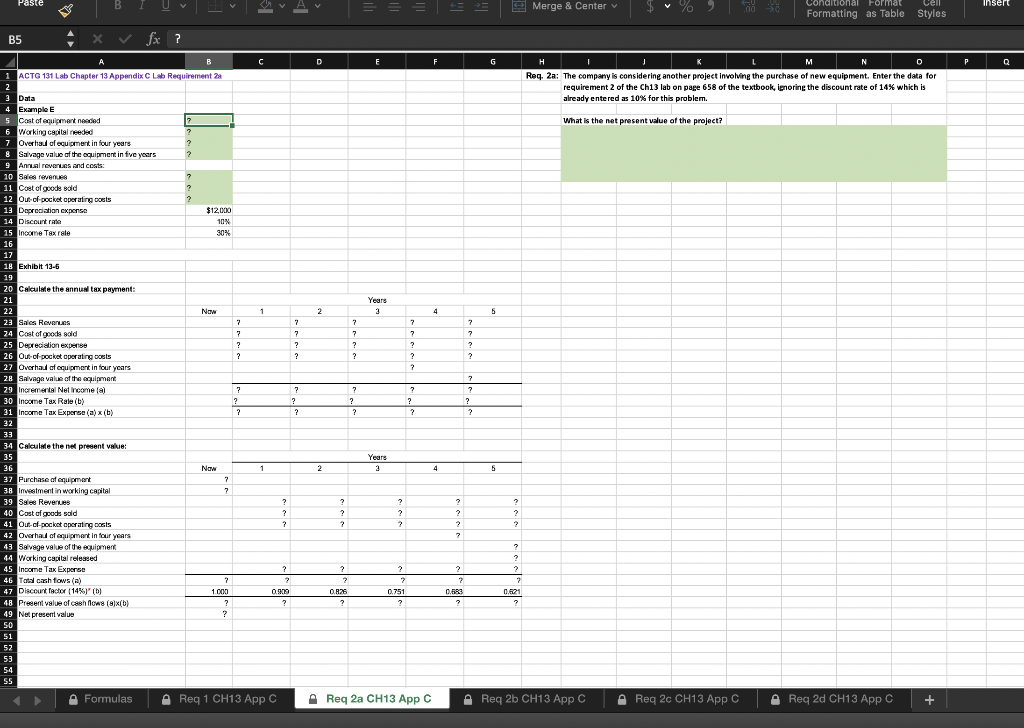

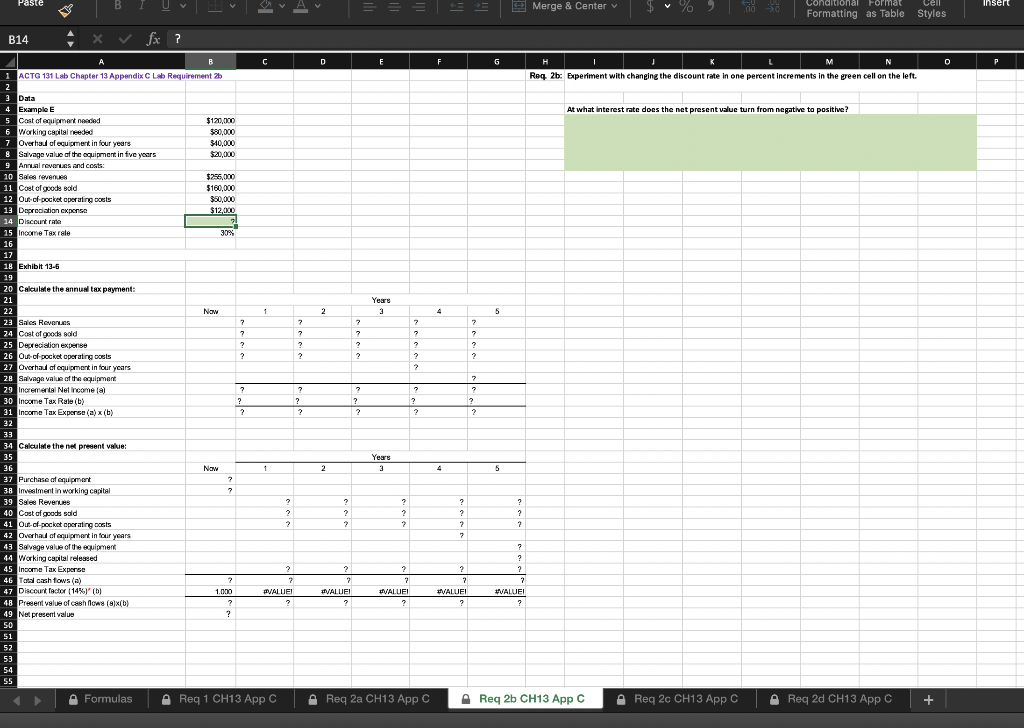

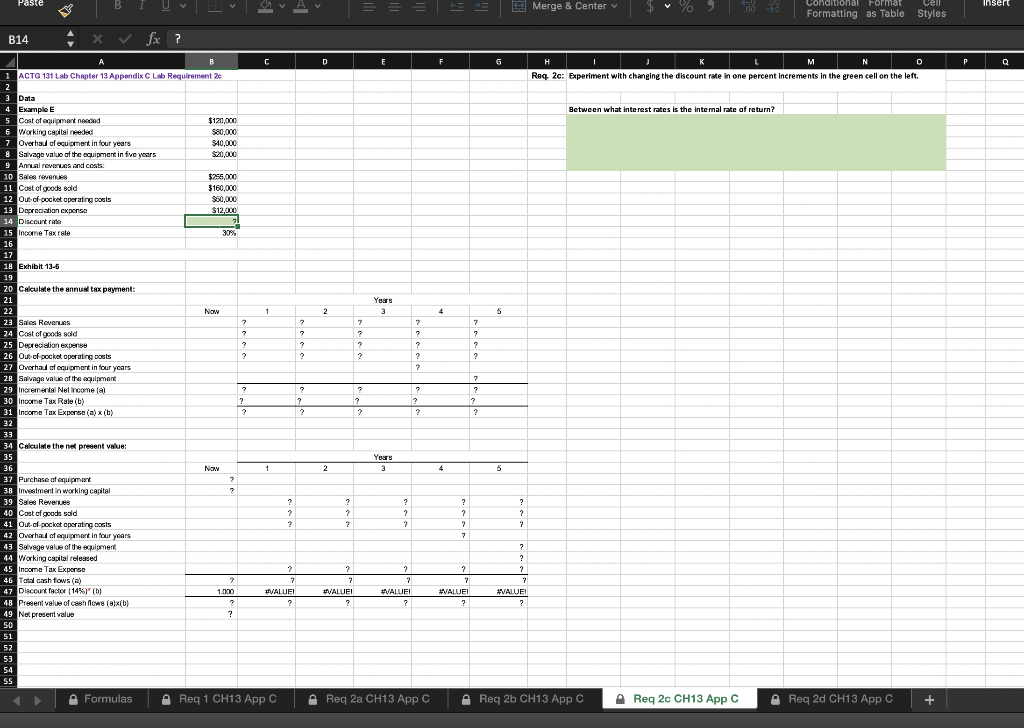

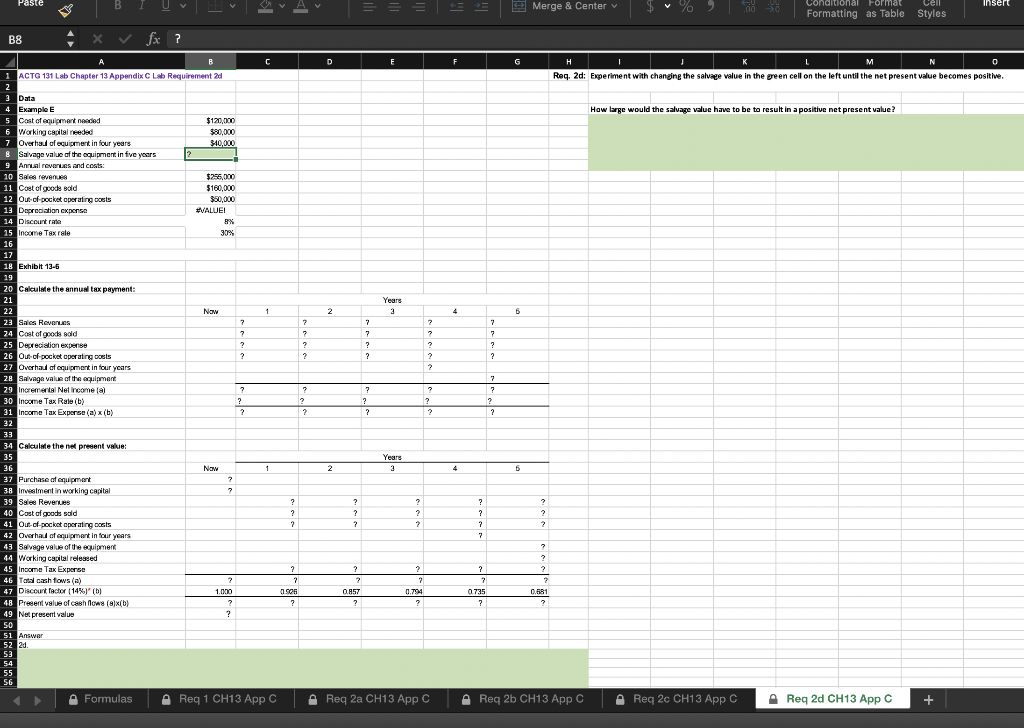

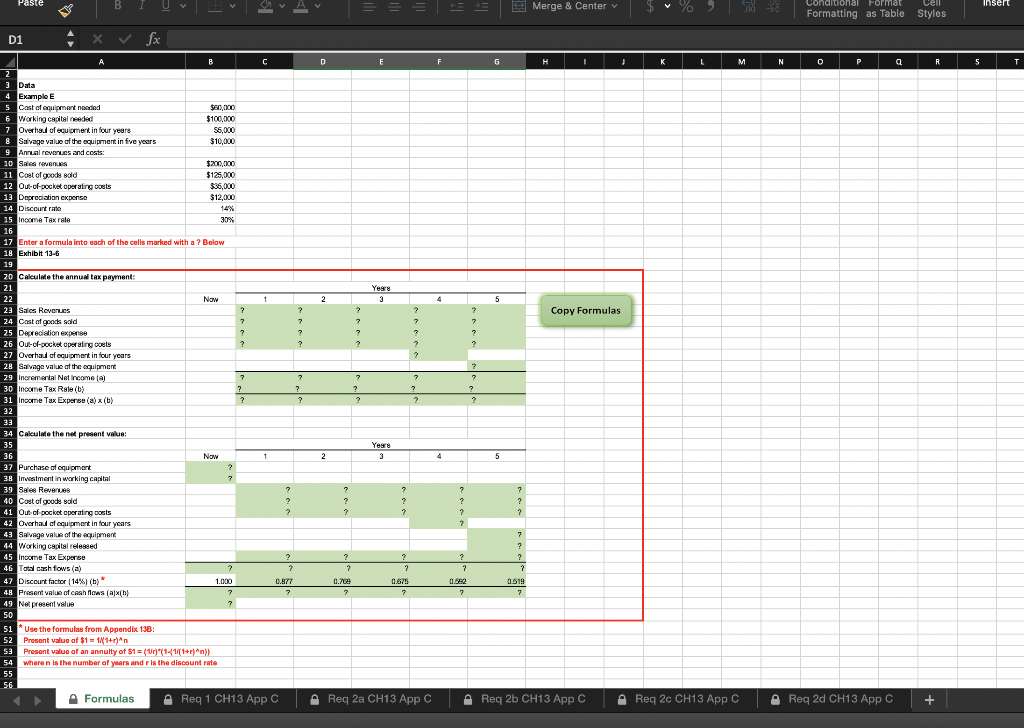

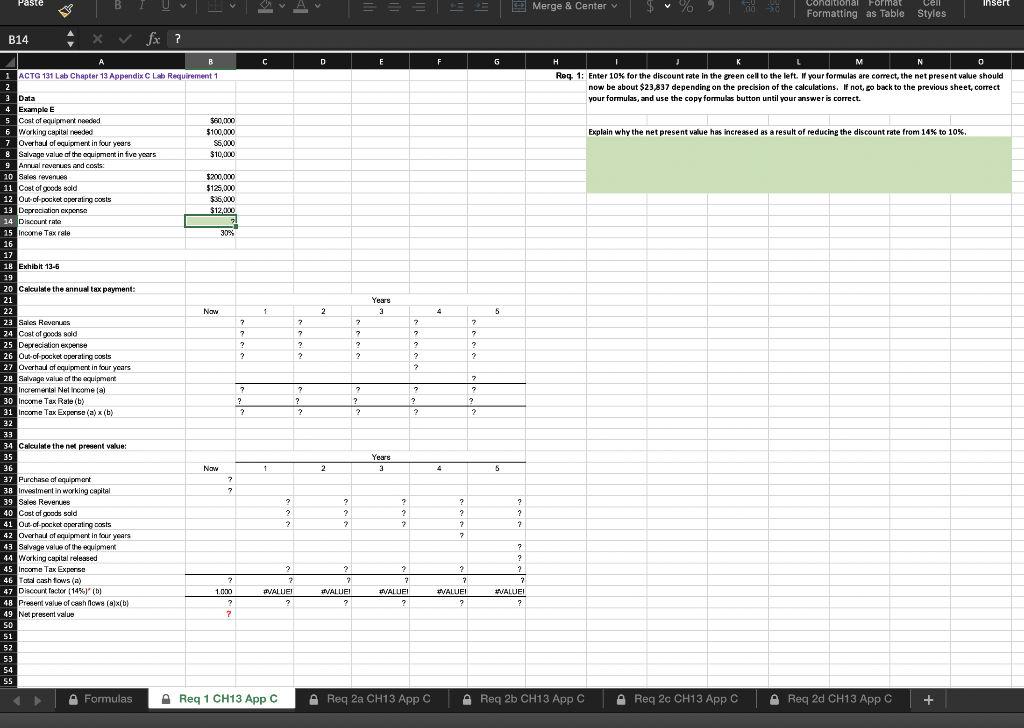

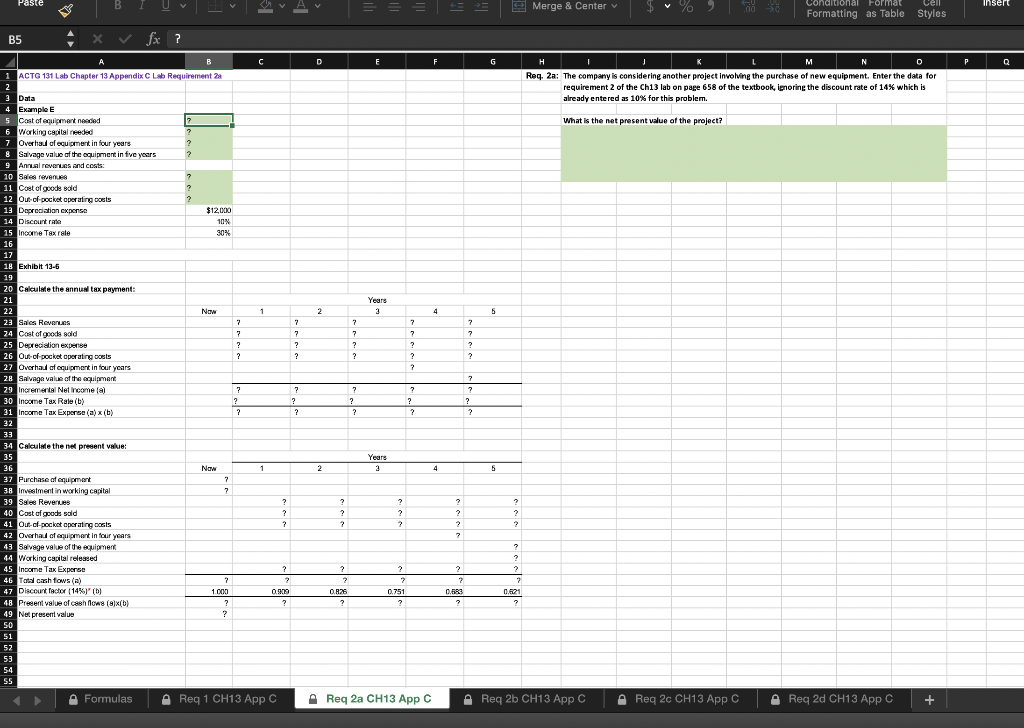

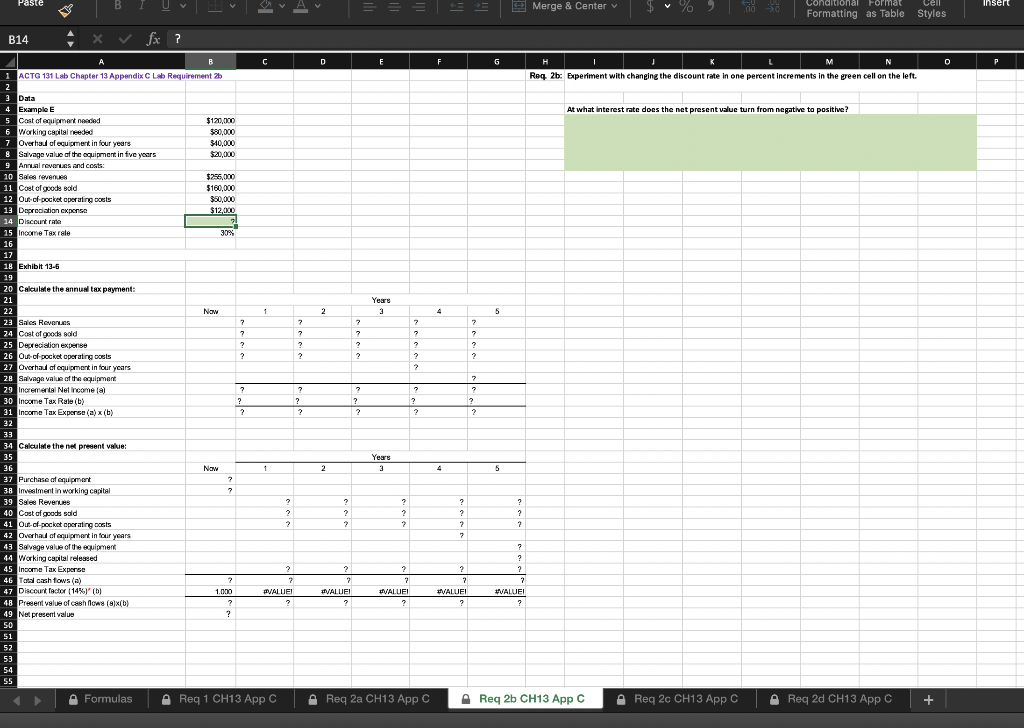

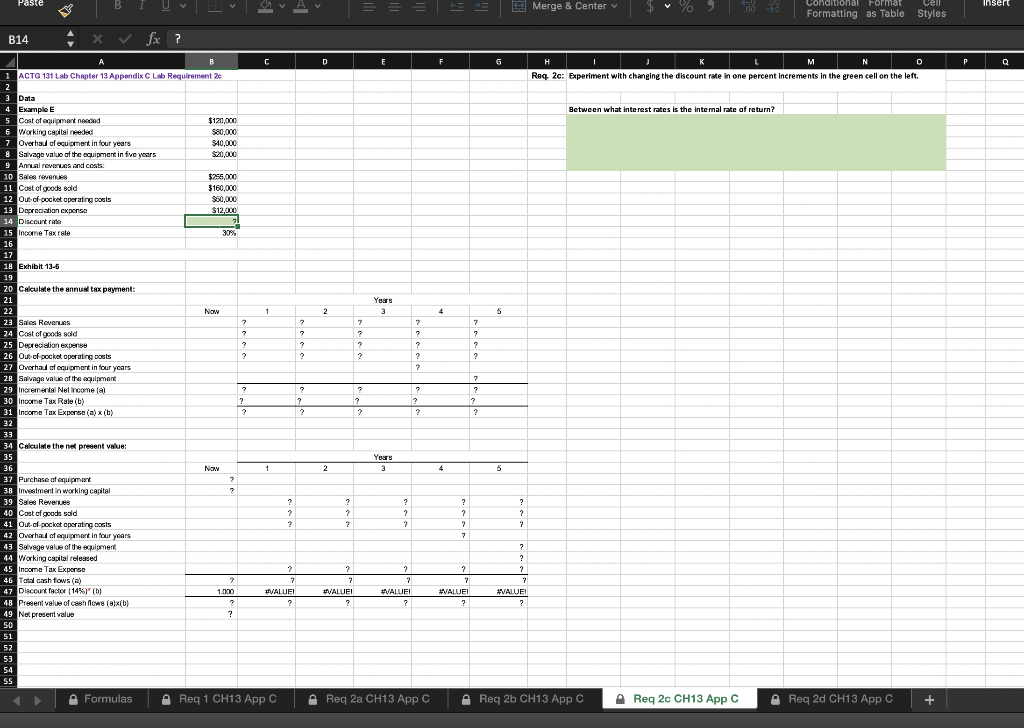

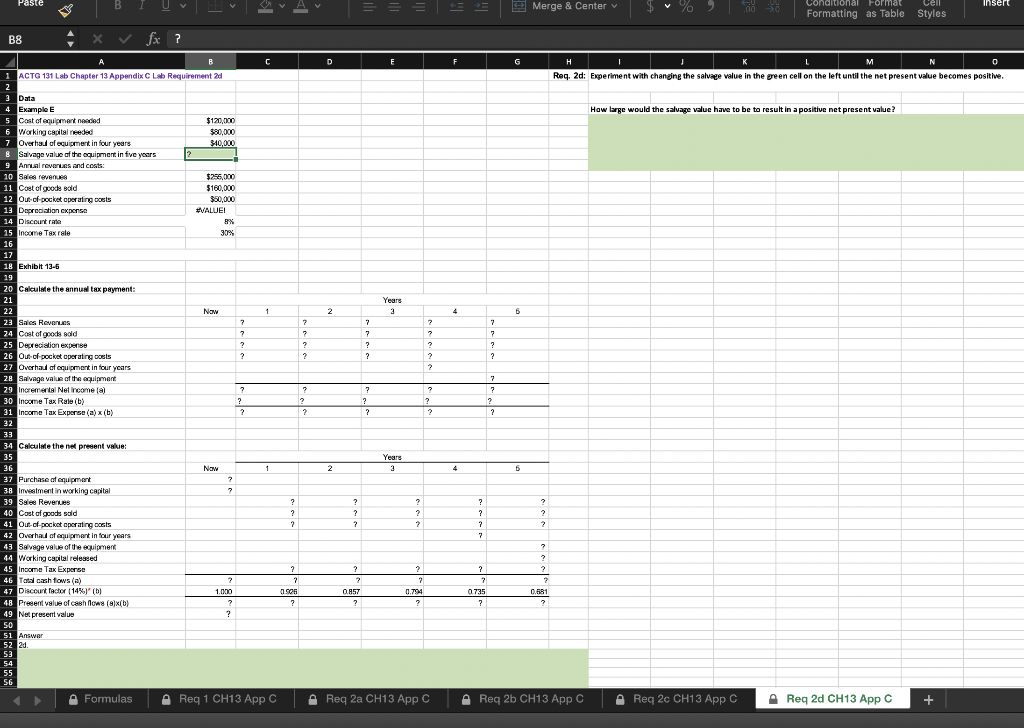

Paste insert Merge & Center = = = = = Conditional Format Formatting as Table Cell Styles D1 A B C E F H I L M N O P a R 5 T Years 2 5 2 ? 7 ? 2 7 Copy Formulas ? 7 ? 7 ? ? ? ? ? 2 ? 7 7 7 ? ? ? 3 Data 4 Example 5 Cast ofcoulement needed $50,00 6 Working capital needed $100,000 7 Overhaul of equipment in four years S6,000 Salvage value of the equipment in five years $10,000 9 Annual revenues and costs: 10 Sales reven $200,000 11 coat of goods sold $125,000 12 Out-of-pocket operating costs $36,000 13 Depreciation expense $12,000 14 Discount rate 14% 15 Income Tax rale 30% 16 17 Enter a formula into each of the cells marked with a ? Below 18 Exhibit 13-6 19 20 Calculate the annual tax payment: 21 22 Now 1 23 Sales Revenues ? 24 Cost of goods sold 7 25 Decreation expertise ? 26 Out-of-poche operating costs ? 27 Overhaul of equipment in four years 28 Salvage value of the equipment 29 Incremental Net Income la 7 30 Income Tax Rate() ? 31 Income Tax Expense (a) (b) ? 32 33 34 Calculate the nel present value: 35 36 Now 1 37 Purchase of equipment ? 38 Investment in working capital 7 39 Sales Revenue ? 40 Cost of goods sold ? Out of pocket operating costs 2 42 Overhaul of guipment in four years 43 Salvage value of the equipment 44 Working capital released 45 Income Tax Expense ? 46 Total cash fows(a) 2 * 47 Discount factor (14%) (b) 1.000 0.977 48 Present value of cash flows (alb) 7 2 49 Net present value ? 50 51 Use the formulas from Appendix 138: 52 Prosent value of $1 = 1/(1+r)^n 53 Present value of an annuity of $1 = (1/1-1/(1+r)^n)) 54 where n is the number of years and is the discount rate 55 56 Formulas Req 1 CH13 App C ? ? ? 2 ? Year 3 2 4 5 ? ? 2 2 2 7 ? ? 7. ? ? ? 2 ? ? 7 ? ? 2 0.519 7 2 0.70 7 0.678 7 7 Req 2a CH13 App C Req 2b CH13 App C A Req 2c CH13 App C Req 2d CH13 App C + Paste B I Merge & Center v = = = = = Insert Conditional Format Formatting as Table Cell Styles B14 fx ? C D E F M 0 H Req. 1: Enter 10% for the discount rate in the green cell to the left. If your formulas are correct, the net present value should now be about $23,837 depending on the precision of the calculations. If not, go back to the previous sheet, correct your formulas, and use the copy formulas button until your answer is correct. Explain why the net present value has increased as a result of reducing the discount rate from 14% to 10%. Yere 3 1 2 4 5 2 7 ? ? ? ? ? ? 7 ? ? 7 ? 3 ? ? ? 