Question

Pat and Mandy are married and have a son, Steve, age 8. Mandy, age 29, earns $40,000 annually from her job. Pat, age 31, earns

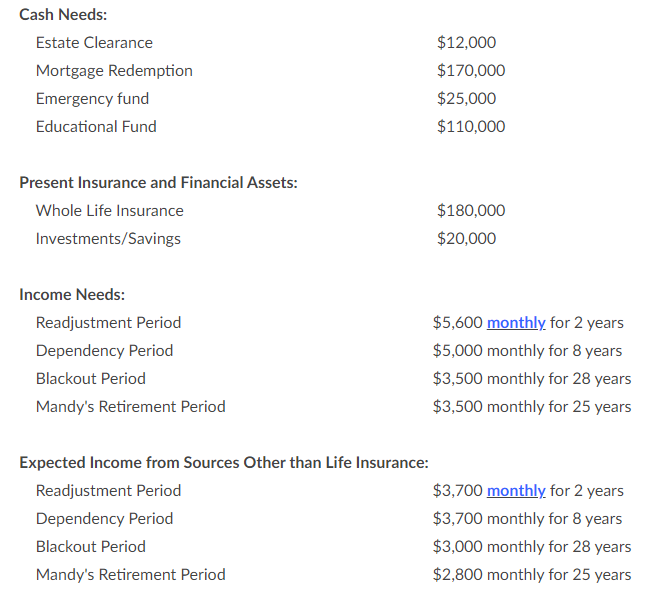

Pat and Mandy are married and have a son, Steve, age 8. Mandy, age 29, earns $40,000 annually from her job. Pat, age 31, earns $50,000 annually from his job. Assume that Pat will die before Mandy. The family wants to ensure that they have adequate life insurance on Pat to cover their cash and income needs if Pat dies. Hence, they want to determine if they should purchase additional life insurance on Pat to cover these needs using Needs Approach. (you may find some hints from your textbook, page 207~209)

The tables below provide figures of their: 1) cash needs; 2) present insurance and financial assets; 3) income needs; and 4) income that the family will receive if no additional life insurance is purchased. Use the values in these tables to determine how much, if any, additional life insurance the family should purchase on Pat to cover their needs. In your answer, calculate and show the components of any additional life insurance needed in terms of cash needs and income needs and the total amount of additional life insurance needed.

This exercise assumes that 1) Pat dies immediately; 2) Mandy continues to work if Pat dies, however, her earning will not be enough. So the needs shown in the table are net of Mandy's earning; 3) Mandy plans to retire at age 65; and 4) the life insurance proceeds are invested at an interest rate equal to the rate of inflation (so, you do not have to worry about time-value of money issues).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started