2 ? ? ? ? A ACTG 131 Lab Chapter 13 Appendix C Lab Requirement 1 2 3 Data 4 Example E 5 Cost of equipment needed $80,000 6 Working capitalreded $100,000 7 Overhaul al equipment in four years $6,000 8 Salvage value of the equipment in five years $10,000 9 Annual revenues and costs: 10 Sales revenues $200,000 11 Cost of goods sold $125,000 12 Out-of-pocket operating costs $36,000 13 Depreciation expensa $12.000 14 Discount rate 15 Income Tax rate 30% 16 17 18 Exhibit 13-0 19 20 Calculate the annual tax payment: 21 22 Now 23 Sales Revenues 24 Cost of goods add 25 Depreciation experise 26 Our cf-pocket operating costs 27 Overhaul of equipment in four years 28 Salvage value of the equipment 29 Incremental Net Income la) 30 Income Tax Rale(b) 31 Income Tax Experse(a) (b) 32 33 34 Calculate the ne present et 35 36 Now 37 Purchase of equipment 7 38 Investment in working capital ? 39 Sales Revenues 40 Cost of goods sold 41 Out-of-pocket operating costs 42 Overhaul of equipment in four years 43 Selvage value of the equipment 44 Working capital released 45 Income Tax Expre 46 Total cash fows (a) 47 Discount factor (14%) (b) 1.000 48 Precent value of cash flows (8)x(b) ? 49 Net present value 7 SO 51 52 53 54 55 ? 2 ? ? ? ? ? ? ? ? 2 ? 2 ? ? 2 ? Years 3 1 2 4 5 ? ? ? 2 ? ? 2 2 7 ? ? ? 2 2 2 ? ? 7 ? ? 2 ? WALUEI ? 2 2 2 #VALUEI ? ? VALUEI ? PALLEI ? WALUEI ? Formulas Req 1 CH13 App C Req 2a CH13 App C Req 2b CH13 App C Req 2c CH13 App C Req 2d CH13 App C + Paste BIU insert Merge & Center = = = = = Conditional Format Formatting as Table Cell Styles B5 fx ? C D E F G H 0 P L M N Req. 2a: The company is considering another project involving the purchase of new equipment. Enter the data for requirement 2 of the Ch13 lab on page 658 of the textbook, ignoring the discount rate of 14% which is already entered as 10% for this problem. What is the net present value of the project? Years 3 1 2 4 5 7 7 ? ? 7 7 ? ? 7 7 ? ? 7 7 ? ? ? 7 7 ? ? A B ACTG 131 Lab Chapter 13 Appendix C Lab Requirement 28 2 3 Data 4 Example E 5 Cost of equipment needed 2 6 Working capital medied ? 7 Overhaul al equipment in four years ? 8 Salvage value of the equipment in five years 2 9 Annual revenues and costs: 10 Se revenue 11 Cost of goods sold ? 12 Out-of-pocket operating costs 2 13 Depreciation expense $12,000 14 Discount rate 10% 15 Income Tax rate 30% 16 17 18 Exhibit 13-6 19 20 Calculate the annual tax payment: 21 22 Now 23 Sales Revenues 24 Cost of goods add 25 Depreciation experise 26 Our cf-pocket operating costs 27 Overhaul of equipment in four years 28 Salvage value of the equipment 29 Incremental Net Income la) 30 Income Tax Rale(b) 31 Income Tax Experse(a) (b) 32 33 34 Calculate the ne present et 35 36 Now 37 Purchase of equipment 7 38 Investment in working capital 7 39 Sales Revenues 40 Cost of goods sold 41 Out-of-pocket operating costs 42 Overhaul of equipment in four years 43 Selvage value of the equipment 44 Working capital released 45 Income Tax Expre 46 Total cash fows (a) 7 47 Discount factor (14%) (b) 1.000 48 Precent value of cash flows (8)x(b) ? 49 Net present value SO 51 52 53 54 55 7 7 ? . ? ? ? 2 7 ? ? ? ? ? ? ? ? Years 3 1 4 5 ? ? ? ? ? ? ? ? ? ? 2 ? ? ? > 2 7 ? ? ? ? ? 7 ? ? 0.900 ? ? 0.63 0.125 0.751 ? ? Formulas Req 1 CH13 App C Req 2a CH13 App C Req 2b CH13 App C Req 2c CH13 App C Req 2d CH13 App C + Paste BIU Merge & Center $ % insert Conditional Format Formatting as Table Cell Styles B14 fx fx ? C D E F H 0 P Reg 2b: Experiment with changing the discount rate in one percent increments in the green cell on the left At what interest rate does the net present value turn from negative to positive? Yere 3 1 2 4 5 2 7 7 2 ? ? ? ? ? ? 7 ? ? 7 ? 3 ? ? ? ? ? ? A B ACTG 131 Lab Chapter 13 Appendix C Lab Requirement 2 2 3 Data 4 Example E 5 Cost of equipment needed $120,000 6 Working capitalreded $80,000 7 Overhaul al equipment in four years $10,000 8 Salvage value of the equipment in five years $20,000 9 Annual revenues and costs: 10 Sales revenues $256,000 11 Cost of goods sold $160,000 12 Out-of-pocket operating costs $50,000 13 Depreciation expensa $12,000 14 Discount rate 15 Income Tax rate 30% 16 17 18 Exhibit 13-0 19 20 Calculate the annual tax payment: 21 22 Now 23 Sales Revenues 24 Cost of goods add 25 Depreciation experise 26 Our cf-pocket operating costs 27 Overhaul of equipment in four years 28 Salvage value of the equipment 29 Incremental Net Income la) 30 Income Tax Rale(b) 31 Income Tax Experse(a) (b) 32 33 34 Calculate the ne present et 35 36 Now 37 Purchase of equipment 7 38 Investment in working capital ? 39 Sales Revenues 40 Cost of goods sold 41 Out-of-pocket operating costs 42 Overhaul of equipment in four years 43 Selvage value of the equipment 44 Working capital released 45 Income Tax Expre 46 Total cash fows (a) 47 Discount factor (14%) (b) 1.000 48 Precent value of cash flows (8)x(b) ? 49 Net present value ? SO 51 52 53 54 55 ? 2 ? ? ? ? ? ? ? ? ? 2 ? ? 2 ? Years 3 1 2 4 5 ? ? ? 2 ? ? 2 2 7 ? ? ? 2 2 ? 2 ? 7 ? ? ? WALUEI ? 2 7 2 2 #VALUEI ? ? VALUEI ? PALLEI ? WALUEI ? Formulas Req 1 CH13 App C Req 2a CH13 App C Req 2b CH13 App C Req 2c CH13 App C Req 2d CH13 App C + Paste BIUL Insert Merge & Center v = = = = = Conditional Format Formatting as Table Cell Styles B14 fx ? D E F G P H K M N 0 Req, 2c: Experiment with changing the discount rate in one percent increments in the green cell on the left. Between what interest rates is the internal rate of return? Years 3 1 2 4 5 2 2 2 ? ? ? 2 ? ? 2 ? ? ? ? ? ? 2 A ACTG 131 Lab Chapter 13 Appendix C Lab Requirement 2 2 3 Data 4 Example 5 Cast of equipment needed $120,000 6 Working capital medied $80,000 7 Overhaul al equipment in four years $10,000 8 Salvage value of the equipment in five years $20,000 9 Annual revenues and costs: 10 Sales revenues 11 Cost of goods sold 3160.000 12 Out-of-pocket operating costs $50,000 13 Depreciation expensa $12.000 14 Discount rate 15 Income Tax rate 30% 16 17 18 Exhibit 13-6 19 20 Calculate the annual tax payment: 21 22 Now 23 Sales Revenues 24 Cost of goda sad 25 Depreciation expertise 26 Out-of-pocket operating costs 27 Overhaul of equipment in four years 28 Salvage value of the equipment 29 Incremental Net Income la) 30 Income Tax Rale(b) 31 Income Tax Experse (a) (b) 32 33 34 Calculate the ne present et 35 36 Now 37 Purchase of equipment 7 38 Investment in working capital ? 39 Sales Revenues 40 Cost of goods sold 41 Out-of-pocket operating costs 42 Overhaul of equipment in four years 43 Selvage value of the equipment 44 Working capital released 45 Income Tax Expre 46 Total cash fows(a) ? 47 Discount factor (14%) (b) 1.000 48 Precent value of cash flows (8)x(b) ? 49 Net present value ? 50 51 52 53 54 55 ? ? ? 7 ? ? ? ? ? 2 ? ? 2 2 ? ? Years Years 1 2 5 ? 2 ? ? 2 ? ? ? 2 7 ? 2 2 2 7 ? 2 2 2 ? ? WALUEI ? 2 7 WALUEI VALUEI 7 #VALUEI ? #VALUEI ? ? ? Formulas Req 1 CH13 App C Req 2a CH13 App C A Req 2b CH13 App C Req 2c CH13 App C Req 2d CH13 App C + Paste BIU Merge & Center insert Conditional Format Formatting as Table Cell Styles B8 fx ? D F F G H | L M N 0 Req. 2d: Experiment with changing the salvage value in the green cell on the left until the net present value becomes positive. How large would the salvage value have to be ta result in a positive net present value? Years 3 2 4 6 2 ? 2 7 7 7 7 ? ? ? ? ? ? 2 ? ? 2 7 A ACTG 131 Lab Chapter 13 Appendix C Lab Requirement 2d 2 3 Data 4 Example Cost of equipment needed $120,000 6 Working capital needed $80,000 7 Overhaul al equipment in four years 340,000 8 Salvage value of the equipment in five years 9 Annual revenues and costs: 10 Sales revenues $256,000 11 Cost of goods sold $160.000 12 Out-of-pocket operating costs $50,000 13 Depreciation expense EVALUE 14 Discount rate % 15 Income Tax rate 30% 16 17 18 Exhibit 13-6 19 20 Calculate the annual tax payment: 21 22 Now 1 23 Sales Revenues 7 24 Cost of goods add 7 25 Depreciation experise 26 Our cf-pocket operating costs ? 27 Overhaul of equipment in four years 28 Salvage value of the equipment 29 Incremental Net Income la) 30 Income Tax Rale(b) ? 31 Income Tax Experse(a) (b) 2 ? 32 33 34 Calculate the ne present et 35 36 Now 1 37 Purchase of equipment 7 38 Investment in working capital ? 39 Sales Revenues 40 Cost of goods sold 41 Out-of-pocket operating costs 42 Overhaul of equipment in four years 43 Selvage value of the equipment 44 Working capital released 45 Income Tax Expre 46 Total cash fows (a) ? 47 Discount factor (14%) (6) 1.000 48 Precent value of cash flows (8)x(b) ? 49 Net present value 50 51 Answer 52 20 53 54 55 56 Formulas Req 1 CH13 App C 7 ? ? 2 2 2 ? ? 2 ? ? 2 Years 3 2 5 ? ? 2 ? ? ? ? 2 ? ? ? 7 ? 2 7 ? ? 2 2 ? 2 ? 7 0906 7 2 2 a 735 ? 0.857 ? ? Req 2a CH13 App C Req 2b CH13 App C Req 2c CH13 App C Req 2d CH13 App C + Paste insert Merge & Center = = = = = Conditional Format Formatting as Table Cell Styles D1 A B C E F H I L M N O P a R 5 T Years 2 5 2 ? 7 ? 2 7 Copy Formulas ? 7 ? 7 ? ? ? ? ? 2 ? 7 7 7 ? ? ? 3 Data 4 Example 5 Cast ofcoulement needed $50,00 6 Working capital needed $100,000 7 Overhaul of equipment in four years S6,000 Salvage value of the equipment in five years $10,000 9 Annual revenues and costs: 10 Sales reven $200,000 11 coat of goods sold $125,000 12 Out-of-pocket operating costs $36,000 13 Depreciation expense $12,000 14 Discount rate 14% 15 Income Tax rale 30% 16 17 Enter a formula into each of the cells marked with a ? Below 18 Exhibit 13-6 19 20 Calculate the annual tax payment: 21 22 Now 1 23 Sales Revenues ? 24 Cost of goods sold 7 25 Decreation expertise ? 26 Out-of-poche operating costs ? 27 Overhaul of equipment in four years 28 Salvage value of the equipment 29 Incremental Net Income la 7 30 Income Tax Rate() ? 31 Income Tax Expense (a) (b) ? 32 33 34 Calculate the nel present value: 35 36 Now 1 37 Purchase of equipment ? 38 Investment in working capital 7 39 Sales Revenue ? 40 Cost of goods sold ? Out of pocket operating costs 2 42 Overhaul of guipment in four years 43 Salvage value of the equipment 44 Working capital released 45 Income Tax Expense ? 46 Total cash fows(a) 2 * 47 Discount factor (14%) (b) 1.000 0.977 48 Present value of cash flows (alb) 7 2 49 Net present value ? 50 51 Use the formulas from Appendix 138: 52 Prosent value of $1 = 1/(1+r)^n 53 Present value of an annuity of $1 = (1/1-1/(1+r)^n)) 54 where n is the number of years and is the discount rate 55 56 Formulas Req 1 CH13 App C ? ? ? 2 ? Year 3 2 4 5 ? ? 2 2 2 7 ? ? 7. ? ? ? 2 ? ? 7 ? ? 2 0.519 7 2 0.70 7 0.678 7 7 Req 2a CH13 App C Req 2b CH13 App C A Req 2c CH13 App C Req 2d CH13 App C + Paste B I Merge & Center v = = = = = Insert Conditional Format Formatting as Table Cell Styles B14 fx ? C D E F M 0 H Req. 1: Enter 10% for the discount rate in the green cell to the left. If your formulas are correct, the net present value should now be about $23,837 depending on the precision of the calculations. If not, go back to the previous sheet, correct your formulas, and use the copy formulas button until your answer is correct. Explain why the net present value has increased as a result of reducing the discount rate from 14% to 10%. Yere 3 1 2 4 5 2 7 ? ? ? ? ? ? 7 ? ? 7 ? 3 ? ? ? 2 ? ? ? ? A ACTG 131 Lab Chapter 13 Appendix C Lab Requirement 1 2 3 Data 4 Example E 5 Cost of equipment needed $80,000 6 Working capitalreded $100,000 7 Overhaul al equipment in four years $6,000 8 Salvage value of the equipment in five years $10,000 9 Annual revenues and costs: 10 Sales revenues $200,000 11 Cost of goods sold $125,000 12 Out-of-pocket operating costs $36,000 13 Depreciation expensa $12.000 14 Discount rate 15 Income Tax rate 30% 16 17 18 Exhibit 13-0 19 20 Calculate the annual tax payment: 21 22 Now 23 Sales Revenues 24 Cost of goods add 25 Depreciation experise 26 Our cf-pocket operating costs 27 Overhaul of equipment in four years 28 Salvage value of the equipment 29 Incremental Net Income la) 30 Income Tax Rale(b) 31 Income Tax Experse(a) (b) 32 33 34 Calculate the ne present et 35 36 Now 37 Purchase of equipment 7 38 Investment in working capital ? 39 Sales Revenues 40 Cost of goods sold 41 Out-of-pocket operating costs 42 Overhaul of equipment in four years 43 Selvage value of the equipment 44 Working capital released 45 Income Tax Expre 46 Total cash fows (a) 47 Discount factor (14%) (b) 1.000 48 Precent value of cash flows (8)x(b) ? 49 Net present value 7 SO 51 52 53 54 55 ? 2 ? ? ? ? ? ? ? ? 2 ? 2 ? ? 2 ? Years 3 1 2 4 5 ? ? ? 2 ? ? 2 2 7 ? ? ? 2 2 2 ? ? 7 ? ? 2 ? WALUEI ? 2 2 2 #VALUEI ? ? VALUEI ? PALLEI ? WALUEI ? Formulas Req 1 CH13 App C Req 2a CH13 App C Req 2b CH13 App C Req 2c CH13 App C Req 2d CH13 App C + Paste BIU insert Merge & Center = = = = = Conditional Format Formatting as Table Cell Styles B5 fx ? C D E F G H 0 P L M N Req. 2a: The company is considering another project involving the purchase of new equipment. Enter the data for requirement 2 of the Ch13 lab on page 658 of the textbook, ignoring the discount rate of 14% which is already entered as 10% for this problem. What is the net present value of the project? Years 3 1 2 4 5 7 7 ? ? 7 7 ? ? 7 7 ? ? 7 7 ? ? ? 7 7 ? ? A B ACTG 131 Lab Chapter 13 Appendix C Lab Requirement 28 2 3 Data 4 Example E 5 Cost of equipment needed 2 6 Working capital medied ? 7 Overhaul al equipment in four years ? 8 Salvage value of the equipment in five years 2 9 Annual revenues and costs: 10 Se revenue 11 Cost of goods sold ? 12 Out-of-pocket operating costs 2 13 Depreciation expense $12,000 14 Discount rate 10% 15 Income Tax rate 30% 16 17 18 Exhibit 13-6 19 20 Calculate the annual tax payment: 21 22 Now 23 Sales Revenues 24 Cost of goods add 25 Depreciation experise 26 Our cf-pocket operating costs 27 Overhaul of equipment in four years 28 Salvage value of the equipment 29 Incremental Net Income la) 30 Income Tax Rale(b) 31 Income Tax Experse(a) (b) 32 33 34 Calculate the ne present et 35 36 Now 37 Purchase of equipment 7 38 Investment in working capital 7 39 Sales Revenues 40 Cost of goods sold 41 Out-of-pocket operating costs 42 Overhaul of equipment in four years 43 Selvage value of the equipment 44 Working capital released 45 Income Tax Expre 46 Total cash fows (a) 7 47 Discount factor (14%) (b) 1.000 48 Precent value of cash flows (8)x(b) ? 49 Net present value SO 51 52 53 54 55 7 7 ? . ? ? ? 2 7 ? ? ? ? ? ? ? ? Years 3 1 4 5 ? ? ? ? ? ? ? ? ? ? 2 ? ? ? > 2 7 ? ? ? ? ? 7 ? ? 0.900 ? ? 0.63 0.125 0.751 ? ? Formulas Req 1 CH13 App C Req 2a CH13 App C Req 2b CH13 App C Req 2c CH13 App C Req 2d CH13 App C + Paste BIU Merge & Center $ % insert Conditional Format Formatting as Table Cell Styles B14 fx fx ? C D E F H 0 P Reg 2b: Experiment with changing the discount rate in one percent increments in the green cell on the left At what interest rate does the net present value turn from negative to positive? Yere 3 1 2 4 5 2 7 7 2 ? ? ? ? ? ? 7 ? ? 7 ? 3 ? ? ? ? ? ? A B ACTG 131 Lab Chapter 13 Appendix C Lab Requirement 2 2 3 Data 4 Example E 5 Cost of equipment needed $120,000 6 Working capitalreded $80,000 7 Overhaul al equipment in four years $10,000 8 Salvage value of the equipment in five years $20,000 9 Annual revenues and costs: 10 Sales revenues $256,000 11 Cost of goods sold $160,000 12 Out-of-pocket operating costs $50,000 13 Depreciation expensa $12,000 14 Discount rate 15 Income Tax rate 30% 16 17 18 Exhibit 13-0 19 20 Calculate the annual tax payment: 21 22 Now 23 Sales Revenues 24 Cost of goods add 25 Depreciation experise 26 Our cf-pocket operating costs 27 Overhaul of equipment in four years 28 Salvage value of the equipment 29 Incremental Net Income la) 30 Income Tax Rale(b) 31 Income Tax Experse(a) (b) 32 33 34 Calculate the ne present et 35 36 Now 37 Purchase of equipment 7 38 Investment in working capital ? 39 Sales Revenues 40 Cost of goods sold 41 Out-of-pocket operating costs 42 Overhaul of equipment in four years 43 Selvage value of the equipment 44 Working capital released 45 Income Tax Expre 46 Total cash fows (a) 47 Discount factor (14%) (b) 1.000 48 Precent value of cash flows (8)x(b) ? 49 Net present value ? SO 51 52 53 54 55 ? 2 ? ? ? ? ? ? ? ? ? 2 ? ? 2 ? Years 3 1 2 4 5 ? ? ? 2 ? ? 2 2 7 ? ? ? 2 2 ? 2 ? 7 ? ? ? WALUEI ? 2 7 2 2 #VALUEI ? ? VALUEI ? PALLEI ? WALUEI ? Formulas Req 1 CH13 App C Req 2a CH13 App C Req 2b CH13 App C Req 2c CH13 App C Req 2d CH13 App C + Paste BIUL Insert Merge & Center v = = = = = Conditional Format Formatting as Table Cell Styles B14 fx ? D E F G P H K M N 0 Req, 2c: Experiment with changing the discount rate in one percent increments in the green cell on the left. Between what interest rates is the internal rate of return? Years 3 1 2 4 5 2 2 2 ? ? ? 2 ? ? 2 ? ? ? ? ? ? 2 A ACTG 131 Lab Chapter 13 Appendix C Lab Requirement 2 2 3 Data 4 Example 5 Cast of equipment needed $120,000 6 Working capital medied $80,000 7 Overhaul al equipment in four years $10,000 8 Salvage value of the equipment in five years $20,000 9 Annual revenues and costs: 10 Sales revenues 11 Cost of goods sold 3160.000 12 Out-of-pocket operating costs $50,000 13 Depreciation expensa $12.000 14 Discount rate 15 Income Tax rate 30% 16 17 18 Exhibit 13-6 19 20 Calculate the annual tax payment: 21 22 Now 23 Sales Revenues 24 Cost of goda sad 25 Depreciation expertise 26 Out-of-pocket operating costs 27 Overhaul of equipment in four years 28 Salvage value of the equipment 29 Incremental Net Income la) 30 Income Tax Rale(b) 31 Income Tax Experse (a) (b) 32 33 34 Calculate the ne present et 35 36 Now 37 Purchase of equipment 7 38 Investment in working capital ? 39 Sales Revenues 40 Cost of goods sold 41 Out-of-pocket operating costs 42 Overhaul of equipment in four years 43 Selvage value of the equipment 44 Working capital released 45 Income Tax Expre 46 Total cash fows(a) ? 47 Discount factor (14%) (b) 1.000 48 Precent value of cash flows (8)x(b) ? 49 Net present value ? 50 51 52 53 54 55 ? ? ? 7 ? ? ? ? ? 2 ? ? 2 2 ? ? Years Years 1 2 5 ? 2 ? ? 2 ? ? ? 2 7 ? 2 2 2 7 ? 2 2 2 ? ? WALUEI ? 2 7 WALUEI VALUEI 7 #VALUEI ? #VALUEI ? ? ? Formulas Req 1 CH13 App C Req 2a CH13 App C A Req 2b CH13 App C Req 2c CH13 App C Req 2d CH13 App C + Paste BIU Merge & Center insert Conditional Format Formatting as Table Cell Styles B8 fx ? D F F G H | L M N 0 Req. 2d: Experiment with changing the salvage value in the green cell on the left until the net present value becomes positive. How large would the salvage value have to be ta result in a positive net present value? Years 3 2 4 6 2 ? 2 7 7 7 7 ? ? ? ? ? ? 2 ? ? 2 7 A ACTG 131 Lab Chapter 13 Appendix C Lab Requirement 2d 2 3 Data 4 Example Cost of equipment needed $120,000 6 Working capital needed $80,000 7 Overhaul al equipment in four years 340,000 8 Salvage value of the equipment in five years 9 Annual revenues and costs: 10 Sales revenues $256,000 11 Cost of goods sold $160.000 12 Out-of-pocket operating costs $50,000 13 Depreciation expense EVALUE 14 Discount rate % 15 Income Tax rate 30% 16 17 18 Exhibit 13-6 19 20 Calculate the annual tax payment: 21 22 Now 1 23 Sales Revenues 7 24 Cost of goods add 7 25 Depreciation experise 26 Our cf-pocket operating costs ? 27 Overhaul of equipment in four years 28 Salvage value of the equipment 29 Incremental Net Income la) 30 Income Tax Rale(b) ? 31 Income Tax Experse(a) (b) 2 ? 32 33 34 Calculate the ne present et 35 36 Now 1 37 Purchase of equipment 7 38 Investment in working capital ? 39 Sales Revenues 40 Cost of goods sold 41 Out-of-pocket operating costs 42 Overhaul of equipment in four years 43 Selvage value of the equipment 44 Working capital released 45 Income Tax Expre 46 Total cash fows (a) ? 47 Discount factor (14%) (6) 1.000 48 Precent value of cash flows (8)x(b) ? 49 Net present value 50 51 Answer 52 20 53 54 55 56 Formulas Req 1 CH13 App C 7 ? ? 2 2 2 ? ? 2 ? ? 2 Years 3 2 5 ? ? 2 ? ? ? ? 2 ? ? ? 7 ? 2 7 ? ? 2 2 ? 2 ? 7 0906 7 2 2 a 735 ? 0.857 ? ? Req 2a CH13 App C Req 2b CH13 App C Req 2c CH13 App C Req 2d CH13 App C +